Question: You are a manager at Percolated Fiber, which is considering expanding its operations. Your boss said to you We already owe these consultants $300,00, and

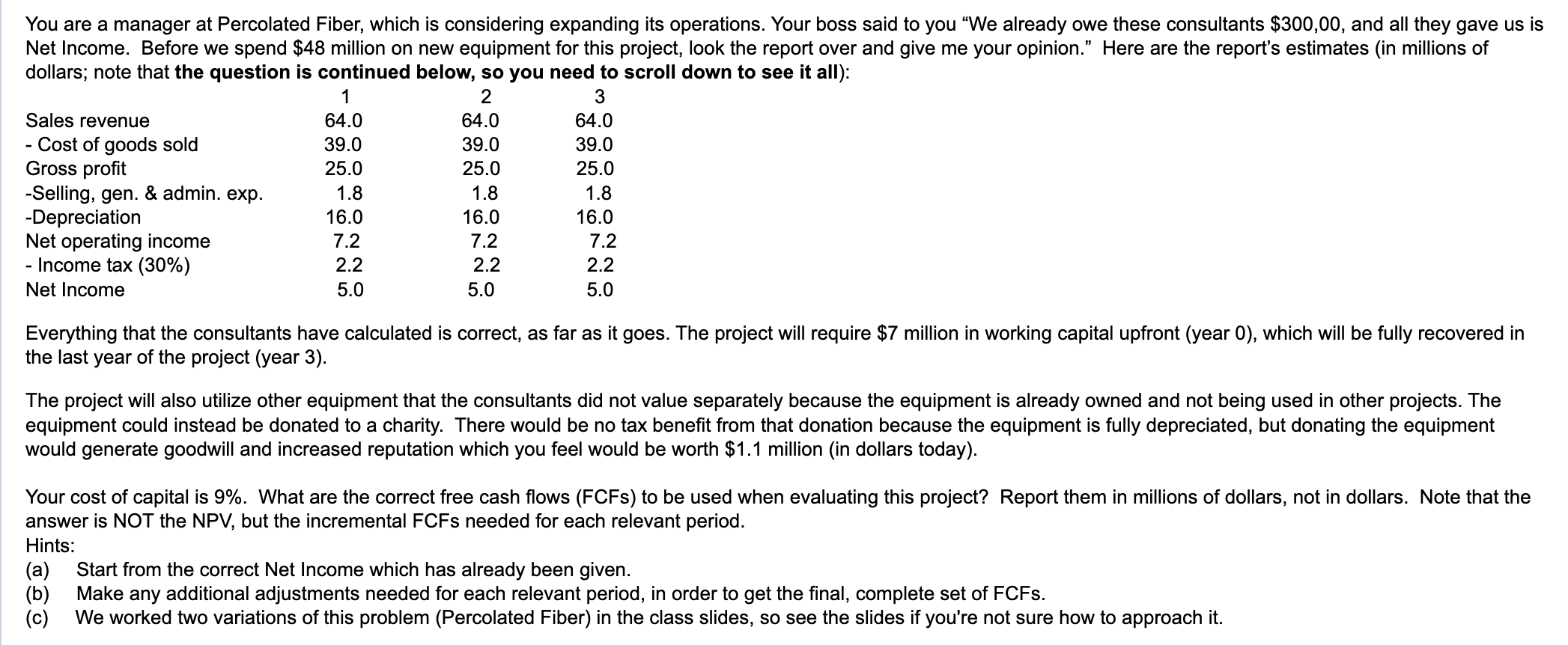

You are a manager at Percolated Fiber, which is considering expanding its operations. Your boss said to you "We already owe these consultants $300,00, and all they gave us is Net Income. Before we spend $48 million on new equipment for this project, look the report over and give me your opinion." Here are the report's estimates (in millions of dollars; note that the question is continued below, so you need to scroll down to see it all): Everything that the consultants have calculated is correct, as far as it goes. The project will require $7 million in working capital upfront (year 0 ), which will be fully recovered in the last year of the project (year 3). The project will also utilize other equipment that the consultants did not value separately because the equipment is already owned and not being used in other projects. The equipment could instead be donated to a charity. There would be no tax benefit from that donation because the equipment is fully depreciated, but donating the equipment would generate goodwill and increased reputation which you feel would be worth $1.1 million (in dollars today). Your cost of capital is 9%. What are the correct free cash flows (FCFs) to be used when evaluating this project? Report them in millions of dollars, not in dollars. Note that the answer is NOT the NPV, but the incremental FCFs needed for each relevant period. Hints: (a) Start from the correct Net Income which has already been given. (b) Make any additional adjustments needed for each relevant period, in order to get the final, complete set of FCFs. (c) We worked two variations of this problem (Percolated Fiber) in the class slides, so see the slides if you're not sure how to approach it. Again, the FCFs should be expressed in millions of dollars to one decimal place, but do not add a dollar sign. The first relevant period's FCF is: The second relevant period's FCF is: The third relevant period's FCF is: The fourth relevant period's FCF is: You are a manager at Percolated Fiber, which is considering expanding its operations. Your boss said to you "We already owe these consultants $300,00, and all they gave us is Net Income. Before we spend $48 million on new equipment for this project, look the report over and give me your opinion." Here are the report's estimates (in millions of dollars; note that the question is continued below, so you need to scroll down to see it all): Everything that the consultants have calculated is correct, as far as it goes. The project will require $7 million in working capital upfront (year 0 ), which will be fully recovered in the last year of the project (year 3). The project will also utilize other equipment that the consultants did not value separately because the equipment is already owned and not being used in other projects. The equipment could instead be donated to a charity. There would be no tax benefit from that donation because the equipment is fully depreciated, but donating the equipment would generate goodwill and increased reputation which you feel would be worth $1.1 million (in dollars today). Your cost of capital is 9%. What are the correct free cash flows (FCFs) to be used when evaluating this project? Report them in millions of dollars, not in dollars. Note that the answer is NOT the NPV, but the incremental FCFs needed for each relevant period. Hints: (a) Start from the correct Net Income which has already been given. (b) Make any additional adjustments needed for each relevant period, in order to get the final, complete set of FCFs. (c) We worked two variations of this problem (Percolated Fiber) in the class slides, so see the slides if you're not sure how to approach it. Again, the FCFs should be expressed in millions of dollars to one decimal place, but do not add a dollar sign. The first relevant period's FCF is: The second relevant period's FCF is: The third relevant period's FCF is: The fourth relevant period's FCF is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts