Question

You are a long-only bond manager and you wish to determine what your holding period return would be if you have a horizon value of

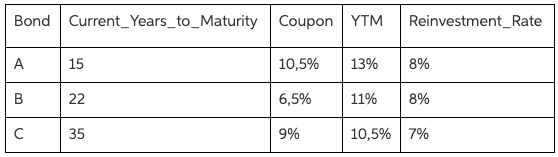

You are a long-only bond manager and you wish to determine what your holding period return would be if you have a horizon value of 12 years (i.e. sell all bonds in your portfolio). Data related to your current portfolio holdings is presented in the table below:

Assuming that you hold one of each bond, coupons are paid annually and each bond is priced assuming apar value of R100, calculate:

1. The current value of your portfolio

2. The future value of your portfolio in 12 years;

3. The HPR return over the 12 year horizon; and

4. The impact on HPR if at year 12, yields on all bonds have decreased by 1%.

Show your workings on Excel Spreadsheet

Bond Current_Years_to_Maturity Coupon YTM Reinvestment_Rate A 15 10,5% 13% 8% B 22 6,5% 11% 8% C 35 9% 10,5% 7%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started