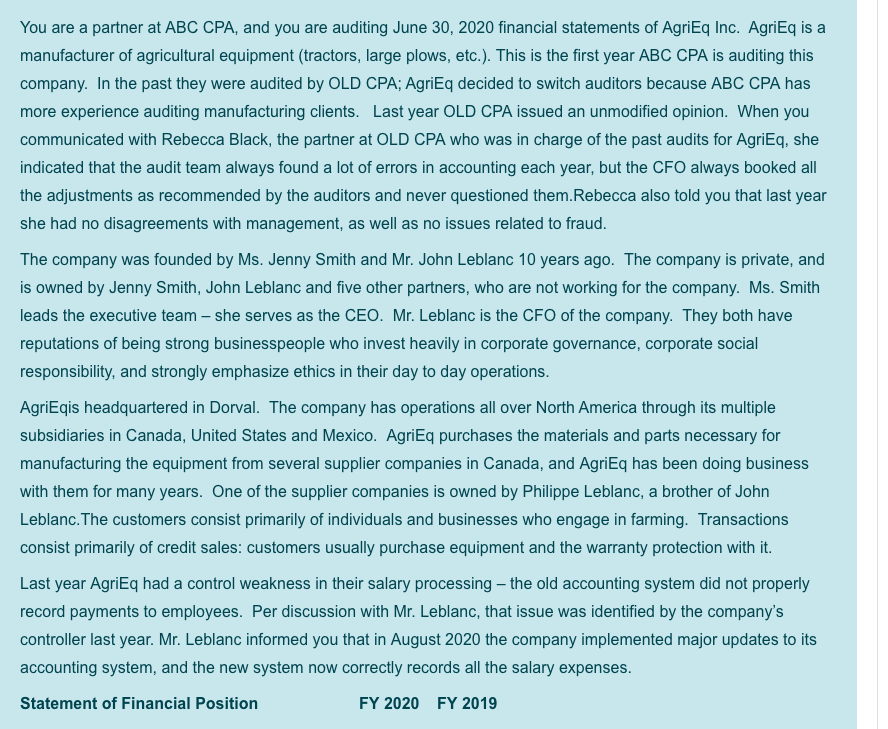

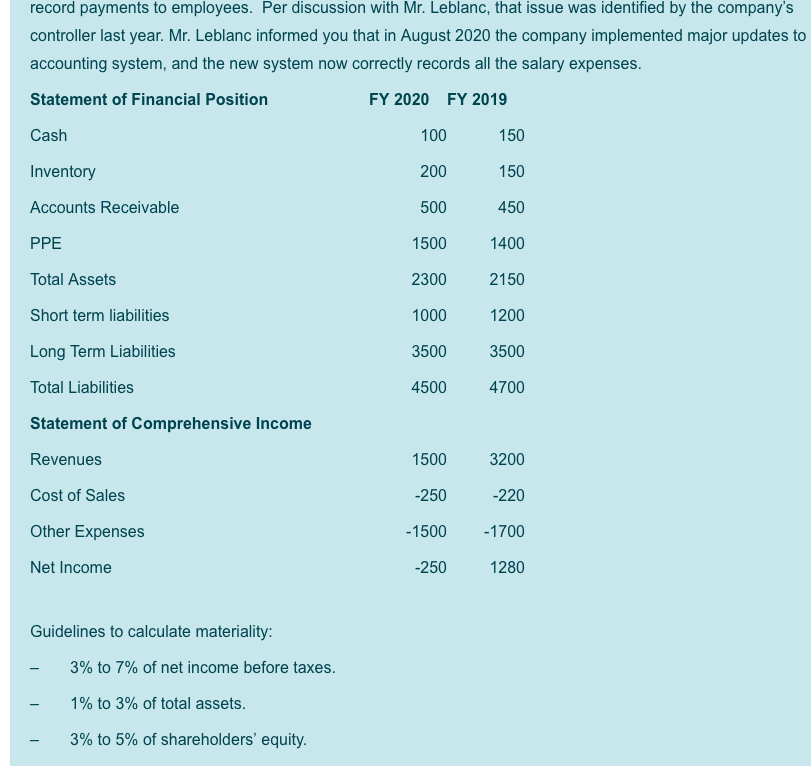

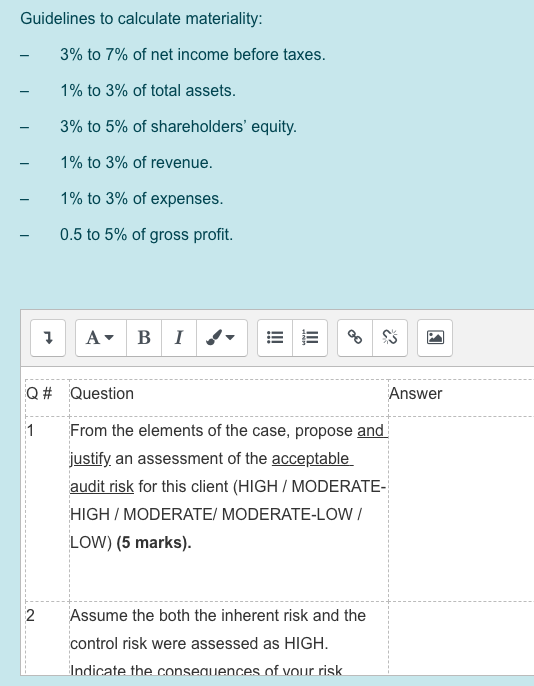

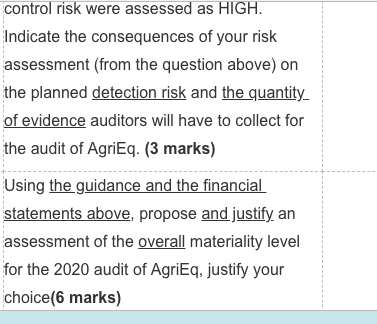

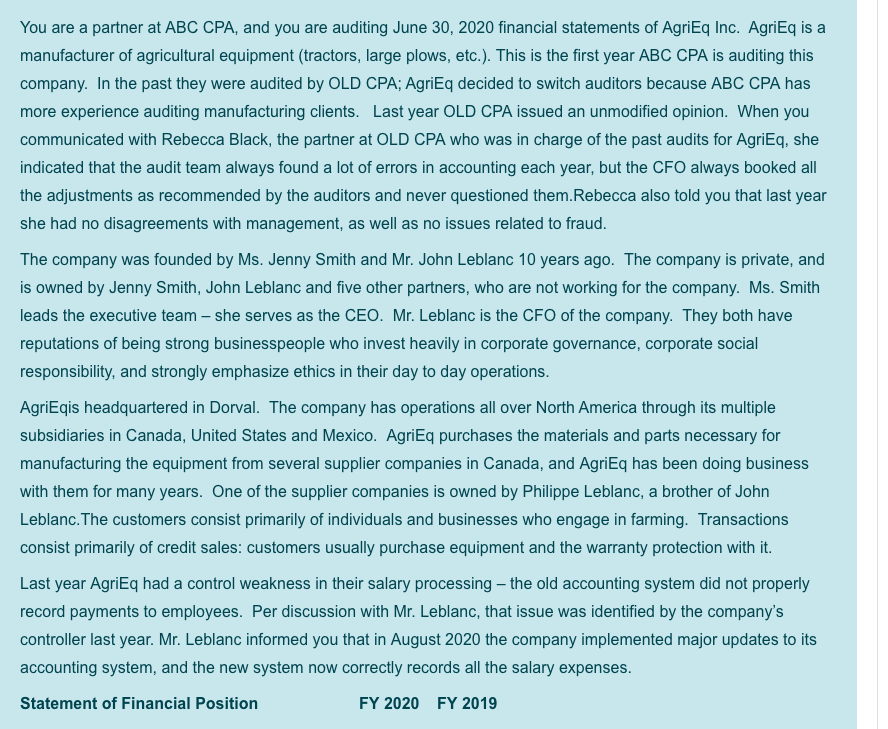

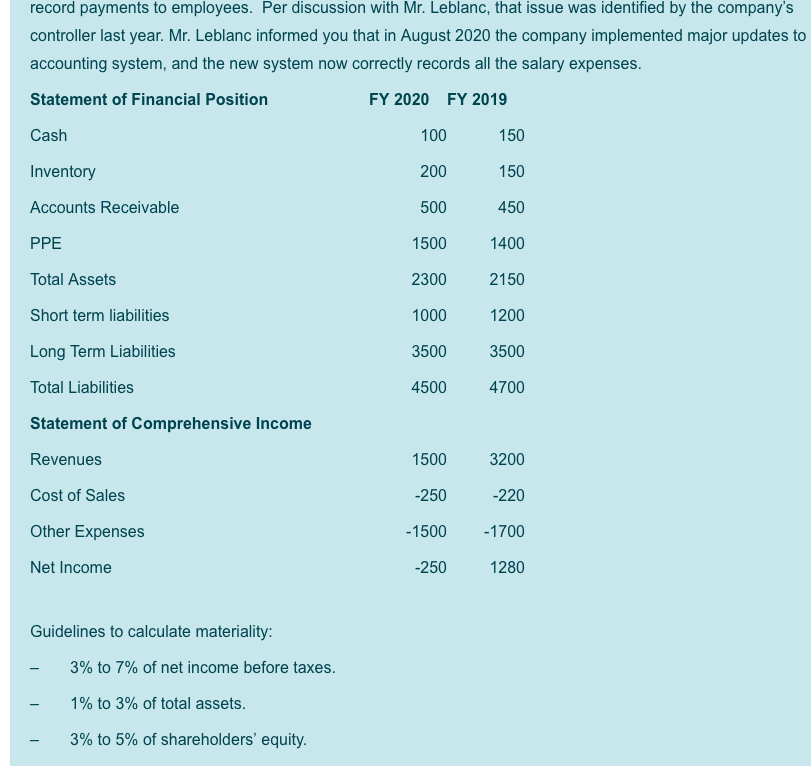

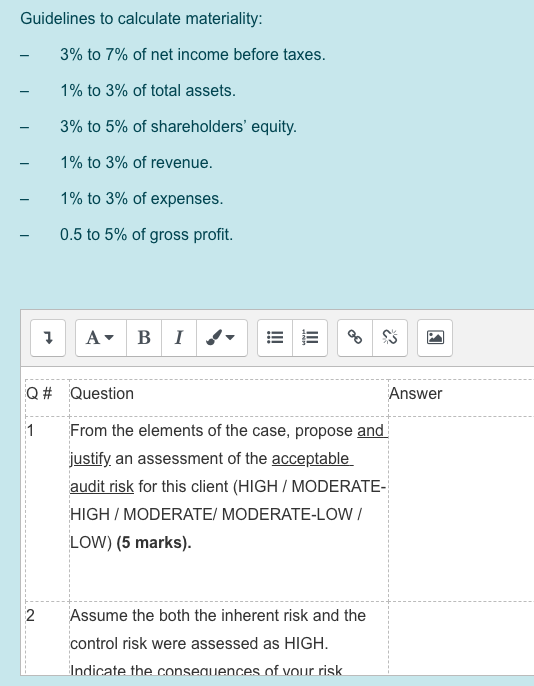

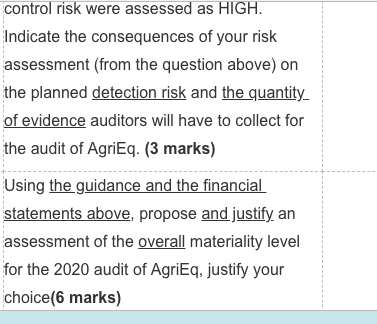

You are a partner at ABC CPA, and you are auditing June 30, 2020 financial statements of AgriEq Inc. AgriEq is a manufacturer of agricultural equipment (tractors, large plows, etc.). This is the first year ABC CPA is auditing this company. In the past they were audited by OLD CPA; AgriEq decided to switch auditors because ABC CPA has more experience auditing manufacturing clients. Last year OLD CPA issued an unmodified opinion. When you communicated with Rebecca Black, the partner at OLD CPA who was in charge of the past audits for AgriEq, she indicated that the audit team always found a lot of errors in accounting each year, but the CFO always booked all the adjustments as recommended by the auditors and never questioned them. Rebecca also told you that last year she had no disagreements with management, as well as no issues related to fraud. The company was founded by Ms. Jenny Smith and Mr. John Leblanc 10 years ago. The company is private, and is owned by Jenny Smith, John Leblanc and five other partners, who are not working for the company. Ms. Smith leads the executive team - she serves as the CEO. Mr. Leblanc is the CFO of the company. They both have reputations of being strong businesspeople who invest heavily in corporate governance, corporate social responsibility, and strongly emphasize ethics in their day to day operations. AgriEqis headquartered in Dorval. The company has operations all over North America through its multiple subsidiaries in Canada, United States and Mexico. AgriEq purchases the materials and parts necessary for manufacturing the equipment from several supplier companies in Canada, and AgriEq has been doing business with them for many years. One of the supplier companies is owned by Philippe Leblanc, a brother of John Leblanc. The customers consist primarily of individuals and businesses