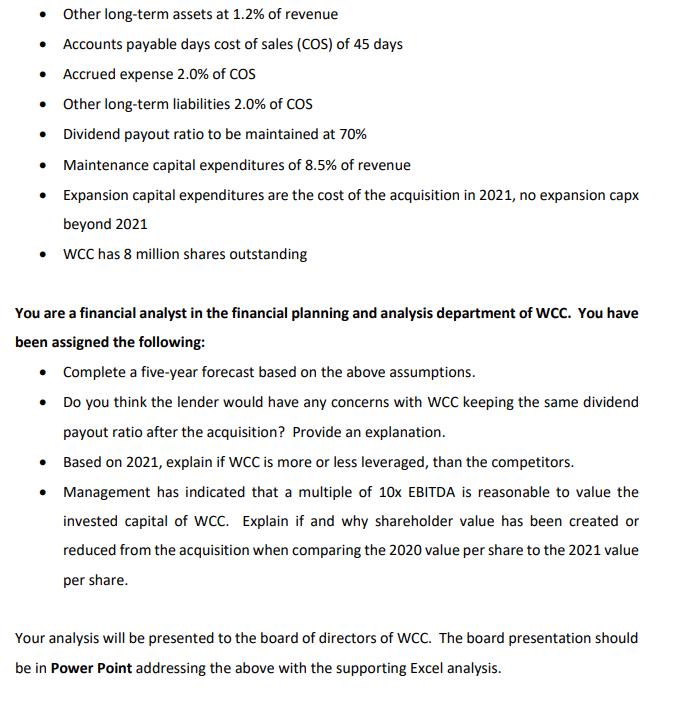

You are a financial analyst in the financial planning and analysis department of WCC. You have been assigned the following: Complete a five-year forecast

You are a financial analyst in the financial planning and analysis department of WCC. You have been assigned the following:

• Complete a five-year forecast based on the above assumptions.

• Do you think the lender would have any concerns with WCC keeping the same dividend payout ratio after the acquisition? Provide an explanation.

• Based on 2021, explain if WCC is more or less leveraged, than the competitors.

• Management has indicated that a multiple of 10x EBITDA is reasonable to value the invested capital of WCC. Explain if and why shareholder value has been created or reduced from the acquisition when comparing the 2020 value per share to the 2021 value per share

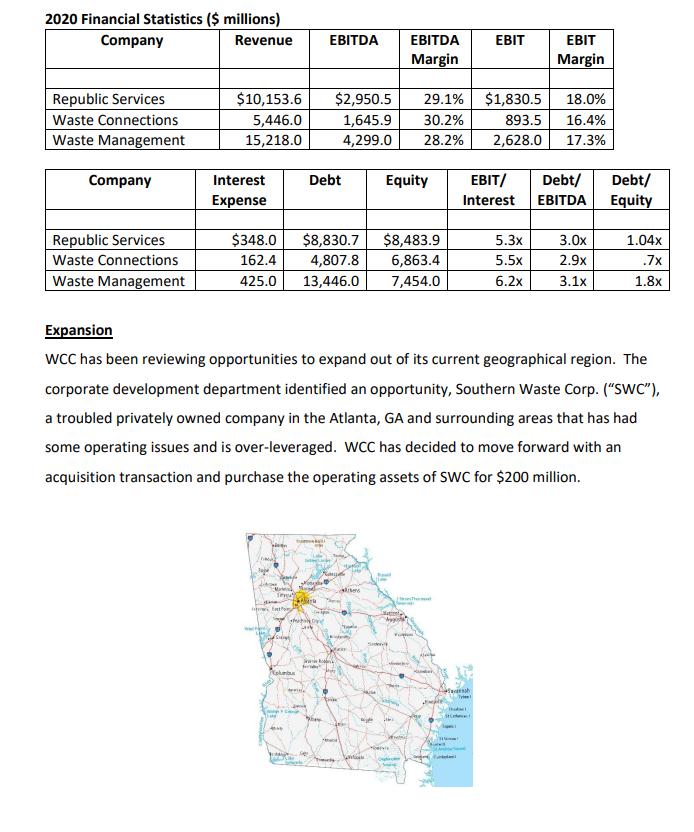

2020 Financial Statistics ($ millions) Company Revenue EBITDA EBITDA EBIT BIT Margin Margin Republic Services $10,153.6 $2,950.5 29.1% $1,830.5 18.0% Waste Connections 5,446.0 1,645.9 30.2% 893.5 16.4% Waste Management 15,218.0 4,299.0 28.2% 2,628.0 17.3% Company Interest Debt Equity EBIT/ Debt/ Debt/ Expense Interest EBITDA Equity Republic Services $348.0 $8,830.7 $8,483.9 5.3x 3.0x 1.04x Waste Connections 162.4 4,807.8 6,863.4 5.5x 2.9x .7x Waste Management 425.0 13,446.0 7,454.0 6.2x 3.1x 1.8x Expansion wCC has been reviewing opportunities to expand out of its current geographical region. The corporate development department identified an opportunity, Southern Waste Corp. ("SWC"), a troubled privately owned company in the Atlanta, GA and surrounding areas that has had some operating issues and is over-leveraged. WCC has decided to move forward with an acquisition transaction and purchase the operating assets of SWC for $200 million. Teu ww S trin

Step by Step Solution

3.40 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

answer If a companys payout ratio is over 100 it is returning more money to shareholders than it is earning and will probably be forced to lower the dividend or stop paying it altogether That result i...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started