Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a provider of portfolio insurance and are establishing a 4-year program. The portfolio you manage is worth $114 million, an you hope to

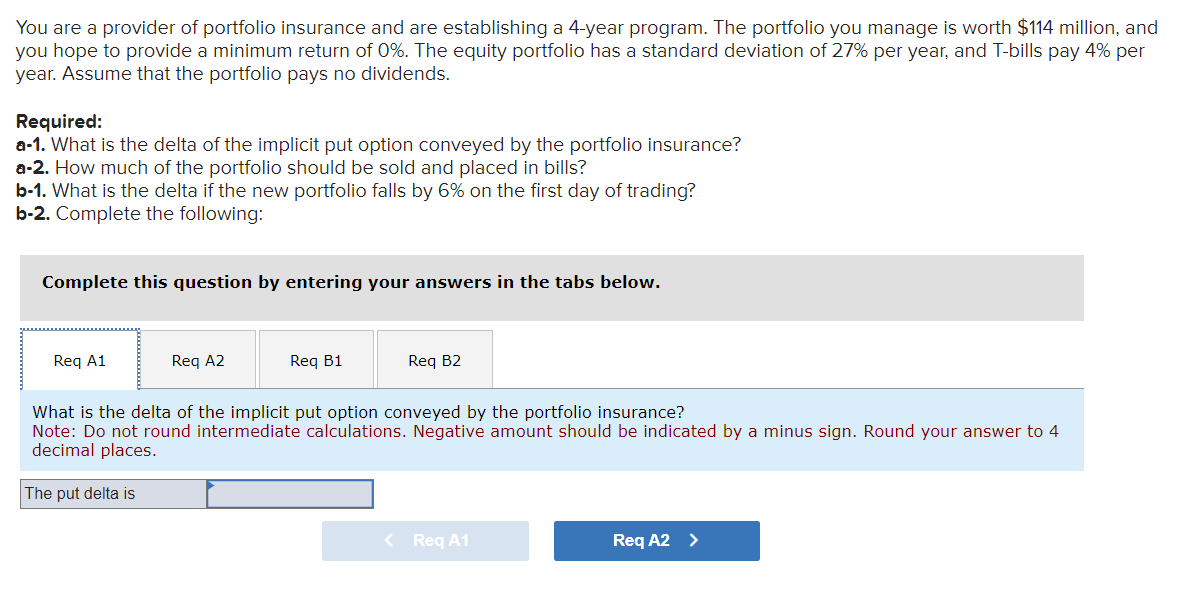

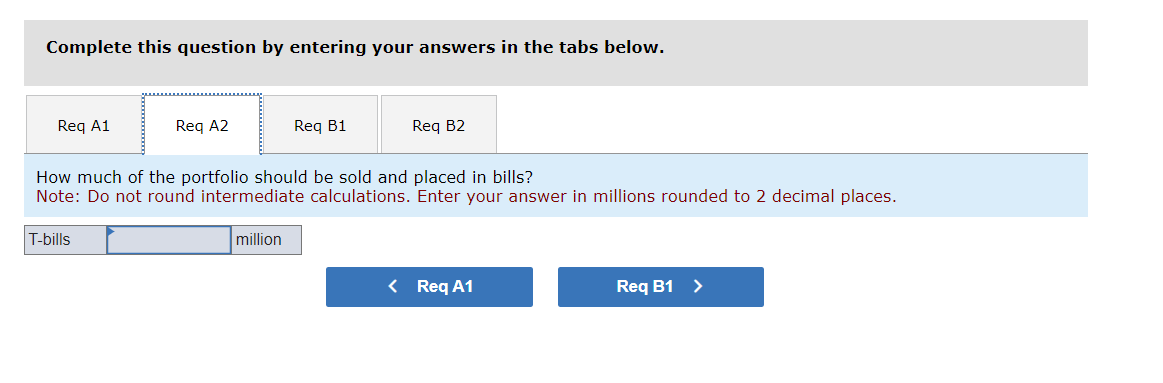

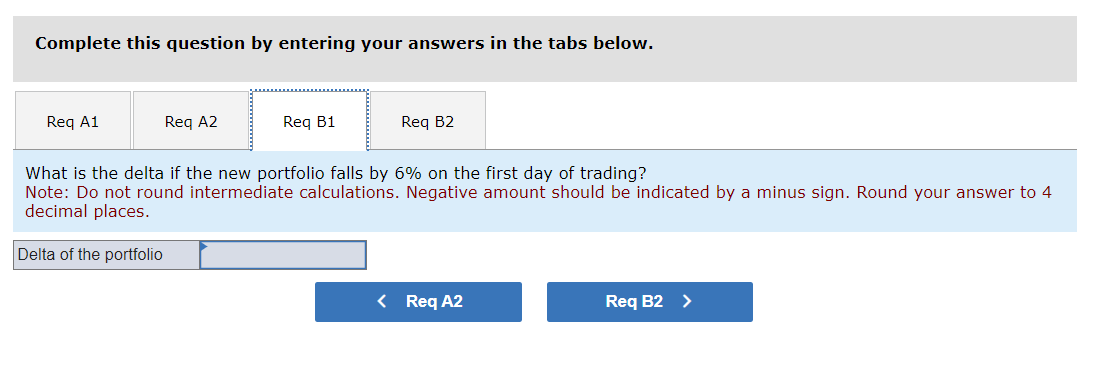

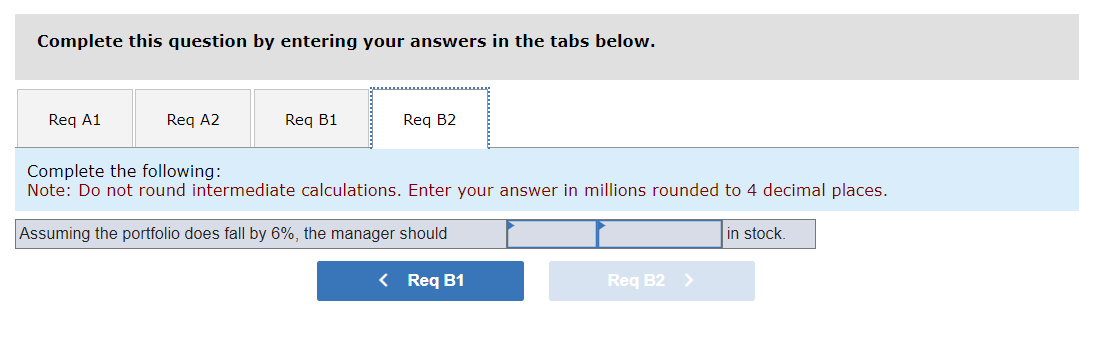

You are a provider of portfolio insurance and are establishing a 4-year program. The portfolio you manage is worth $114 million, an you hope to provide a minimum return of 0%. The equity portfolio has a standard deviation of 27% per year, and T-bills pay 4% per year. Assume that the portfolio pays no dividends. Required: a-1. What is the delta of the implicit put option conveyed by the portfolio insurance? a-2. How much of the portfolio should be sold and placed in bills? b-1. What is the delta if the new portfolio falls by 6% on the first day of trading? b-2. Complete the following: Complete this question by entering your answers in the tabs below. What is the delta of the implicit put option conveyed by the portfolio insurance? Note: Do not round intermediate calculations. Negative amount should be indicated by a minus sign. Round your answer to 4 decimal places. Complete this question by entering your answers in the tabs below. How much of the portfolio should be sold and placed in bills? Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. Complete this question by entering your answers in the tabs below. What is the delta if the new portfolio falls by 6% on the first day of trading? Note: Do not round intermediate calculations. Negative amount should be indicated by a minus sign. Round your answer to 4 decimal places. Complete this question by entering your answers in the tabs below. Complete the following: Note: Do not round intermediate calculations. Enter your answer in millions rounded to 4 decimal places. Assuming the portfolio does fall by 6%, the manager should

You are a provider of portfolio insurance and are establishing a 4-year program. The portfolio you manage is worth $114 million, an you hope to provide a minimum return of 0%. The equity portfolio has a standard deviation of 27% per year, and T-bills pay 4% per year. Assume that the portfolio pays no dividends. Required: a-1. What is the delta of the implicit put option conveyed by the portfolio insurance? a-2. How much of the portfolio should be sold and placed in bills? b-1. What is the delta if the new portfolio falls by 6% on the first day of trading? b-2. Complete the following: Complete this question by entering your answers in the tabs below. What is the delta of the implicit put option conveyed by the portfolio insurance? Note: Do not round intermediate calculations. Negative amount should be indicated by a minus sign. Round your answer to 4 decimal places. Complete this question by entering your answers in the tabs below. How much of the portfolio should be sold and placed in bills? Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. Complete this question by entering your answers in the tabs below. What is the delta if the new portfolio falls by 6% on the first day of trading? Note: Do not round intermediate calculations. Negative amount should be indicated by a minus sign. Round your answer to 4 decimal places. Complete this question by entering your answers in the tabs below. Complete the following: Note: Do not round intermediate calculations. Enter your answer in millions rounded to 4 decimal places. Assuming the portfolio does fall by 6%, the manager should Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started