Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a MNC looking at buying a company in your country of choice. You have determined that the free cash flow is $150 Million

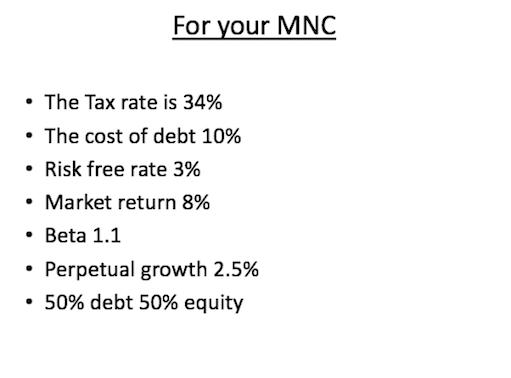

You are a MNC looking at buying a company in your country of choice. You have determined that the free cash flow is $150 Million growing at 9% each year. How much would you pay for this company? You will have to use the Capital Asset Pricing Model (CAPM), determine the Weighted Average Cost of Capital (WACC) and then discount the free cash flows that you will determine after applying the growth.

r

r

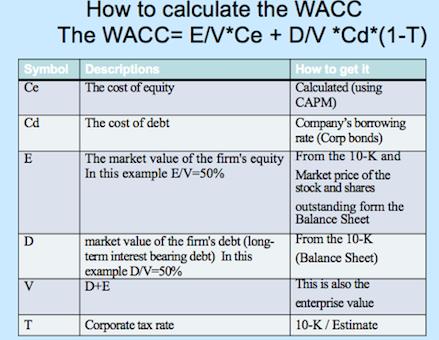

How to calculate the WACC The WACC= E/V*Ce + D/V *Cd*(1-T) Symbol Descriptions Ce How to get it Calculated (using ) The cost of equity The cost of debt Company's borrowing rate (Corp bonds) The market value of the firm's equity From the 10-K and Market price of the stock and shares Cd E In this example E/V=50% outstanding form the Balance Sheet From the 10-K market value of the firm's debt (long- term interest bearing debt) In this example D/V-50% D+E (Balance Sheet) This is also the enterprise value V Corporate tax rate 10-K / Estimate

Step by Step Solution

★★★★★

3.26 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Market risk premium market return risk free rate 8 3 5 Using CAPM Cost of e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started