Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a manager at Percolated Fiber, which is considering expanding its operations by starting a new project. You thought that you had estimated

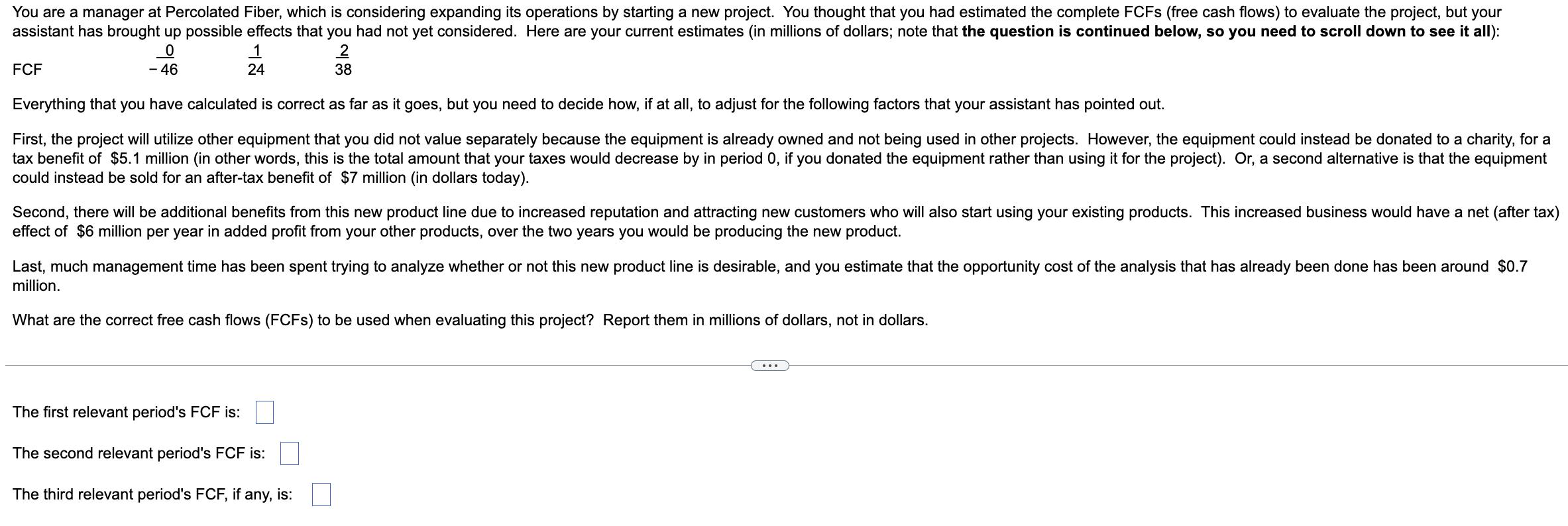

You are a manager at Percolated Fiber, which is considering expanding its operations by starting a new project. You thought that you had estimated the complete FCFs (free cash flows) to evaluate the project, but your assistant has brought up possible effects that you had not yet considered. Here are your current estimates (in millions of dollars; note that the question is continued below, so you need to scroll down to see it all): 0 2 38 - 46 FCF 24 Everything that you have calculated is correct as far as it goes, but you need to decide how, if at all, to adjust for the following factors that your assistant has pointed out. First, the project will utilize other equipment that you did not value separately because the equipment is already owned and not being used in other projects. However, the equipment could instead be donated to a charity, for a tax benefit of $5.1 million (in other words, this is the total amount that your taxes would decrease by in period 0, if you donated the equipment rather than using it for the project). Or, a second alternative is that the equipment could instead be sold for an after-tax benefit of $7 million (in dollars today). Second, there will be additional benefits from this new product line due to increased reputation and attracting new customers who will also start using your existing products. This increased business would have a net (after tax) effect of $6 million per year in added profit from your other products, over the two years you would be producing the new product. Last, much management time has been spent trying to analyze whether or not this new product line is desirable, and you estimate that the opportunity cost of the analysis that has already been done has been around $0.7 million. What are the correct free cash flows (FCFS) to be used when evaluating this project? Report them in millions of dollars, not in dollars. The first relevant period's FCF is: The second relevant period's FCF is: The third relevant period's FCF, if any, is: ...

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To adjust for the factors pointed out by your assistant the free cash flows FCFs need to be modified ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started