You are a financial analyst in the Bridgetown Foundationa public service agency in Chicago that provides specialized mental care services to the poor. The foundations

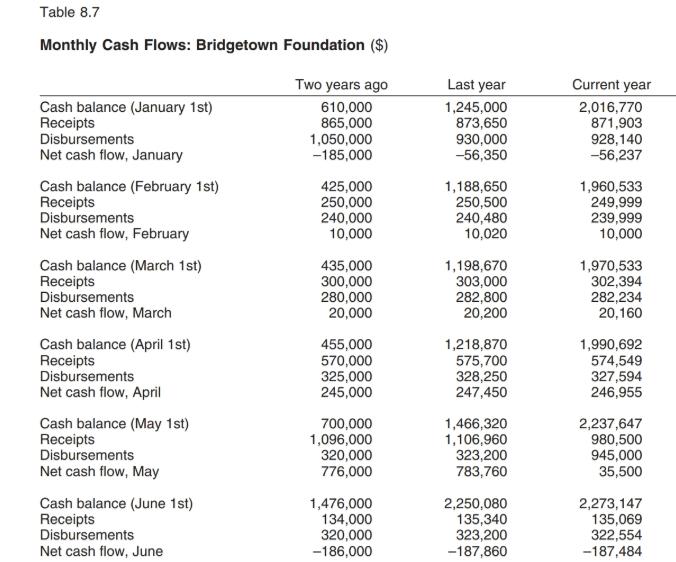

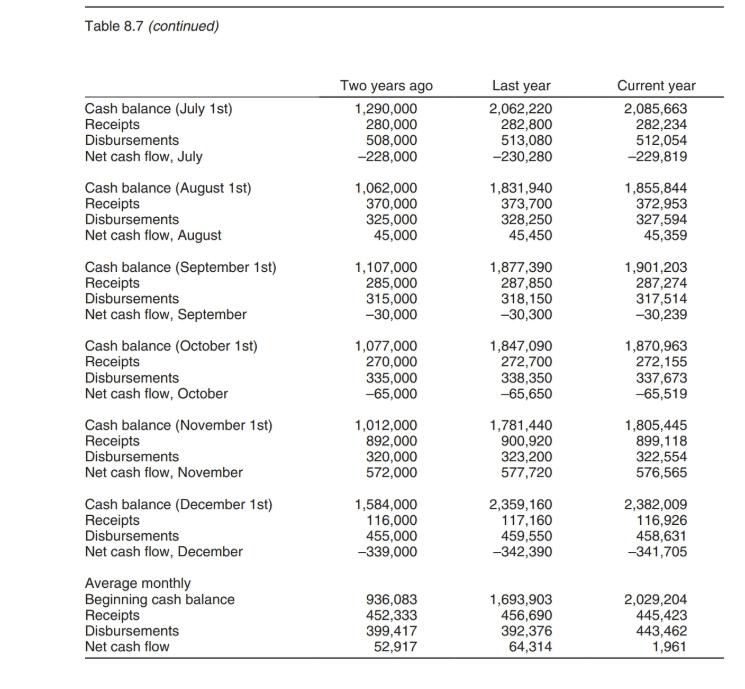

You are a financial analyst in the Bridgetown Foundation—a public service agency in Chicago that provides specialized mental care services to the poor. The foundation’s financial resources are mainly from various state and federal grants and business or individual donations. In a recent financial audit, an independent auditor suggested the foundation explore the possibility of investing in the market as an additional revenue source. You are assigned the responsibility of analyzing the foundation’s cash flows to determine whether such a possibility exists and, if it does, how much the founda- tion should invest and what the investment strategy should be. You pull out the cash flow information for the last three years as shown in Table 8.7.

1. Create a cash budget forth next year. Use the proper forecasting techniques (from Chapter 1) and defend your reasoning for your choice of technique.

Table 8.7 Monthly Cash Flows: Bridgetown Foundation ($) Two years ago Last year Current year Cash balance (January 1st) Receipts Disbursements Net cash flow, January 2,016,770 871,903 610,000 865,000 1,050,000 -185,000 1,245,000 873,650 930,000 -56,350 928,140 -56,237 Cash balance (February 1st) Receipts Disbursements Net cash flow, February 425,000 250,000 240,000 10,000 1,188,650 250,500 240,480 10,020 1,960,533 249,999 239,999 10,000 Cash balance (March 1st) Receipts Disbursements Net cash flow, March 435,000 300,000 280,000 20,000 1,198,670 303,000 282,800 20,200 1,970,533 302,394 282,234 20,160 Cash balance (April 1st) Receipts Disbursements 455,000 570,000 325,000 245,000 1,218,870 575,700 328,250 247,450 1,990,692 574,549 327,594 246,955 Net cash flow, April Cash balance (May 1st) Receipts Disbursements Net cash flow, May 700,000 1,096,000 320,000 776,000 1,466,320 1,106,960 323,200 783,760 2,237,647 980,500 945,000 35,500 Cash balance (June 1st) 1,476,000 134,000 320,000 -186,000 2,250,080 135,340 323,200 -187,860 2,273,147 135,069 322,554 -187,484 Receipts Disbursements Net cash flow, June

Step by Step Solution

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started