Answered step by step

Verified Expert Solution

Question

1 Approved Answer

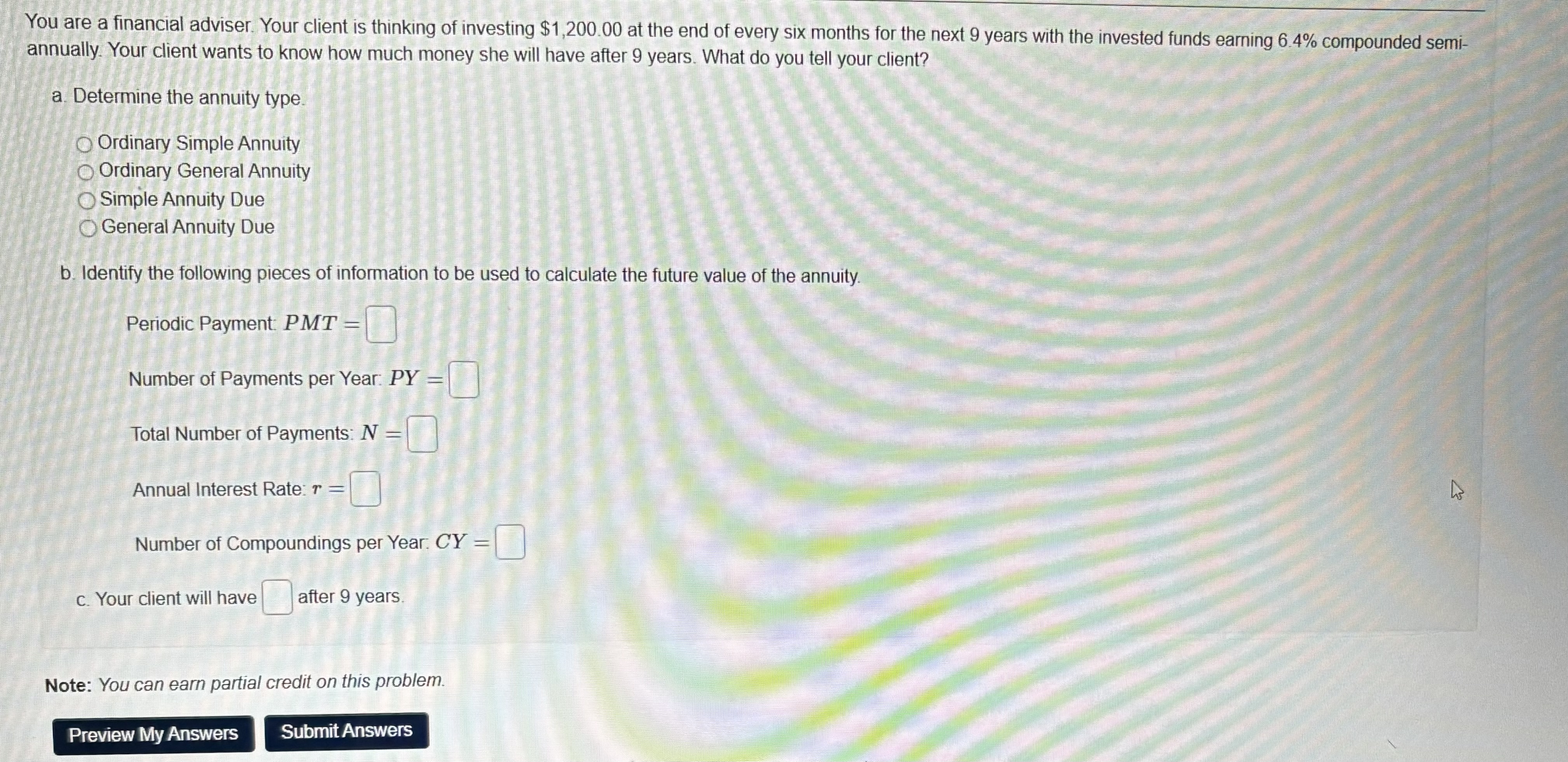

You are a financial adviser. Your client is thinking of investing $ 1 , 2 0 0 . 0 0 at the end of every

You are a financial adviser. Your client is thinking of investing $ at the end of every six months for the next years with the invested funds earning compounded semiannually. Your client wants to know how much money she will have after years. What do you tell your client?

a Determine the annuity type.

Ordinary Simple Annuity

Ordinary General Annuity

Simple Annuity Due

General Annuity Due

b Identify the following pieces of information to be used to calculate the future value of the annuity.

Periodic Payment:

Number of Payments per Year:

Total Number of Payments:

Annual Interest Rate:

Number of Compoundings per Year.

c Your client will have after years.

Note: You can earn partial credit on this problem.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started