Question

You are a production coordinator for Soapex Corporation, a manufacturing company that manufactures bottles of liquid soap. Soapex has determined that they need to make

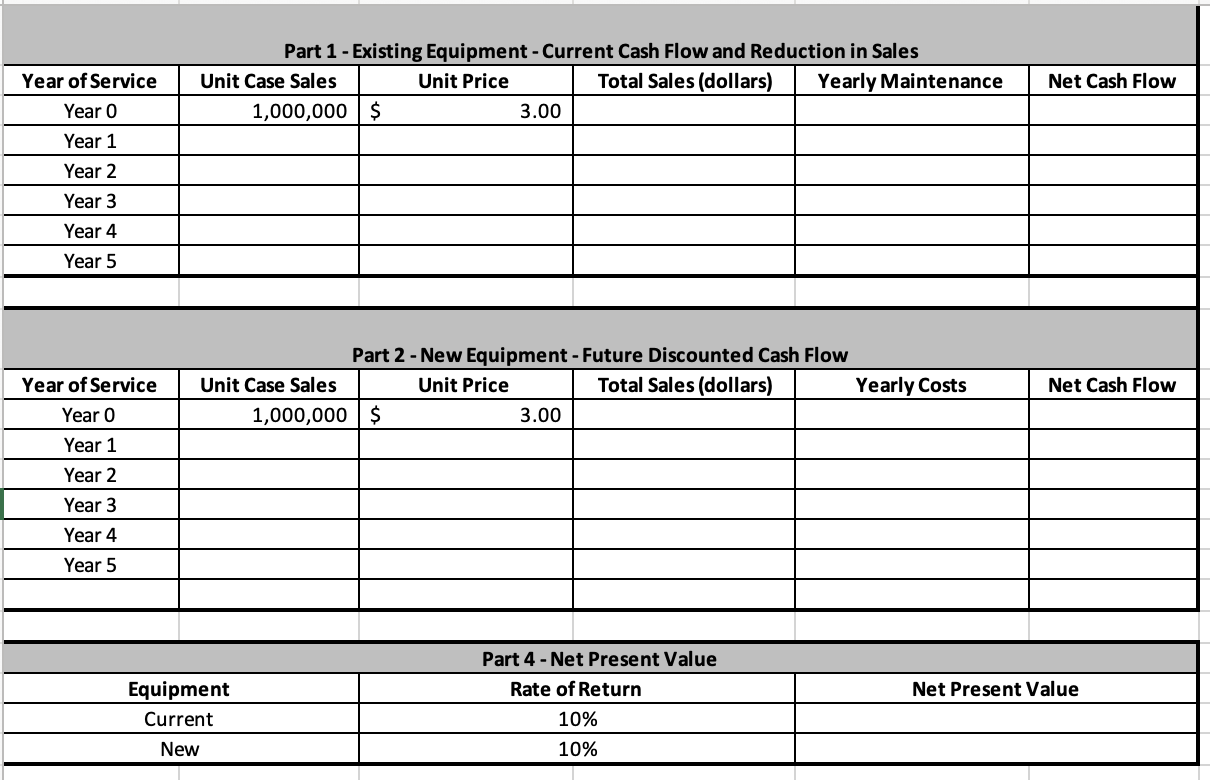

You are a production coordinator for Soapex Corporation, a manufacturing company that manufactures bottles of liquid soap. Soapex has determined that they need to make some strong investments to ramp up production and generate an increase in revenue. Currently, the equipment Soapex uses is over 20 years old, purchased when liquid soap first entered the retail market. While the equipment still works, the company incurs $100,000 annually in maintenance expenses because the equipment is old. Soapex presently produces 1 million cases of liquid soap per year. This soap sells for $3 per case.

Given the age of the equipment, you anticipate a decline in production of 50,000 cases in each of the next five years because of breakdowns in the equipment. You have been researching new production equipment and have found a new machine that will reduce annual operating costs to $48,000 per year and allow an increase in production over the 1 million cases presently being sold by sales and marketing. In conversations with sales and marketing, management believes they can increase sales by 1% per year for the next five years. The new machine will have a fully loaded cost of $370,000 and an expected useful life of 5 years with no salvage value. The old machine can be sold today as scrap for $5,000.

- Using the Net Cash Flow template, develop a schedule of projected cash flows using current equipment, including the reduction in future sales. Insert this information in your PowerPoint presentation. referencing scholarly resources

Part 1 - Existing Equipment-Current Cash Flow and Reduction in Sales Total Sales (dollars) Yearly Maintenance Net Cash Flow Year of Service Unit Case Sales Unit Price Year 0 1,000,000 $ 3.00 Year 1 Year 2 Year 3 Year 4 Year 5 Part 2 - New Equipment - Future Discounted Cash Flow Year of Service Year O Unit Case Sales 1,000,000 $ Unit Price 3.00 Year 1 Year 2 Year 3 Year 4 Year 5 Total Sales (dollars) Equipment Current New Part 4 - Net Present Value Rate of Return 10% 10% Yearly Costs Net Cash Flow Net Present Value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started