Question

Entity A has an existing freehold factory property, which it intends to knock down and redevelop. During the redevelopment period the company will move

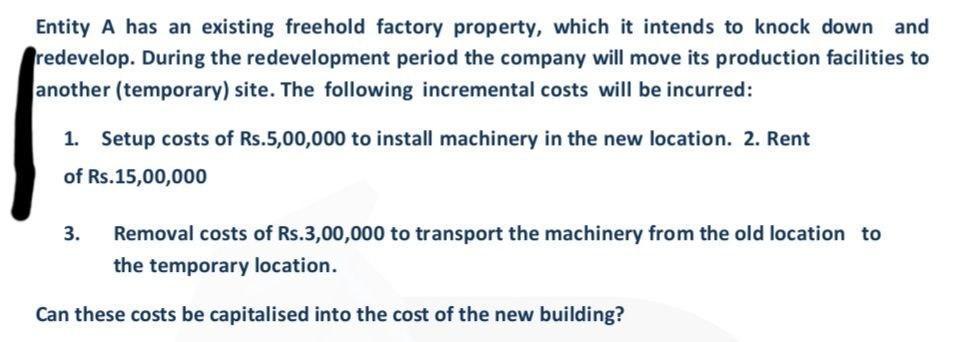

Entity A has an existing freehold factory property, which it intends to knock down and redevelop. During the redevelopment period the company will move its production facilities to another (temporary) site. The following incremental costs will be incurred: 1. Setup costs of Rs.5,00,000 to install machinery in the new location. 2. Rent of Rs.15,00,000 3. Removal costs of Rs.3,00,000 to transport the machinery from the old location to the temporary location. Can these costs be capitalised into the cost of the new building?

Step by Step Solution

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

No these costs cannot be capitalised into the cost of the new building Capitalisation of costs ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield

13th Edition

9780470374948, 470423684, 470374942, 978-0470423684

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App