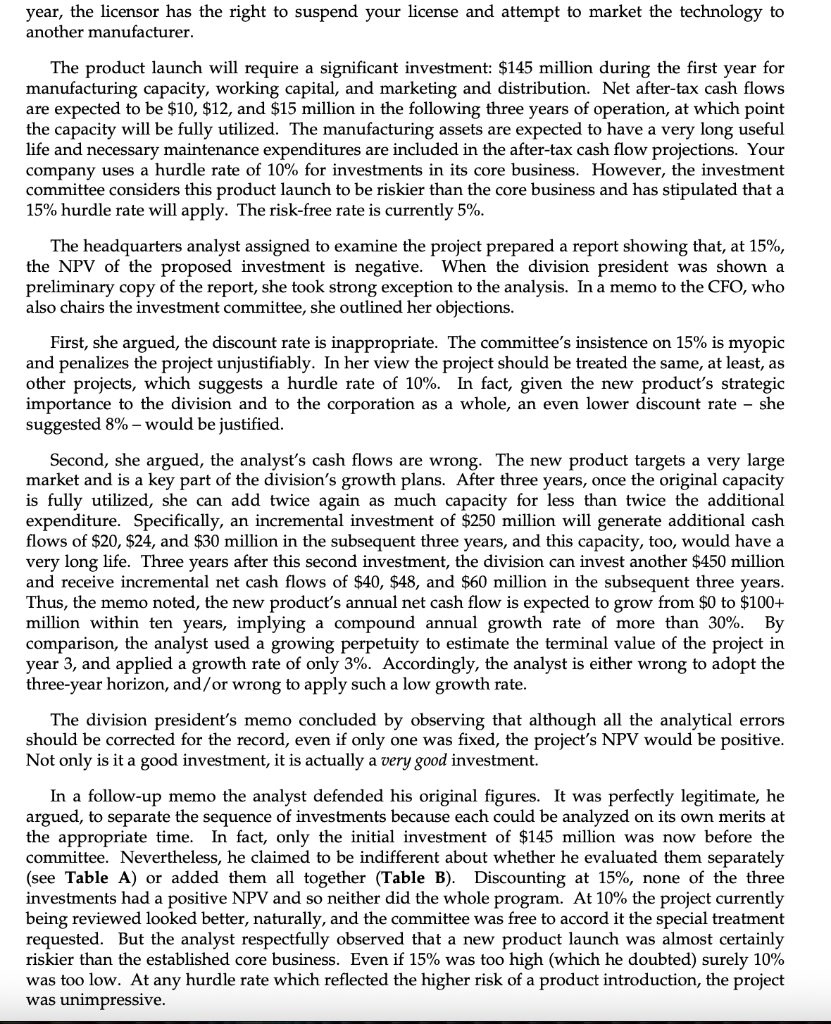

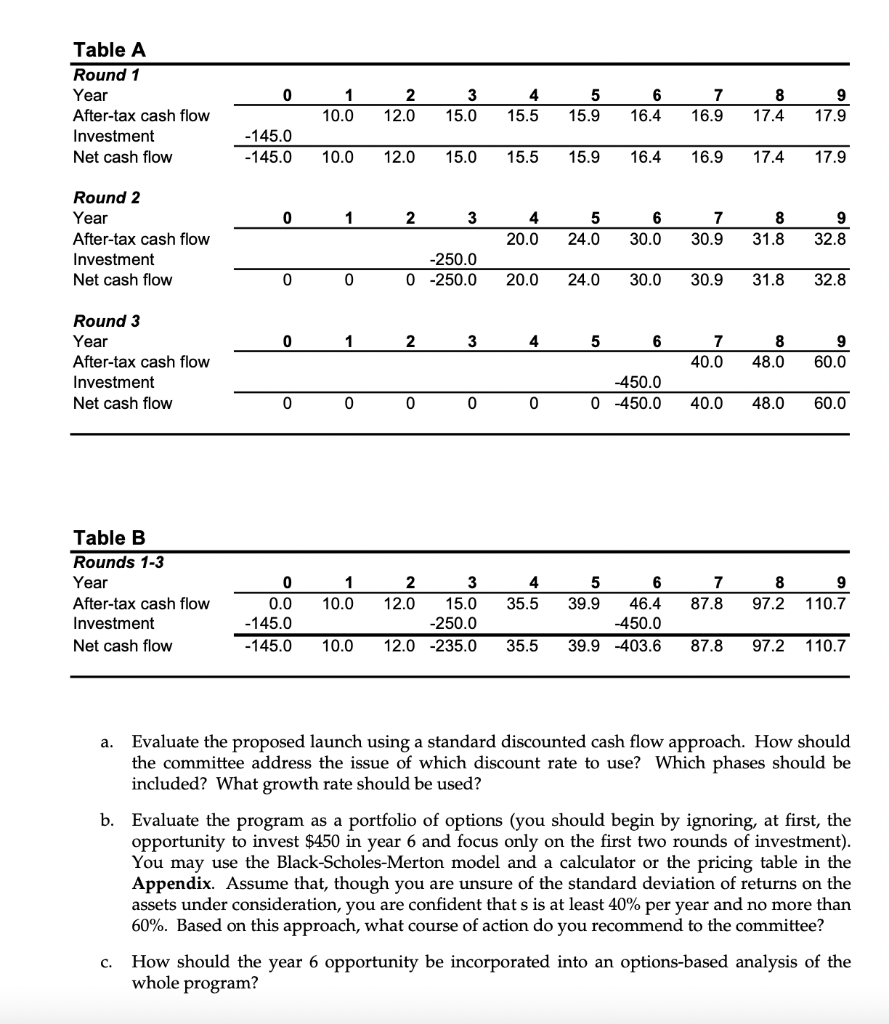

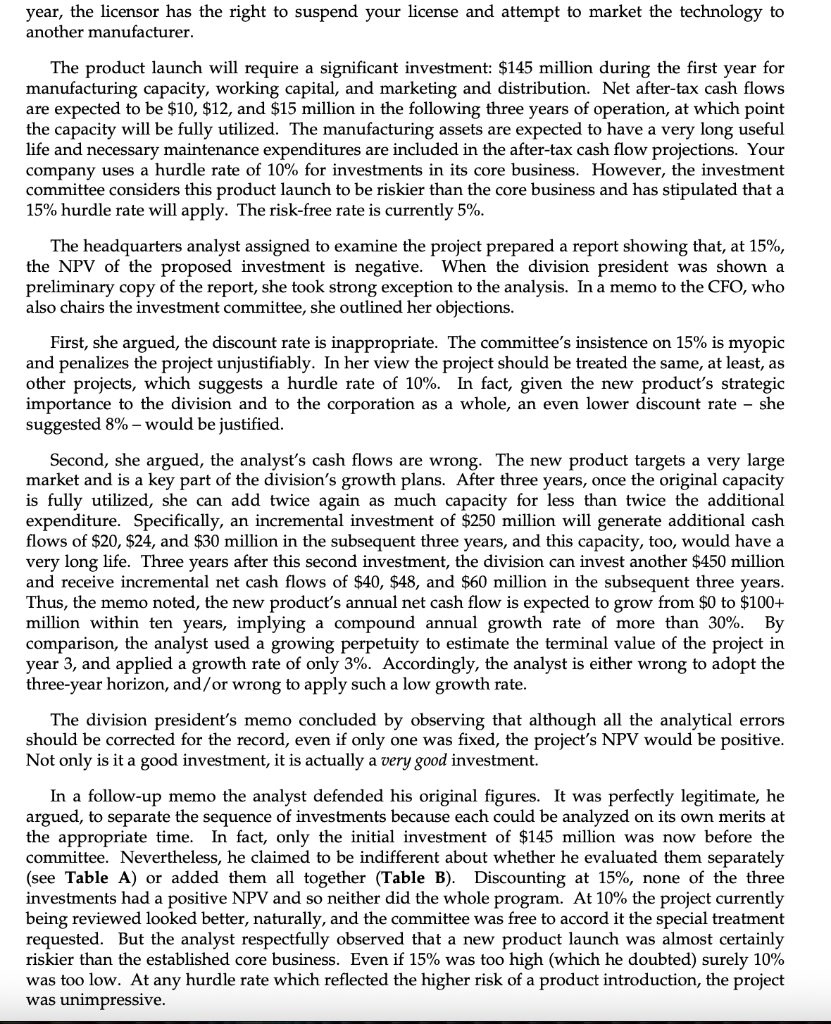

You are a member of the investment committee for a large manufacturing company that two years ago licensed a new technology from a small start-up firm. Based largely on that technology, engineers in one of your company's divisions developed a new product that is now ready for launch. The division president recommends proceeding with the project and has requested authorization and funding to begin the launch. Your committee has to decide whether to endorse the recommendation and authorize the necessary funding. If your company does not proceed with the launch within the year, the licensor has the right to suspend your license and attempt to market the technology to another manufacturer. The product launch will require a significant investment: $145 million during the first year for manufacturing capacity, working capital, and marketing and distribution. Net after-tax cash flows are expected to be $10, $12, and $15 million in the following three years of operation, at which point the capacity will be fully utilized. The manufacturing assets are expected to have a very long useful life and necessary maintenance expenditures are included in the after-tax cash flow projections. Your company uses a hurdle rate of 10% for investments in its core business. However, the investment committee considers this product launch to be riskier than the core business and has stipulated that a 15% hurdle rate will apply. The risk-free rate is currently 5%. The headquarters analyst assigned to examine the project prepared a report showing that, at 15%, the NPV of the proposed investment is negative. When the division president was shown a preliminary copy of the report, she took strong exception to the analysis. In a memo to the CFO, who also chairs the investment committee, she outlined her objections. First, she argued, the discount rate is inappropriate. The committee's insistence on 15% is myopic and penalizes the project unjustifiably. In her view the project should be treated the same, at least, as other projects, which suggests a hurdle rate of 10%. In fact, given the new product's strategic importance to the division and to the corporation as a whole, an even lower discount rate - she suggested 8% - would be justified. Second, she argued, the analyst's cash flows are wrong. The new product targets a large market and is a key part of the division's growth plans. After three years, once the original capacity is fully utilized, she can add twice again as much capacity for less than twice the additional expenditure. Specifically, an incremental investment of $250 million will generate additional cash flows of $20, $24, and $30 million in the subsequent three years, and this capacity, too, would have a very long life. Three years after this second investment, the division can invest another $450 million and receive incremental net cash flows of $40, $48, and $60 million in the subsequent three years. Thus, the memo noted, the new product's annual net cash flow is expected to