Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a financial analyst working in the office of the CFO of Jupiter Pharma Ltd. Your company has been working on Rand D, and

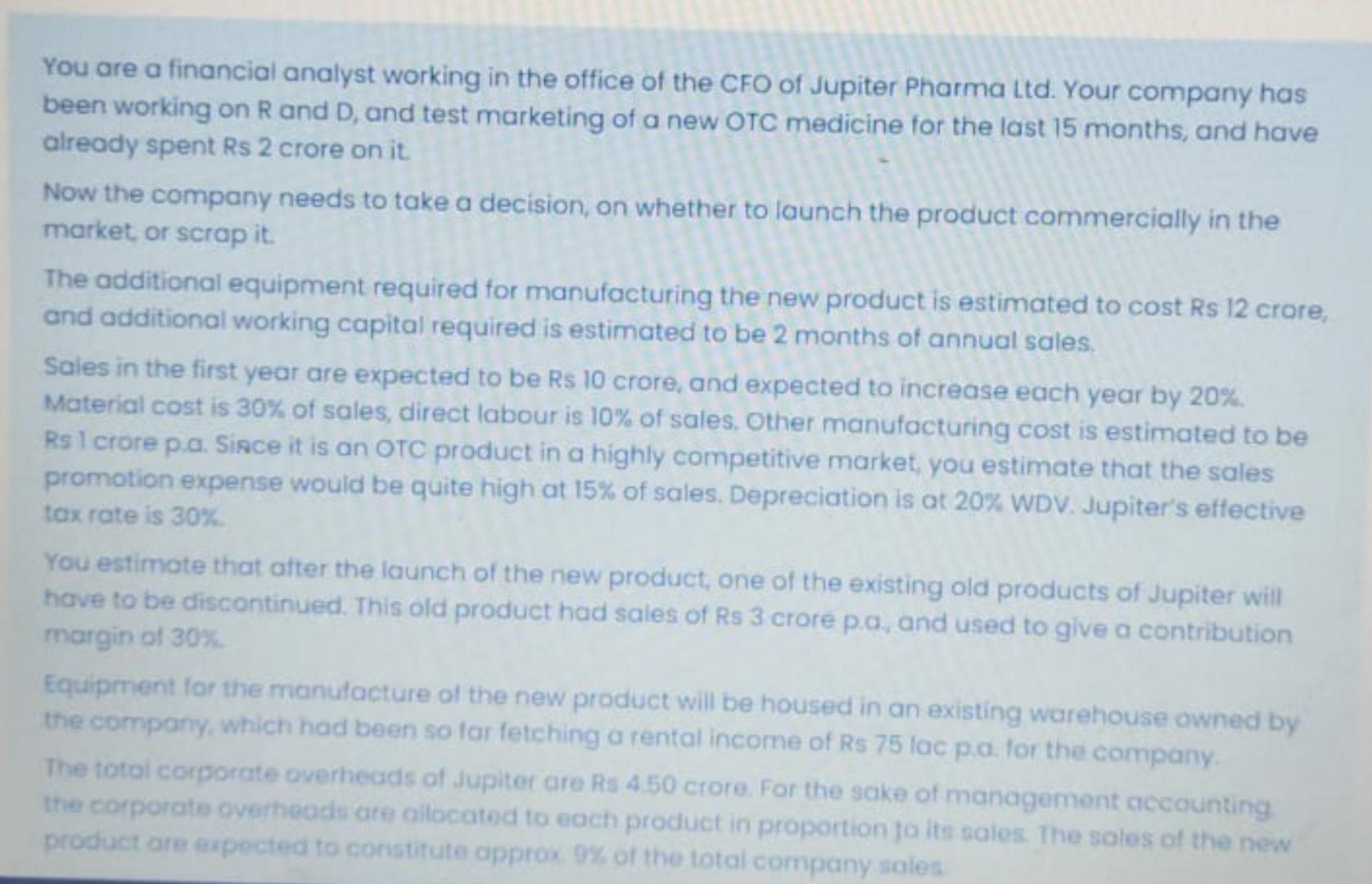

You are a financial analyst working in the office of the CFO of Jupiter Pharma Ltd. Your company has been working on Rand D, and test marketing of a new OTC medicine for the last 15 months, and have already spent Rs 2 crore on it. Now the company needs to take a decision, on whether to launch the product commercially in the market or scrap it. The additional equipment required for manufacturing the new product is estimated to cost Rs 12 crore, and additional working capital required is estimated to be 2 months of annual sales. Sales in the first year are expected to be Rs 10 crore, and expected to increase each year by 20%. Material cost is 30% of sales, direct labour is 10% of sales. Other manufacturing cost is estimated to be Rs 1 crore pa. Since it is an OTC product in a highly competitive market you estimate that the sales promotion expense would be quite high at 15% of sales. Depreciation is at 20% WDV. Jupiter's effective tax rate is 30% You estimate that after the launch of the new product, one of the existing old products of Jupiter will have to be discontinued. This old product had sales of Rs 3 crore pa, and used to give a contribution margin of 30% Equipment for the manufacture of the new product will be housed in an existing warehouse owned by the company, which had been so farfetching a rental income of Rs 75 lac pa for the company The total corporate overheads of Jupiter are Rs 450 crore. For the sake of management accounting the corporate overheads are allocated to each product in proportion to its sales. The sales of the new product are expected to constitute approx 9% of the total company sales

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started