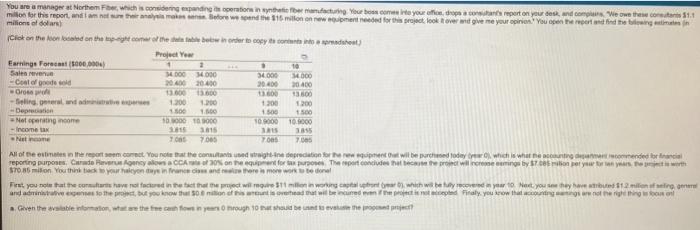

You are a manager at Northem Fiber, which is considering expanding its operations in synthetic fiber manufacturing Your boss comes into your office, drops a constant's report on your desk, and complains We owe these constants 31.1 million for this report, and i ir analysis makes sense. Before we spend the $15 million on new equipment needed for this project, look it over and give me your opinion. You open the report and find the blewing estimates (Click on the Moon located on the p-night comer of the dis table below in order to copy its contents into predst milions of dollars) Project Year Earnings Forecast ($000,000) Sales revenue -Cost of goods sold Gross prof -Seling, general, and administrative expenses -Depreciation Net operating income Income tax Net income 2 34.000 34.000 20400 20400 13.000 13.600 1.200 1.200 1.500 1.500 10.9000 109000 3815 7.005 3.815 2005 " 34.000 20.400 13.600 1.200 1.500 10.9000 3.815 7.005 10 34.000 20 400 13.600 1200 1.500 10.9000 3855 All of the estimates in the report seem comect. You note that the consultants used straight-ine depreciation for the new equipment that will be purchased today (year O), which is what the accounting department recommended for financial reporting purposes. Canade Reverus Agency allows a CCA rate of 30% on the equipment for tax purposes. The report concludes that because the project will increase esmings by $7.085 milion per your for ten years, the project is worth $70,85 milion You think back to your halcyon days in finance cises and realize there is more work to be donel First, you note that the consultants have not factored in the fact that the project will require $11 million in working capital upfront (year 0), which will be fully recovered in year 10 Next, you see they have atributed $1.2 million of seling, gener and administrative expenses to the project, but you know that 500 million of this anunt is overhead that be incurred even if the project is not accepted Finally, you know that accounting anings are not the right things on a. Given the available information, what are the free cash flows in years 0 mhrough 10 that should be used to evaluse the proposed project