grow from $0 to $100+ million within ten years, implying a compound annual growth rate of more than 30%. By comparison, the analyst used a growing perpetuity to estimate the terminal value of the project in year 3, and applied a growth rate of only 3%. Accordingly, the analyst is either wrong to adopt the three-year horizon, and/or wrong to apply such a low growth rate. The division president's memo concluded by observing that although all the analytical errors should be corrected for the record, even if only one was fixed, the project's NPV would be positive. Not only is it a good investment, it is actually a very good investment. In a follow-up memo the analyst defended his original figures. It was perfectly legitimate, he argued, to separate the sequence of investments because each could be analyzed on its own merits at the appropriate time. In fact, only the initial investment of $145 million was now before the committee. Nevertheless, he claimed to be indifferent about whether he evaluated them separately (see Table A) or added them all together (Table B). Discounting at 15%, none of the three investments had a positive NPV and so neither did the whole program. At 10% the project currently being reviewed looked better, naturally, and the committee was free to accord it the special treatment requested. But the analyst respectfully observed that a new product launch was almost certainly riskier than the established core business. Even if 15% was too high (which he doubted) surely 10% was too low. At any hurdle rate which reflected the higher risk of a product introduction, the project was unimpressive. 0 Table A Round 1 Year After-tax cash flow Investment Net cash flow 1 10.0 2 12.0 3 15.0 4 15.5 5 15.9 6 16.4 7 16.9 8 17.4 9 17.9 -145.0 -145.0 10.0 12.0 15.0 15.5 15.9 16.4 16.9 17.4 17.9 0 1 2 3 Round 2 Year After-tax cash flow Investment Net cash flow 4 20.0 5 24.0 6 30.0 7 30.9 8 31.8 9 32.8 -250.0 0-250.0 0 0 20.0 24.0 30.0 30.9 31.8 32.8 0 1 2 3 4 5 6 Round 3 Year After-tax cash flow Investment Net cash flow 7 40.0 8 48.0 9 60.0 -450.0 -450.0 0 0 0 0 0 0 40.0 48.0 60.0 Table B Rounds 1-3 Year After-tax cash flow Investment Net cash flow 1 10.0 4 35.5 7 87.8 8 9 97.2 110.7 0 0.0 -145.0 -145.0 2 3 12.0 15.0 -250.0 12.0 -235.0 5 6 39.9 46.4 -450.0 39.9 -403.6 10.0 35.5 87.8 97.2 110.7 a. Evaluate the proposed launch using a standard discounted cash flow approach. How should the committee address the issue of which discount rate to use? Which phases should be included? What growth rate should be used? b. Evaluate the program as a portfolio of options (you should begin by ignoring, at first, the opportunity to invest $450 in year 6 and focus only on the first two rounds of investment). You may use the Black-Scholes-Merton model and a calculator or the pricing table in the Appendix. Assume that, though you are unsure of the standard deviation of returns on the assets under consideration, you are confident that s is at least 40% per year and no more than 60%. Based on this approach, what course of action do you recommend to the committee? How should the year 6 opportunity be