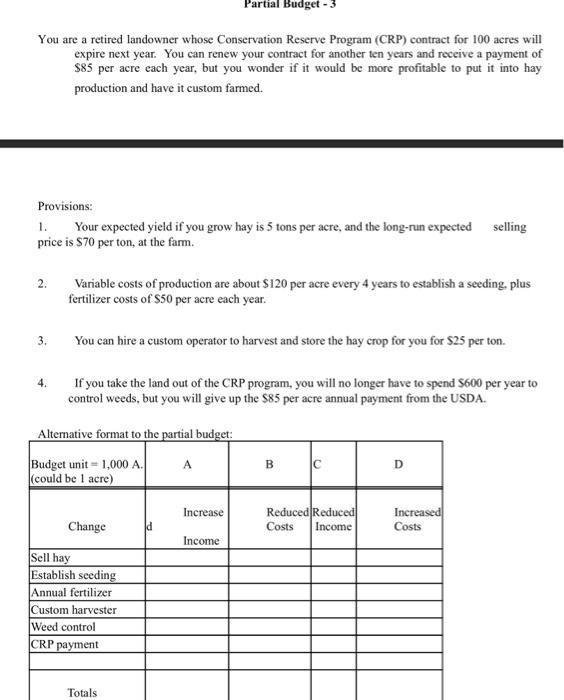

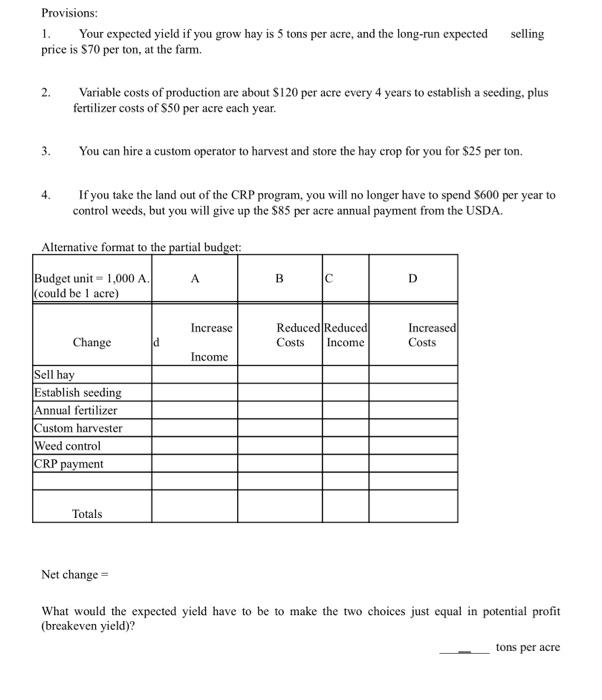

You are a retired landowner whose Conservation Reserve Program (CRP) contract for 100 acres will expire next year. You can renew your contract for another ten years and receive a payment of $85 per acre each year, but you wonder if it would be more profitable to put it into hay production and have it custom farmed. Provisions: 1. Your expected yield if you grow hay is 5 tons per acre, and the long-run expected selling price is $70 per ton, at the farm. 2. Variable costs of production are about $120 per acre every 4 years to establish a seeding, plus fertilizer costs of $50 per acre each year. 3. You can hire a custom operator to harvest and store the hay crop for you for $25 per ton. 4. If you take the land out of the CRP program, you will no longer have to spend $600 per year to control weeds, but you will give up the $85 per acre annual payment from the USDA. Provisions: 1. Your expected yield if you grow hay is 5 tons per acre, and the long-run expected selling price is $70 per ton, at the farm. 2. Variable costs of production are about $120 per acre every 4 years to establish a seeding, plus fertilizer costs of $50 per acre each year. 3. You can hire a custom operator to harvest and store the hay crop for you for $25 per ton. 4. If you take the land out of the CRP program, you will no longer have to spend $600 per year to control weeds, but you will give up the $85 per acre annual payment from the USDA. Net change = What would the expected yield have to be to make the two choices just equal in potential profit (breakeven yield)? You are a retired landowner whose Conservation Reserve Program (CRP) contract for 100 acres will expire next year. You can renew your contract for another ten years and receive a payment of $85 per acre each year, but you wonder if it would be more profitable to put it into hay production and have it custom farmed. Provisions: 1. Your expected yield if you grow hay is 5 tons per acre, and the long-run expected selling price is $70 per ton, at the farm. 2. Variable costs of production are about $120 per acre every 4 years to establish a seeding, plus fertilizer costs of $50 per acre each year. 3. You can hire a custom operator to harvest and store the hay crop for you for $25 per ton. 4. If you take the land out of the CRP program, you will no longer have to spend $600 per year to control weeds, but you will give up the $85 per acre annual payment from the USDA. Provisions: 1. Your expected yield if you grow hay is 5 tons per acre, and the long-run expected selling price is $70 per ton, at the farm. 2. Variable costs of production are about $120 per acre every 4 years to establish a seeding, plus fertilizer costs of $50 per acre each year. 3. You can hire a custom operator to harvest and store the hay crop for you for $25 per ton. 4. If you take the land out of the CRP program, you will no longer have to spend $600 per year to control weeds, but you will give up the $85 per acre annual payment from the USDA. Net change = What would the expected yield have to be to make the two choices just equal in potential profit (breakeven yield)