Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a finance professional. A client wants to ada investment portfolio. They were surprised to learn that bond trading is often done over the

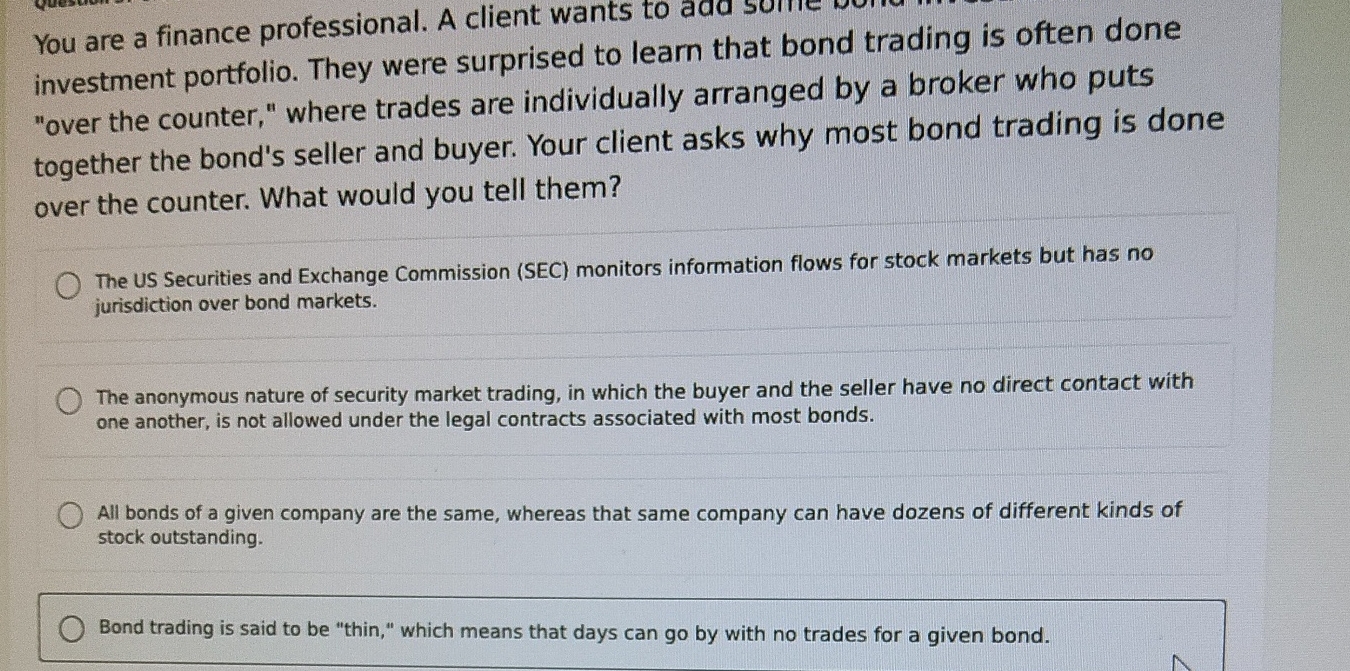

You are a finance professional. A client wants to ada investment portfolio. They were surprised to learn that bond trading is often done "over the counter," where trades are individually arranged by a broker who puts together the bond's seller and buyer. Your client asks why most bond trading is done over the counter. What would you tell them?

The US Securities and Exchange Commission SEC monitors information flows for stock markets but has no jurisdiction over bond markets.

The anonymous nature of security market trading, in which the buyer and the seller have no direct contact with one another, is not allowed under the legal contracts associated with most bonds.

All bonds of a given company are the same, whereas that same company can have dozens of different kinds of stock outstanding.

Bond trading is said to be "thin," which means that days can go by with no trades for a given bond.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started