Question

You are a European investor who is considering investments in the Swiss stock market, but you worry about currency risk. You run a regression of

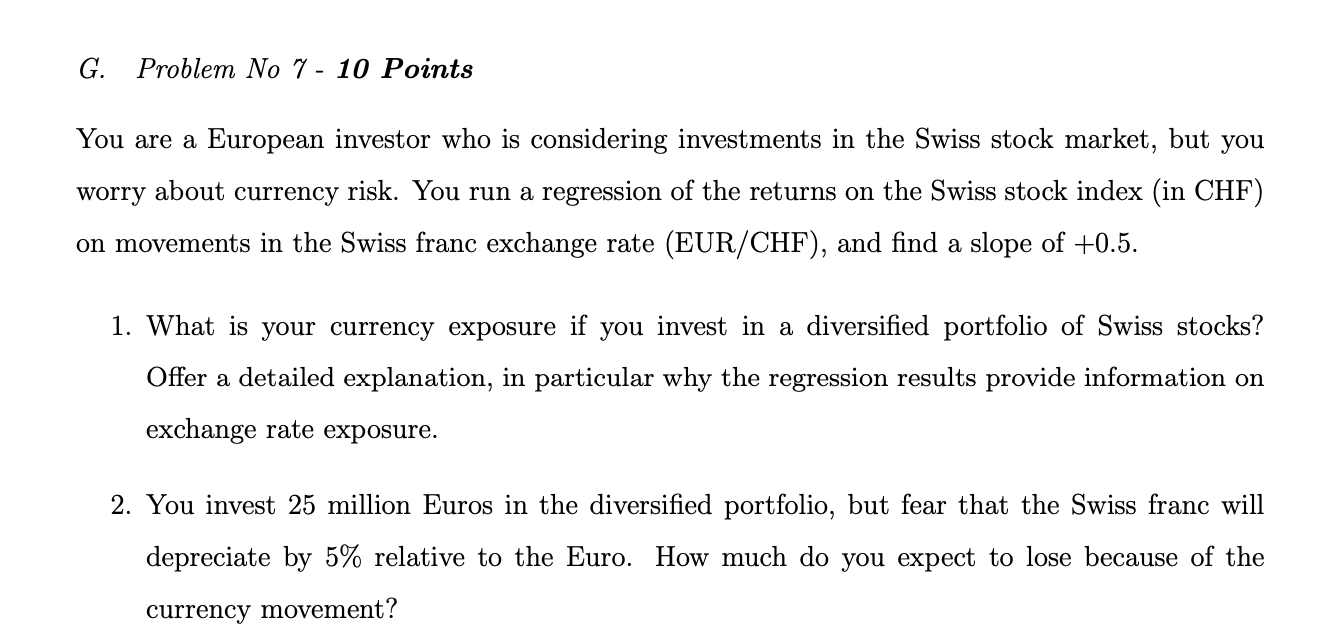

You are a European investor who is considering investments in the Swiss stock market, but you worry about currency risk. You run a regression of the returns on the Swiss stock index (in CHF) on movements in the Swiss franc exchange rate (EUR/CHF), and find a slope of +0.5.\ 1.) What is your currency exposure if you invest in a diversified portfolio of Swiss stocks? Offer a detailed explanation, in particular why the regression results prG. Problem No 7-10 Points\ You are a European investor who is considering investments in the Swiss stock market, but you\ worry about currency risk. You run a regression of the returns on the Swiss stock index (in CHF)\ on movements in the Swiss franc exchange rate (EUR/CHF), and find a slope of +0.5 .\ What is your currency exposure if you invest in a diversified portfolio of Swiss stocks?\ Offer a detailed explanation, in particular why the regression results provide information on\ exchange rate exposure.\ You invest 25 million Euros in the diversified portfolio, but fear that the Swiss franc will\ depreciate by

5%relative to the Euro. How much do you expect to lose because of the\ currency movement?ovide information on exchange rate exposure.\ 2.) You invest 25 million Euros in the diversified portfolio, but fear that the Swiss franc will depreciate by 5% relative to the Euro. How much do you expect to lose because of the currency movement?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started