who engage in farming. Transactions consist primarily of credit sales: customers usually purchase equipment and the warranty protection with it. Last year AgriEq had a control weakness in their salary processing - the old accounting system did not properly record payments to employees. Per discussion with Mr. Leblanc, that issue was identified by the company's controller last year. Mr. Leblanc informed you that in August 2020 the company implemented major updates to its accounting system, and the new system now correctly records all the salary expenses. Statement of Financial Position FY 2020 FY 2019 record payments to employees. Per discussion with Mr. Leblanc, that issue was identified by the company's controller last year. Mr. Leblanc informed you that in August 2020 the company implemented major updates to accounting system, and the new system now correctly records all the salary expenses. Statement of Financial Position FY 2020 FY 2019 Cash 100 150 200 150 Inventory Accounts Receivable 500 450 PPE 1500 1400 Total Assets 2300 2150 Short term liabilities 1000 1200 Long Term Liabilities 3500 3500 Total Liabilities 4500 4700 Statement of Comprehensive Income Revenues 1500 3200 -250 -220 Cost of Sales Other Expenses Net Income -1500 -1700 -250 1280 Guidelines to calculate materiality: 3% to 7% of net income before taxes. 1% to 3% of total assets. 3% to 5% of shareholders' equity. Guidelines to calculate materiality: 3% to 7% of net income before taxes. 1% to 3% of total assets. 3% to 5% of shareholders' equity. 1% to 3% of revenue. 1% to 3% of expenses. 0.5 to 5% of gross profit. 7 A B 1 Q # Question Answer 1 From the elements of the case, propose and justify, an assessment of the acceptable audit risk for this client (HIGH / MODERATE- HIGH / MODERATE/ MODERATE-LOW / LOW) (5 marks). 2 Assume the both the inherent risk and the control risk were assessed as HIGH. Indicate the consequences of vour risk control risk were assessed as HIGH. Indicate the consequences of your risk assessment (from the question above) on the planned detection risk and the quantity of evidence auditors will have to collect for the audit of AgriEq. (3 marks) Using the