Question

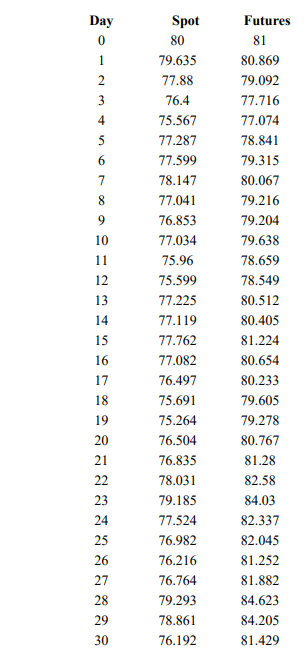

You are a portfolio manager and you would like to hedge a portfolio daily over a thirty-day horizon using futures. The table below provides data

You are a portfolio manager and you would like to hedge a portfolio daily over a thirty-day horizon using futures. The table below provides data on the values of the spot portfolio and the futures that will be used as a hedging instrument:

a) Use the data to find the minimum variance hedge ratio you would use to achieve the hedge

b) Using the hedge ratio from a., calculate the daily change in value of the hedged portfolio.

c) What is the standard deviation of changes in value of the hedged portfolio? How does this compare to the standard deviation of changes in the unhedged spot position?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started