You are a newly employed Accountant at Harvey company Ltd. The company produces two products, X and Y. Within the first week of your

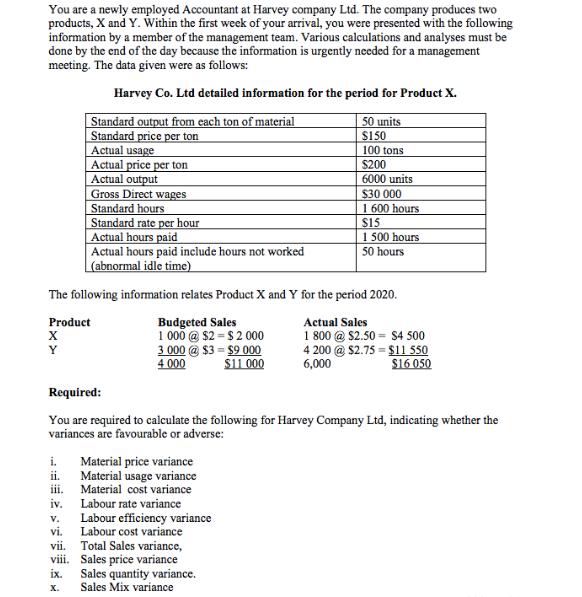

You are a newly employed Accountant at Harvey company Ltd. The company produces two products, X and Y. Within the first week of your arrival, you were presented with the following information by a member of the management team. Various calculations and analyses must be done by the end of the day because the information is urgently needed for a management meeting. The data given were as follows: Harvey Co. Ltd detailed information for the period for Product X. Standard output from each ton of material Standard price per ton Actual usage Actual price per ton Actual output Gross Direct wages Standard hours Standard rate per hour Actual hours paid Actual hours paid include hours not worked (abnormal idle time) 50 units $150 100 tons $200 6000 units $30 000 1 600 hours. $15 1 500 hours. 50 hours The following information relates Product X and Y for the period 2020. Product Y Budgeted Sales Actual Sales 1000 @ $2-$2000 1 800 @ $2.50 $4500 3.000 @ $3-$9 000 4 200 @ $2.75 $11 550 4.000 $11.000 6,000 $16 050 Required: You are required to calculate the following for Harvey Company Ltd, indicating whether the variances are favourable or adverse: i. Material price variance ii. Material usage variance iii. Material cost variance iv. Labour rate variance V. Labour efficiency variance vi. Labour cost variance vii. Total Sales variance, viii. Sales price variance ix. Sales quantity variance. x. Sales Mix variance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the variances we need to use the following formulas i Material price variance Actual Price Standard Price x Actual Usage ii Material usage variance Actual Usage Standard Usage x St...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started