guidance and the financial statements above, propose and justify, an assessment of the overall materiality level for the 2020 audit of AgriEq, justify your choice (6 marks) You are a partner at ABC CPA, and you are auditing June 30, 2020 financial statements of AgriEq Inc. AgriEq is a manufacturer of agricultural equipment (tractors, large plows, etc.). This is the first year ABC CPA is auditing this company. In the past they were audited by OLD CPA; AgriEq decided to switch auditors because ABC CPA has more experience auditing manufacturing clients. Last year OLD CPA issued an unmodified opinion. When you communicated with Rebecca Black, the partner at OLD CPA who was in charge of the past audits for AgriEq, she indicated that the audit team always found a lot of errors in accounting each year, but the CFO always booked all the adjustments as recommended by the auditors and never questioned them. Rebecca also told you that last year she had no disagreements with management, as well as no issues related to fraud. The company was founded by Ms. Jenny Smith and Mr. John Leblanc 10 years ago. The company is private, and is owned by Jenny Smith, John Leblanc and five other partners, who are not working for the company. Ms. Smith leads the executive team - she serves as the CEO. Mr. Leblanc is the CFO of the company. They both have reputations of being strong businesspeople who invest heavily in corporate governance, corporate social responsibility, and strongly emphasize ethics in their day to day operations. AgriEqis headquartered in Dorval. The company has operations all over North America through its multiple subsidiaries in Canada, United States and Mexico. AgriEq purchases the materials and parts necessary for manufacturing the equipment from several supplier companies in Canada, and AgriEq has been doing business with them for many years. One of the supplier companies is owned by Philippe Leblanc, a brother of John Leblanc. The customers consist primarily of individuals and businesses who engage in farming. Transactions consist primarily of credit sales: customers usually purchase equipment and the warranty protection with it. Last year AgriEq had