incorporated into an options-based analysis of the whole program? c. You are a member of the investment committee for a large manufacturing company that two years ago licensed a new technology from a small start-up firm. Based largely on that technology, engineers in one of your company's divisions developed a new product that is now ready for launch. The division president recommends proceeding with the project and has requested authorization and funding to begin the launch. Your committee has to decide whether to endorse the recommendation and authorize the necessary funding. If your company does not proceed with the launch within the year, the licensor has the right to suspend your license and attempt to market the technology to another manufacturer. The product launch will require a significant investment: $145 million during the first year for manufacturing capacity, working capital, and marketing and distribution. Net after-tax cash flows are expected to be $10, $12, and $15 million in the following three years of operation, at which point the capacity will be fully utilized. The manufacturing assets are expected to have a very long useful life and necessary maintenance expenditures are included in the after-tax cash flow projections. Your company uses a hurdle rate of 10% for investments in its core business. However, the investment committee considers this product launch to be riskier than the core business and has stipulated that a 15% hurdle rate will apply. The risk-free rate is currently 5%. The headquarters analyst assigned to examine the project prepared a report showing that, at 15%, the NPV of the proposed investment is negative. When the division president was shown a preliminary copy of the report, she took strong exception to the analysis. In a memo to the CFO, who also chairs the investment committee, she outlined her objections. First, she argued, the discount rate is inappropriate. The committee's insistence on 15% is myopic and penalizes the project unjustifiably. In her view the project should be treated the same, at least, as other projects, which suggests a hurdle rate of 10%. In fact, given the new product's strategic importance to the division and to the corporation as a whole, an even lower discount rate - she suggested 8% - would be justified. Second, she argued, the analyst's cash flows are wrong. The new product targets a large market and is a key part of the division's growth plans. After three years, once the original capacity is fully utilized, she can add twice again as much capacity for less than twice the additional expenditure. Specifically, an incremental investment of $250 million will generate additional cash flows of $20, $24, and $30 million in the subsequent three years, and this capacity, too, would have a very long life. Three years after this second investment, the division can invest another $450 million and receive incremental net cash flows of $40, $48, and $60 million in the subsequent three years. Thus, the memo noted, the new product's annual net cash flow is expected to grow from $0 to $100+ million within ten years, implying a