Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a Management Accounting for a record company and you receive the following email from your Financial Manager You received the following email

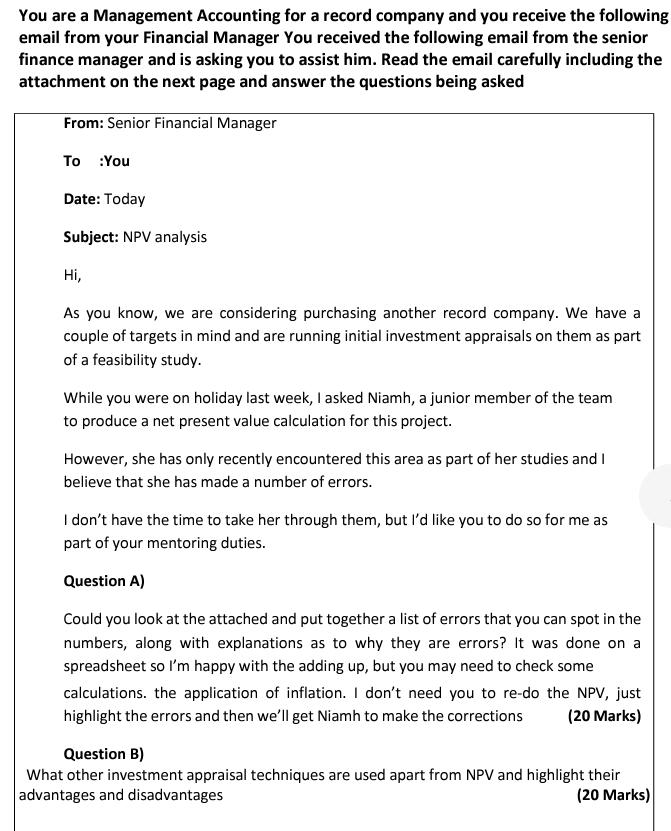

You are a Management Accounting for a record company and you receive the following email from your Financial Manager You received the following email from the senior finance manager and is asking you to assist him. Read the email carefully including the attachment on the next page and answer the questions being asked From: Senior Financial Manager To : You Date: Today Subject: NPV analysis Hi, As you know, we are considering purchasing another record company. We have a couple of targets in mind and are running initial investment appraisals on them as part of a feasibility study. While you were on holiday last week, I asked Niamh, a junior member of the team to produce a net present value calculation for this project. However, she has only recently encountered this area as part of her studies and I believe that she has made a number of errors. I don't have the time to take her through them, but I'd like you to do so for me as part of your mentoring duties. Question A) Could you look at the attached and put together a list of errors that you can spot in the numbers, along with explanations as to why they are errors? It was done on a spreadsheet so I'm happy with the adding up, but you may need to check some calculations. the application of inflation. I don't need you to re-do the NPV, just highlight the errors and then we'll get Niamh to make the corrections (20 Marks) Question B) What other investment appraisal techniques are used apart from NPV and highlight their advantages and disadvantages (20 Marks) Use this reference material for part A of the Question REFERENCE MATERIALS Figures in F$ million Sales revenue Artists and repertoire costs Production costs Licensing costs Administrative expenses Selling and marketing expenses Distribution expenses Interest on project funding loan Depreciation Operating profits Tax on operating profits Company purchase value Total cash flows Discount at 10% Present values NPV y/e y/e y/e y/e y/e 31/12/16 31/12/17 31/12/18 31/12/19 31/12/20 1 200 200 300.0 46 90.0 45.0 2.0 200 29 77 54.0 42.0 6.0 5.0 10.0 14 32 0.909 312.1 56 90.0 45.0 2.0 55.1 42.8 6.1 5.0 10.0 17 39 0.826 32 315.2 years Sales volumes are assumed to grow at 1% per year over the 59 - 90.0 45.0 2.0 55.1 42.8 6.1 5.0 10.0 18 41 0.751 31 Notes: Figures have been prepared for purchasing and running the company for four 318.4 62 90.0 45.0 2.0 55.1 42.8 6.1 5.0 10.0 19 44 0.683 30 appraisal period Inflation on sales prices will run at 3% per annum Artists and repertiore, production and licensing costs have been included at their value for 2019 Admin, selling & marketing and distribution expenses have been assumed to inflate at 2% per annum The general rate of inflation over the period will be 2.5% per annum The real cost of capital is 10% A loan of F$ 200m will be taken out to fund the purchase

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

solution The management of an organisation tries to maximises the present value not only for shareho...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started