Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a senior accountant in a second-tier accounting firm. Your client, Banksia Ltd, has prepared its adjusted trial balance for the year ended 30

You are a senior accountant in a second-tier accounting firm. Your client, Banksia Ltd, has prepared its adjusted trial balance for the year ended 30 June 2035. Your manager has asked you to assist the client to determine the income tax expense for the year and the tax assets and liabilities that arise from the transactions and events of the year.

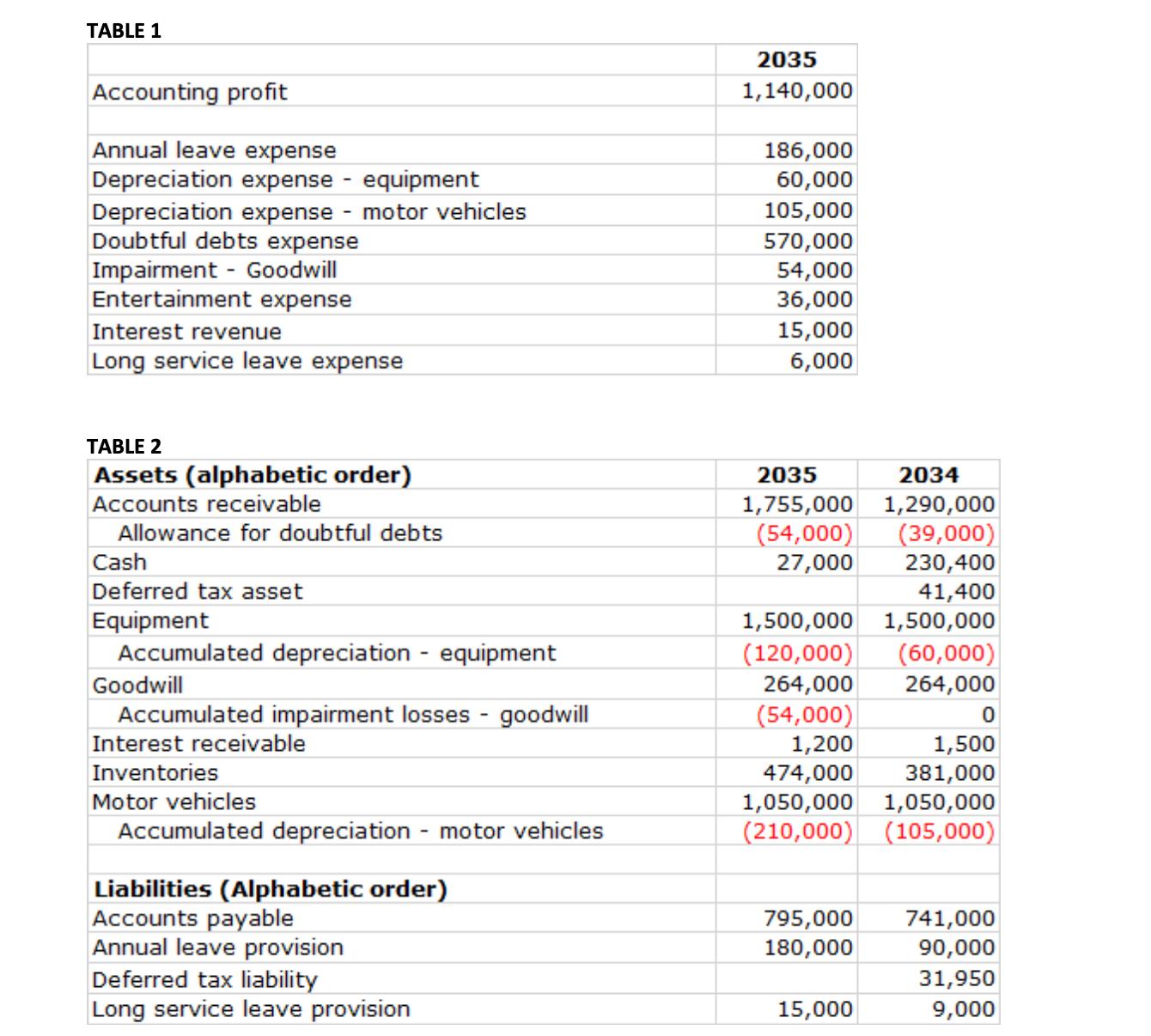

The following tables provide relevant information from the adjusted trial balance:

TABLE 1 2035 Accounting profit 1,140,000 Annual leave expense 186,000 Depreciation expense - equipment 60,000 Depreciation expense motor vehicles 105,000 Doubtful debts expense 570,000 Impairment Goodwill 54,000 Entertainment expense 36,000 Interest revenue 15,000 Long service leave expense 6,000 TABLE 2 Assets (alphabetic order) Accounts receivable Allowance for doubtful debts Cash Deferred tax asset Equipment Accumulated depreciation equipment Goodwill Accumulated impairment losses - goodwill Interest receivable Inventories Motor vehicles Accumulated depreciation motor vehicles Liabilities (Alphabetic order) Accounts payable Annual leave provision Deferred tax liability Long service leave provision 2035 1,755,000 2034 1,290,000 (54,000) (39,000) 27,000 230,400 41,400 1,500,000 1,500,000 (120,000) (60,000) 264,000 264,000 (54,000) 0 1,200 1,500 474,000 381,000 1,050,000 1,050,000 (210,000) (105,000) 795,000 741,000 180,000 90,000 31,950 15,000 9,000

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To determine the income tax expense for the year and the tax assets and liabilities for Banksia Ltd we need to consider the relevant information from ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started