Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a hedge fund trader specializing in the pharmaceutical industry. Your models indicate that the stock of Merck ( NYSE: MRK ) is currently

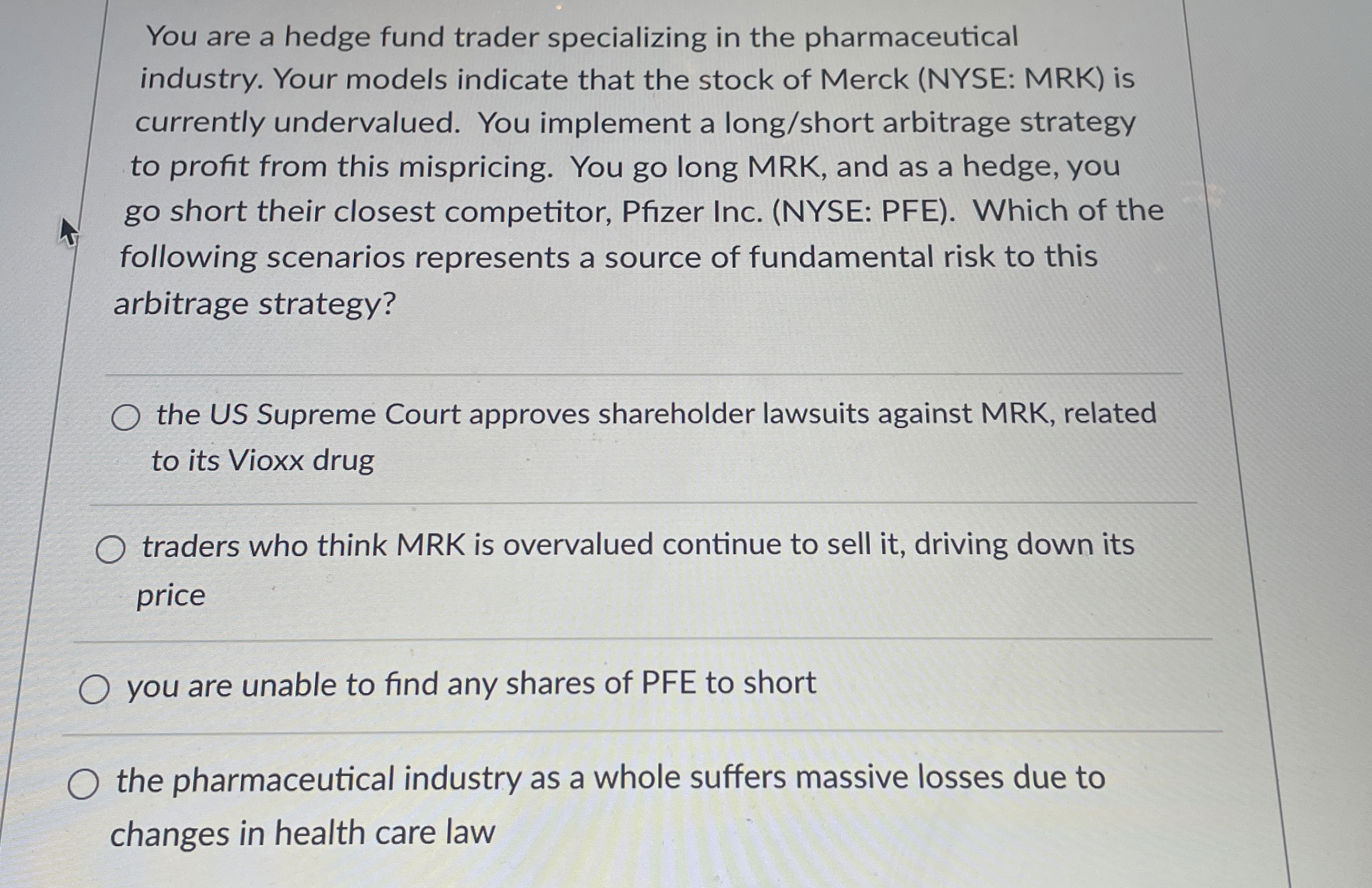

You are a hedge fund trader specializing in the pharmaceutical industry. Your models indicate that the stock of Merck NYSE: MRK is currently undervalued. You implement a longshort arbitrage strategy to profit from this mispricing. You go long MRK and as a hedge, you go short their closest competitor, Pfizer Inc. NYSE: PFE Which of the following scenarios represents a source of fundamental risk to this arbitrage strategy?

the US Supreme Court approves shareholder lawsuits against MRK related to its Vioxx drug

traders who think MRK is overvalued continue to sell it driving down its price

you are unable to find any shares of PFE to short

the pharmaceutical industry as a whole suffers massive losses due to changes in health care law

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started