compound annual growth rate of more than 30%. By comparison, the analyst used a growing perpetuity to estimate the terminal value of the project in year 3, and applied a growth rate of only 3%. Accordingly, the analyst is either wrong to adopt the three-year horizon, and/or wrong to apply such a low growth rate. The division president's memo concluded by observing that although all the analytical errors should be corrected for the record, even if only one was fixed, the project's NPV would be positive. Not only is it a good investment, it is actually a very good investment. In a follow-up memo the analyst defended his original figures. It was perfectly legitimate, he argued, to separate the sequence of investments because each could be analyzed on its own merits at the appropriate time. In fact, only the initial investment of $145 million was now before the committee. Nevertheless, he claimed to be indifferent about whether he evaluated them separately (see Table A) or added them all together (Table B). Discounting at 15%, none of the three investments had a positive NPV and so neither did the whole program. At 10% the project currently being reviewed looked better, naturally, and the committee was free to accord it the special treatment requested. But the analyst respectfully observed that a new product launch was almost certainly riskier than the established core business. Even if 15% was too high (which he doubted) surely 10% was too low. At any hurdle rate which reflected the higher risk of a product introduction, the project was unimpressive. 0 Table A Round 1 Year After-tax cash flow Investment Net cash flow 1 10.0 2 12.0 3 15.0 4 15.5 5 15.9 6 16.4 7 16.9 8 17.4 9 17.9 -145.0 -145.0 10.0 12.0 15.0 15.5 15.9 16.4 16.9 17.4 17.9 0 1 2 3 Round 2 Year After-tax cash flow Investment Net cash flow 4 20.0 5 24.0 6 30.0 7 30.9 8 31.8 9 32.8 -250.0 0-250.0 0 0 20.0 24.0 30.0 30.9 31.8 32.8 0 1 2 3 4 5 6 Round 3 Year After-tax cash flow Investment Net cash flow 7 40.0 8 48.0 9 60.0 -450.0 -450.0 0 0 0 0 0 0 40.0 48.0 60.0 Table B Rounds 1-3 Year After-tax cash flow Investment Net cash flow 1 10.0 4 35.5 7 87.8 8 9 97.2 110.7 0 0.0 -145.0 -145.0 2 3 12.0 15.0 -250.0 12.0 -235.0 5 6 39.9 46.4 -450.0 39.9 -403.6 10.0 35.5 87.8 97.2 110.7 a. Evaluate the proposed launch using a standard discounted cash flow approach. How should the committee address the issue of which discount rate to use? Which phases should be included? What growth rate should be used? b. Evaluate the program as a portfolio of options (you should begin by ignoring, at first, the opportunity to invest $450 in year 6 and focus only on the first two rounds of investment). You may use the Black-Scholes-Merton model and a calculator or the pricing table in the Appendix. Assume that, though you are unsure of the standard deviation of returns on the assets under consideration, you are confident that s is at least 40% per year and no more than 60%. Based on this approach, what course of action do you recommend to the committee? How should the year 6 opportunity be incorporated into an options-based analysis of the whole program? c