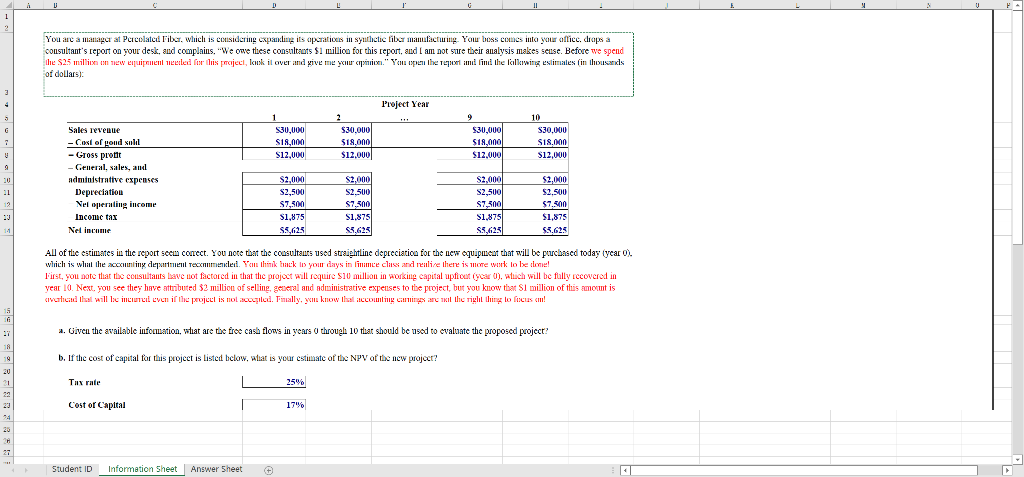

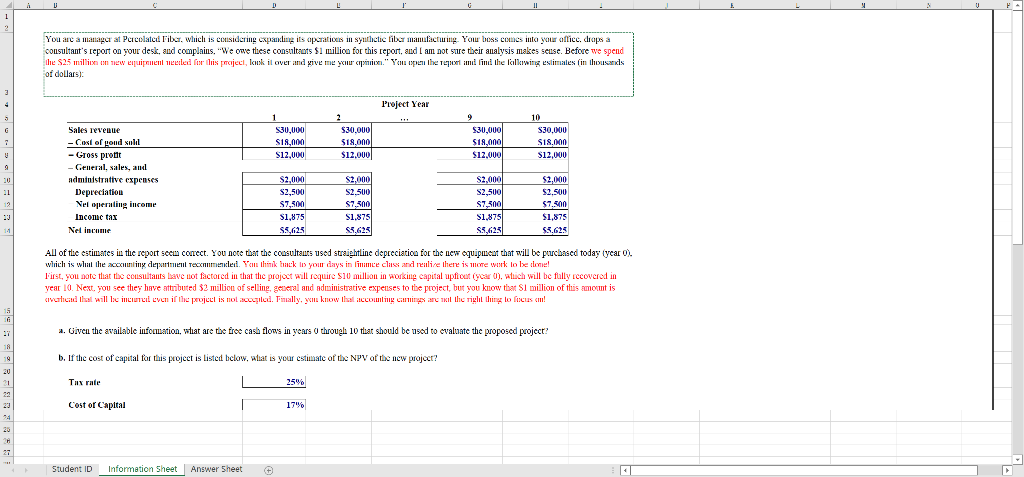

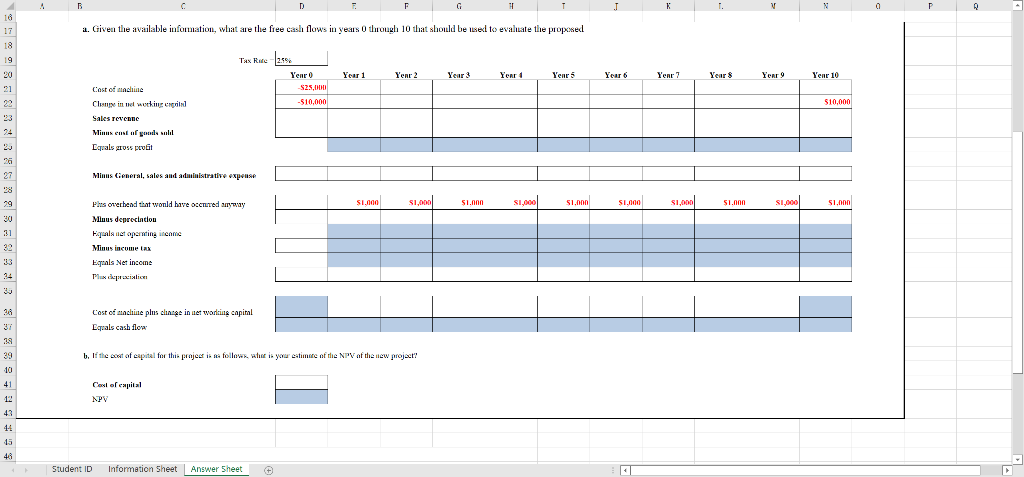

| You are a manager at Percolated Fiber, which is considering expanding its operations in synthetic fiber manufacturing. Your boss comes into your office, drops a consultants report on your desk, and complains, We owe these consultants $1 million for this report, and I am not sure their analysis makes sense. Before we spend the $25 million on new equipment needed for this project, look it over and give me your opinion. You open the report and find the following estimates (in thousands of dollars):

