Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a financial adviser and the married couple Timothy (aged 37) and Sara (aged 38) Brown approached you for planning to save for their

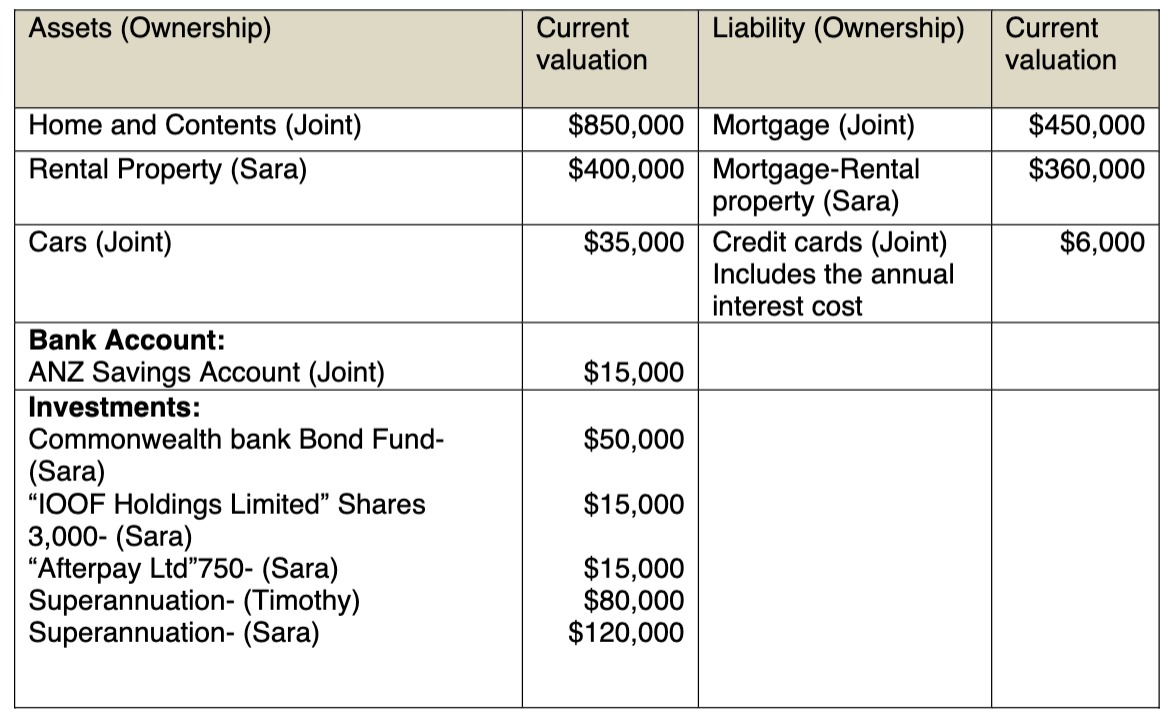

You are a financial adviser and the married couple Timothy (aged 37) and Sara (aged 38) Brown approached you for planning to save for their retirement. The following information is an extract of data you gathered as part of fact-finding during an initial client consultation. Timothy works as a human resources administrator and Sara works as a Medical Imaging Technologist. They have two children who are aged 13 and 15.

- Sara on the advice of her brother purchased a rental property for $400,000 by borrowing $360,000 from Bank in 2015. The annual insurance, rates and costs to maintain the property is $3,900 p.a. and interest costs on her loan is $24,000 for the year.

- 10 months ago, Sara invested in shares. She bought 3,000 shares in "IOOF Holdings Limited" at $5 a share (current market price: $3.50) and 750 shares in "Afterpay Ltd" at $20 a share (current market price: $120). She wants to sell her Afterpay Ltd shares to lock in her profit and has come to you for advice. Her brother advised her to use the sale proceeds of these shares to buy another investment property to avail negative gearing. This time she wants to buy the property in the name of her husband. She does not expect any major change in the prices of these shares in the near future.

- Required:

- Timothy and Sara would like to know how much money they will receive after paying tax for the year ended 30th June 2021. They would like advice on how to reduce their tax liability in the future.

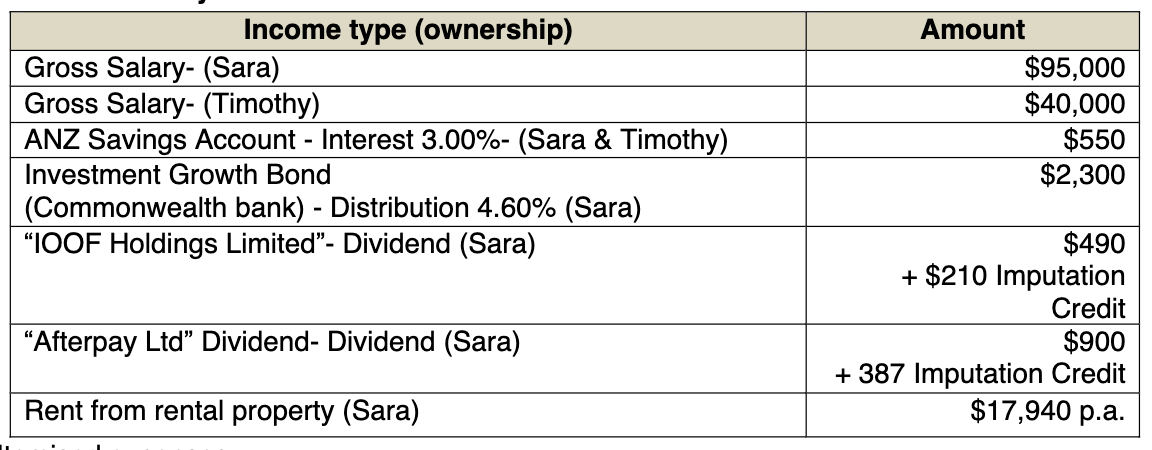

Income for the year ended 30th June 2021:

Income type (ownership) Gross Salary- (Sara) Gross Salary- (Timothy) ANZ Savings Account - Interest 3.00%- (Sara & Timothy) Investment Growth Bond (Commonwealth bank) - Distribution 4.60% (Sara) "IOOF Holdings Limited- Dividend (Sara) "Afterpay Ltd" Dividend- Dividend (Sara) Rent from rental property (Sara) Amount $95,000 $40,000 $550 $2,300 $490 + $210 Imputation Credit $900 + 387 Imputation Credit $17,940 p.a.

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Timothy and Saras taxable income for the year ended 30th June 2021 we need to consider ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started