Question

You are a senior accountant in a top-tier accounting firm. Your senior manager has asked you to assist your client, Daisy Ltd, in the preparation

You are a senior accountant in a top-tier accounting firm. Your senior manager has asked you to assist your client, Daisy Ltd, in the preparation of consolidated financial statements for the year ended 30 June 2035. The senior manager hands you a file which contains important information about Daisy Ltd and the acquisition of Rose Ltd.

On 1 July 2033, Daisy Ltd acquired all the issued shares (ex. div) of Rose Ltd for $935,000. At this date the equity of Rose Ltd consisted of: Share capital: $187,500, Retained earnings: $575,000

The identifiable assets and liabilities recorded on the balance sheet of Rose Ltd were at amounts equal to fair value except for:

Inventory: $70,000(fair value), $56,250(carrying amount)

Machinery: $237,500(fair value), $187,500(carrying amount)

Additional information:

Adjustments for differences between carrying amounts and fair values at acquisition date are made on consolidation.

The tax rate is 30%.

The inventories on hand on the day of acquisition were sold by 30 June 2034.

The machinery on hand on the day of acquisition had an original cost of $350,000.

This machinery has a remaining useful life of five years, is depreciated using the straight-line method and has a residual of nil.

On the day of acquisition, the balance sheet of Rose Ltd included goodwill of $25,000.

On the day of acquisition, Daisy Ltd identified a brand name with a fair value of $112,500 that was not recorded on the balance sheet of Rose Ltd.

The brand name was considered to have an indefinite useful life.

Rose Ltd transferred $200,000 from retained earnings to the general reserve on 30 June 2035.

The goodwill acquired by Daisy Ltd has been impaired by $15,000 on 30 June 2035.

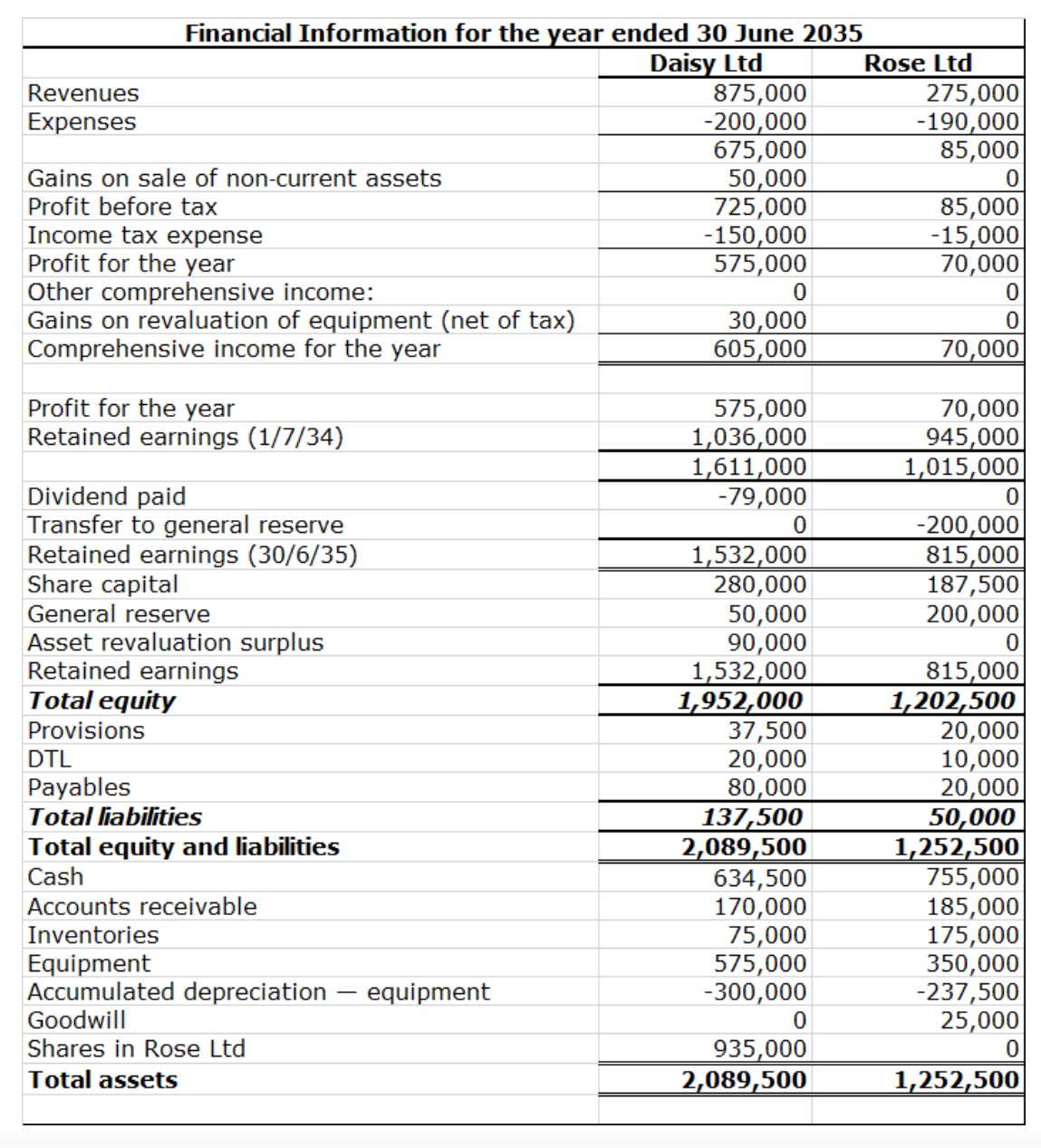

Financial information for Daisy Ltd and Rose Ltd for the year ended 30 June 2035 is shown on the following page.

Required:

1. Prepare the consolidation journal entries required to prepare the consolidated accounts for Daisy Ltd Group as at 30 June 2035.

2. Prepare the consolidation worksheet for the Daisy Ltd Group as at 30 June 2035.

3. Prepare the consolidated financial statements for the Daisy Ltd Group the year ended 30 June 2035.

Note: the consolidated financial statements include: consolidated statement of profit and loss and other comprehensive income, consolidated statement of changes in equity, and the consolidated statement of financial position. You are not required to prepare a consolidated statement of cashflows.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started