Question

You are a recent college graduate beginning the process of retirement planning. Once again you will rely on your Excel skills to construct a spreadsheet

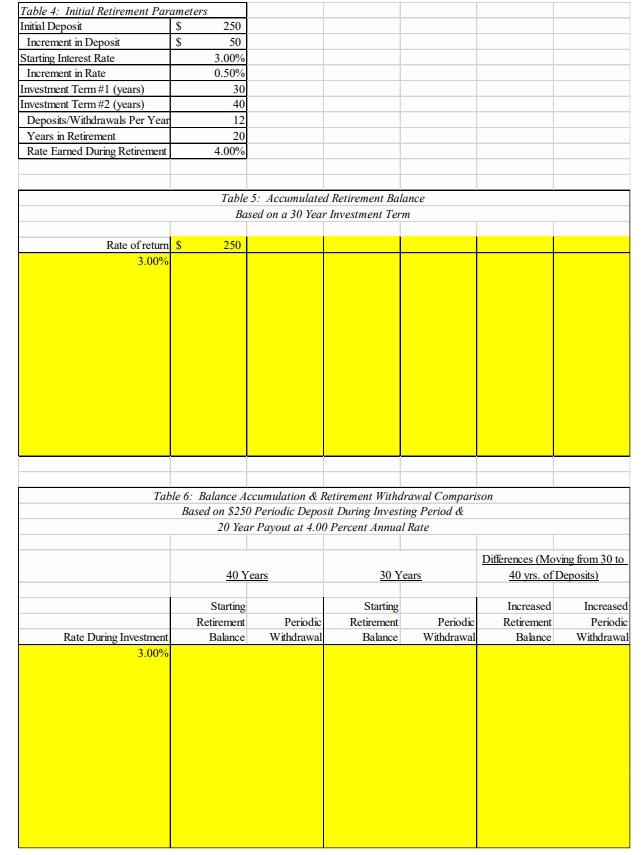

You are a recent college graduate beginning the process of retirement planning. Once again you will rely on your Excel skills to construct a spreadsheet investigating retirement value accumulation as the rate of interest earned and the periodic deposit amount varies. You will also investigate how the length of investment affects your periodic retirement payout. The initial retirement assumptions shown in Table 4 include:

Rates of return rangingfrom3.00 to 9.00%, with a 0.50% constant increment.

Monthly deposit amounts ranging from $250 to $500, with a $50 constant increment. Table 5will illustrate how the final accumulated retirement balance changes in response to the rate of return and the amount of periodic deposit, while Table 6 will compare the differences in accumulated balances and the periodic payout when delaying retirement 10 years.

All cells highlighted in yellow must contain a cell reference, mathematical equation, or function

Table 4. Initial Retirement Parameters Initial Deposit $ 250 Increment in Deposit $ 50 Starting Interest Rate 3.00% Increment in Rate 0.50% Investment Term #1 (years) 30 Investment Term #2 (years) 40 Deposits/Withdrawals Per Year 12 Years in Retirement 20 Rate Earned During Retirement 4.00% Table 5. Accumulated Retirement Balance Based on a 30 Year Investment Term 250 Rate of returns 3.00% Table 6: Balance Accumulation & Retirement Withdrawal Comparison Based on $250 Periodic Deposit During Investing Period & 20 Year Payout at 4.00 Percent Annual Rate Differences Moving from 30 to 40 yrs. of Deposits) 40 Years 30 Years Starting Retirement Balance Periodic Withdrawal Starting Retirement Balance Increased Retirement Balance Periodic Withdrawal Increased Periodic Withdrawal Rate During Investment 3.00% Table 4. Initial Retirement Parameters Initial Deposit $ 250 Increment in Deposit $ 50 Starting Interest Rate 3.00% Increment in Rate 0.50% Investment Term #1 (years) 30 Investment Term #2 (years) 40 Deposits/Withdrawals Per Year 12 Years in Retirement 20 Rate Earned During Retirement 4.00% Table 5. Accumulated Retirement Balance Based on a 30 Year Investment Term 250 Rate of returns 3.00% Table 6: Balance Accumulation & Retirement Withdrawal Comparison Based on $250 Periodic Deposit During Investing Period & 20 Year Payout at 4.00 Percent Annual Rate Differences Moving from 30 to 40 yrs. of Deposits) 40 Years 30 Years Starting Retirement Balance Periodic Withdrawal Starting Retirement Balance Increased Retirement Balance Periodic Withdrawal Increased Periodic Withdrawal Rate During Investment 3.00%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started