|

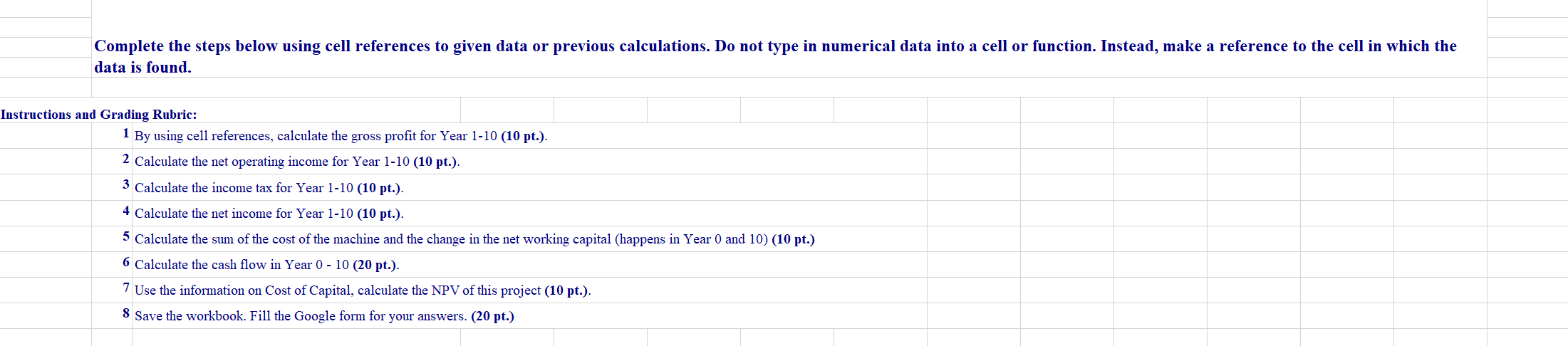

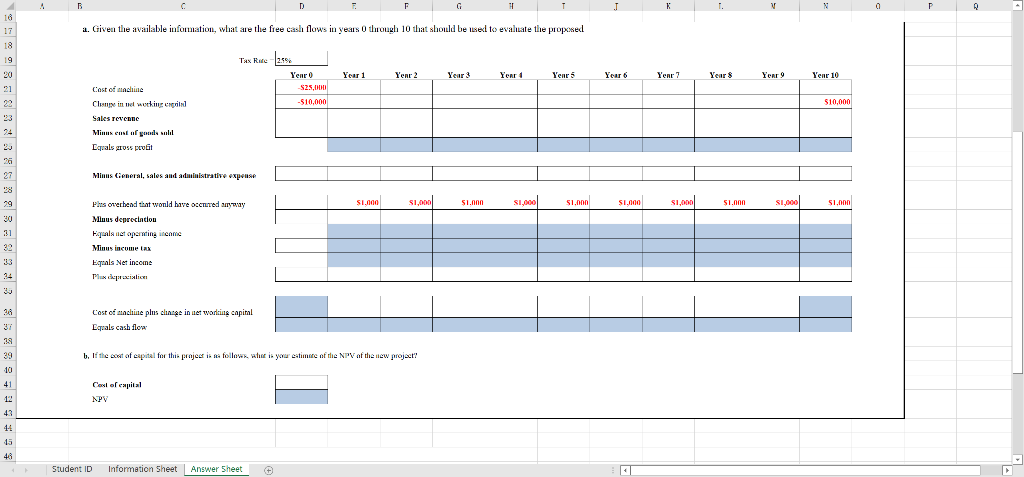

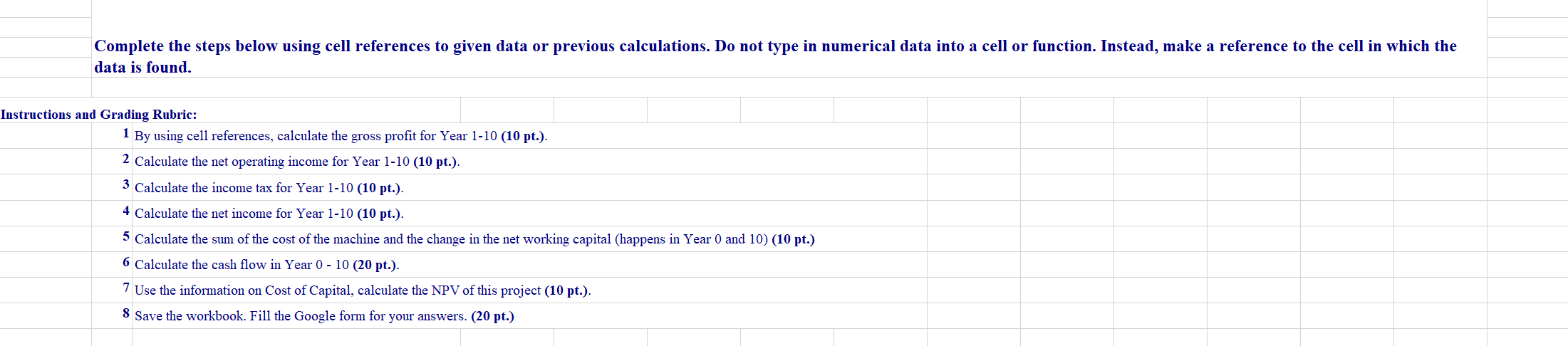

consultant's report on your desk, and complains, "We owe these consnltzots $1 wiliou for this report, and I am not swe their analysis makes sense. Before we spend of dollarsi: All of the estimates in the report seew conect. You note that the coasultamts used straightline depreciation for the uem oquipmeat that will be purchased today fyear oi. year 10. Next. you see they have atubuted 32 million of selling, geceral and administrative expenses to the project, but you know that $1 milion of this amount is a. Given the available infoumation, what are the free cash floos in years o through 10 that should be asod to evaluate the proposed project? data is found. Instructions and Grading Rubric: 1 By using cell references, calculate the gross profit for Year 1-10 (10 pt.). 2 Calculate the net operating income for Year 1-10 (10 pt.). 3 Calculate the income tax for Year 1-10 (10 pt.). 4 Calculate the net income for Year 1-10 (10 pt.). 5 Calculate the sum of the cost of the machine and the change in the net working capital (happens in Year 0 and 10)(10 pt.) 6 Calculate the cash flow in Year 010 (20 pt.). 7 Use the information on Cost of Capital, calculate the NPV of this project (10 pt.). 