Question

You are a portfolio manager that is interested in incorporating a new share in your portfolio multi-asset portfolio. Your portfolio currently holds bonds therefore you

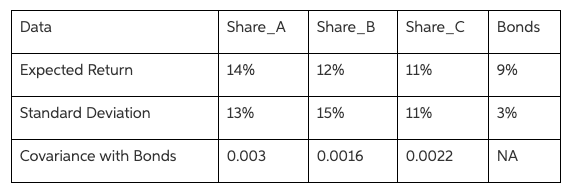

You are a portfolio manager that is interested in incorporating a new share in your portfolio multi-asset portfolio. Your portfolio currently holds bonds therefore you are faced with a simple two-asset problem. Assuming a risk-free rate of 6% and the data in the table below:

Please calculate:

1. The optimal weight in a share versus your current bond holding

2. The return of the new portfolio (made up of one share and your bond holding)

3. The risk of the new portfolio ((made up of one share and your bond holding)

Use EXCEL to calculate. Show your workings and formulas used

Data Share_A Share_B Share_C Bonds Expected Return 14% 12% 11% 9% Standard Deviation 13% 15% 11% 3% Covariance with Bonds 0.003 0.0016 0.0022 NA Data Share_A Share_B Share_C Bonds Expected Return 14% 12% 11% 9% Standard Deviation 13% 15% 11% 3% Covariance with Bonds 0.003 0.0016 0.0022 NAStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started