a control weakness in their salary processing - the old accounting system did not properly record payments to employees. Per discussion with Mr. Leblanc, that issue was identified by the company's controller last year. Mr. Leblanc informed you that in August 2020 the company implemented major updates to its accounting system, and the new system now correctly records all the salary expenses. Statement of Financial Position FY 2020 FY 2019 record payments to employees. Per discussion with Mr. Leblanc, that issue was identified by the company's controller last year. Mr. Leblanc informed you that in August 2020 the company implemented major updates to accounting system, and the new system now correctly records all the salary expenses. Statement of Financial Position FY 2020 FY 2019 Cash 100 150 200 150 Inventory Accounts Receivable 500 450 PPE 1500 1400 Total Assets 2300 2150 Short term liabilities 1000 1200 Long Term Liabilities 3500 3500 Total Liabilities 4500 4700 Statement of Comprehensive Income Revenues 1500 3200 -250 -220 Cost of Sales Other Expenses Net Income -1500 -1700 -250 1280 Guidelines to calculate materiality: 3% to 7% of net income before taxes. 1% to 3% of total assets. 3% to 5% of shareholders' equity. Guidelines to calculate materiality: 3% to 7% of net income before taxes. 1% to 3% of total assets. 3% to 5% of shareholders' equity. 1% to 3% of revenue. 1% to 3% of expenses. 0.5 to 5% of gross profit. 7 A B 1 Q # Question Answer 1 From the elements of the case, propose and justify, an assessment of the acceptable audit risk for this client (HIGH / MODERATE- HIGH / MODERATE/ MODERATE-LOW / LOW) (5 marks). 2 Assume the both the inherent risk and the control risk were assessed as HIGH. Indicate the consequences of vour risk control risk were assessed as HIGH. Indicate the consequences of your risk assessment (from the question above) on the planned detection risk and the quantity of evidence auditors will have to collect for the audit of AgriEq. (3 marks) Using the guidance and the financial statements above, propose and justify, an assessment of the overall materiality level for the 2020 audit of AgriEq, justify your choice (6 marks)