Answered step by step

Verified Expert Solution

Question

1 Approved Answer

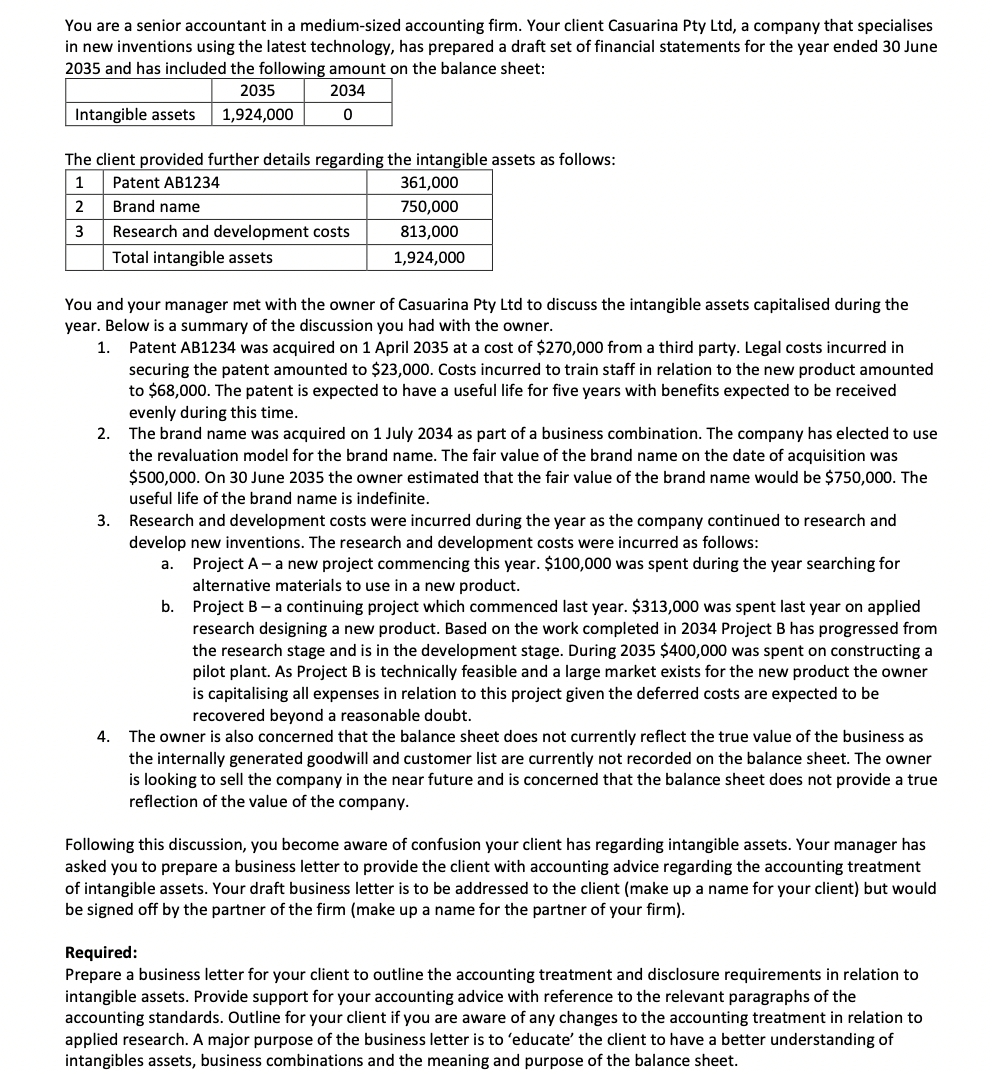

You are a senior accountant in a medium - sized accounting firm. Your client Casuarina Pty Ltd , a company that specialises in new inventions

You are a senior accountant in a mediumsized accounting firm. Your client Casuarina Pty Ltd a company that specialises

in new inventions using the latest technology, has prepared a draft set of financial statements for the year ended June

and has included the following amount on the balance sheet:

The client provided further details regarding the intangible assets as follows:

You and your manager met with the owner of Casuarina Pty Ltd to discuss the intangible assets capitalised during the

year. Below is a summary of the discussion you had with the owner.

Patent AB was acquired on April at a cost of $ from a third party. Legal costs incurred in

securing the patent amounted to $ Costs incurred to train staff in relation to the new product amounted

to $ The patent is expected to have a useful life for five years with benefits expected to be received

evenly during this time.

The brand name was acquired on July as part of a business combination. The company has elected to use

the revaluation model for the brand name. The fair value of the brand name on the date of acquisition was

$ On June the owner estimated that the fair value of the brand name would be $ The

useful life of the brand name is indefinite.

Research and development costs were incurred during the year as the company continued to research and

develop new inventions. The research and development costs were incurred as follows:

a Project A a new project commencing this year. $ was spent during the year searching for

alternative materials to use in a new product.

b Project B a continuing project which commenced last year. $ was spent last year on applied

research designing a new product. Based on the work completed in Project B has progressed from

the research stage and is in the development stage. During $ was spent on constructing a

pilot plant. As Project B is technically feasible and a large market exists for the new product the owner

is capitalising all expenses in relation to this project given the deferred costs are expected to be

recovered beyond a reasonable doubt.

The owner is also concerned that the balance sheet does not currently reflect the true value of the business as

the internally generated goodwill and customer list are currently not recorded on the balance sheet. The owner

is looking to sell the company in the near future and is concerned that the balance sheet does not provide a true

reflection of the value of the company.

Following this discussion, you become aware of confusion your client has regarding intangible assets. Your manager has

asked you to prepare a business letter to provide the client with accounting advice regarding the accounting treatment

of intangible assets. Your draft business letter is to be addressed to the client make up a name for your client but would

be signed off by the partner of the firm make up a name for the partner of your firm

Required:

Prepare a business letter for your client to outline the accounting treatment and disclosure requirements in relation to

intangible assets. Provide support for your accounting advice with reference to the relevant paragraphs of the

accounting standards. Outline for your client if you are aware of any changes to the accounting treatment in relation to

applied research. A major purpose of the business letter is to 'educate' the client to have a better understanding of

intangibles assets, business combinations and the meaning and purpose of the balance sheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started