8 Save the workbook. Fill the Google form for your answers. (20 pt.) a. Givea the available information, what ale the free ciash flows in years 0 though 10 that should be used to evaluate the propossed consultant's report on your desk, and complains, "We owe these consnltzots $1 wiliou for this report, and I am not swe their analysis makes sense. Before we spend of dollarsi: All of the estimates in the report seew conect. You note that the coasultamts used straightline depreciation for the uem oquipmeat that will be purchased today fyear oi. year 10. Next. you see they have atubuted 32 million of selling, geceral and administrative expenses to the project, but you know that $1 milion of this amount is a. Given the available infoumation, what are the free cash floos in years o through 10 that should be asod to evaluate the proposed project? data is found. Instructions and Grading Rubric: 1 By using cell references, calculate the gross profit for Year 1-10 (10 pt.). 2 Calculate the net operating income for Year 1-10 (10 pt.). 3 Calculate the income tax for Year 1-10 (10 pt.). 4 Calculate the net income for Year 1-10 (10 pt.). 5 Calculate the sum of the cost of the machine and the change in the net working capital (happens in Year 0 and 10)(10 pt.) 6 Calculate the cash flow in Year 010 (20 pt.). 7 Use the information on Cost of Capital, calculate the NPV of this project (10 pt.). 8 Save the workbook. Fill the Google form for your answers. (20 pt.) a. Givea the available information, what ale the free ciash flows in years 0 though 10 that should be used to evaluate the propossed