Answered step by step

Verified Expert Solution

Question

1 Approved Answer

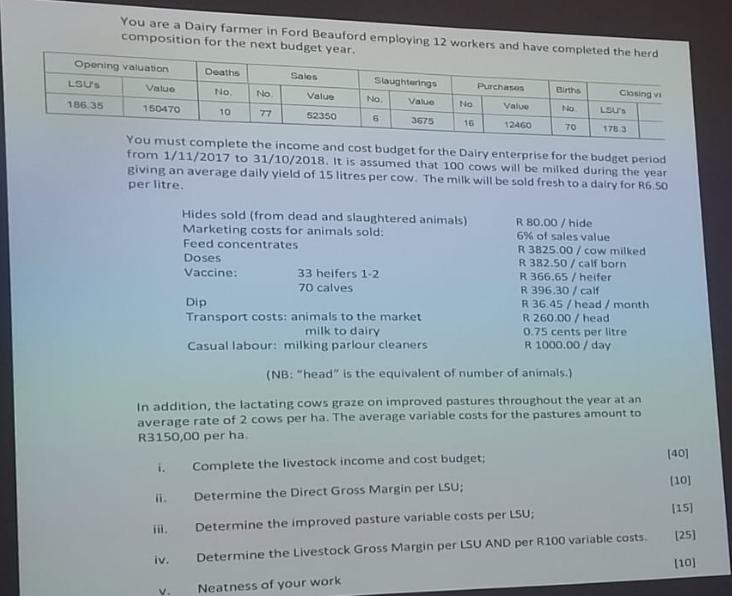

You are a Dairy farmer in Ford Beauford employing 12 workers and have completed the herd composition for the next budget year. Opening valuation

You are a Dairy farmer in Ford Beauford employing 12 workers and have completed the herd composition for the next budget year. Opening valuation LSU''S 186.35 Value 150470 ii. iii. Deaths No. 10 iv. No V. 77 Sales Value 52350 Slaughterings Value 3675 No. 6 No 33 heifers 1-2 70 calves 16 Hides sold (from dead and slaughtered animals) Marketing costs for animals sold: Feed concentrates Doses Vaccine: Dip Transport costs: animals to the market milk to dairy Casual labour: milking parlour cleaners You must complete the income and cost budget for the Dairy enterprise for the budget period from 1/11/2017 to 31/10/2018. It is assumed that 100 cows will be milked during the year giving an average daily yield of 15 litres per cow. The milk will be sold fresh to a dairy for R6.50 per litre. Purchases Value 12460 Births NO 70 Closing vi LOUS 178.3 (NB: "head" is the equivalent of number of animals.) In addition, the lactating cows graze on improved pastures throughout the year at an average rate of 2 cows per ha. The average variable costs for the pastures amount to R3150,00 per ha. R 80.00/hide 6% of sales value R 3825.00/ cow milked R 382.50/calf born R 366.65/ heifer R 396.30/calf R 36.45/head/month R 260.00/head 0.75 cents per litre R 1000.00/day Complete the livestock income and cost budget; Determine the Direct Gross Margin per LSU; Determine the improved pasture variable costs per LSU; Determine the Livestock Gross Margin per LSU AND per R100 variable costs. Neatness of your work [40] [10] [15] [25] [10]

Step by Step Solution

★★★★★

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Livestock Income and Cost Budget a Milk Sales Total Milk Yield 100cows 15litrescowday 365days 547500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started