Answered step by step

Verified Expert Solution

Question

1 Approved Answer

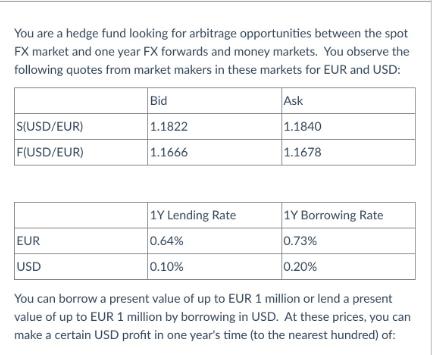

You are a hedge fund looking for arbitrage opportunities between the spot FX market and one year FX forwards and money markets. You observe

You are a hedge fund looking for arbitrage opportunities between the spot FX market and one year FX forwards and money markets. You observe the following quotes from market makers in these markets for EUR and USD: S(USD/EUR) F(USD/EUR) EUR USD Bid 1.1822 1.1666 1Y Lending Rate 0.64% 0.10% Ask 1.1840 1.1678 1Y Borrowing Rate 0.73% 0.20% You can borrow a present value of up to EUR 1 million or lend a present value of up to EUR 1 million by borrowing in USD. At these prices, you can make a certain USD profit in one year's time (to the nearest hundred) of: 10,400 6,000 12,300 7.100 None of the other answers,

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the profit we need to first determine the forward points spread between the spot rate and the forward rate The forward points spread is calculated as follows Forward Points Spread ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started