Question

You are a senior audit manager in Hartman & Co, a firm of Chartered Certified Accountants, and have been designated as the quality control reviewer

You are a senior audit manager in Hartman & Co, a firm of Chartered Certified Accountants, and have been designated as the quality control reviewer for the audit of the Turner Group (the Group). The audit fieldwork for the financial year ending 30 June 20Y0 has been completed and the Group auditor's report is planned to be issued imminently.

Materiality for the consolidated financial statements had been set at $200,000. The following information has been brought to your attention by the audit supervisor:

-- During the year, a fraud occurred in which a manager in the Group's payroll department created 'ghost employees' and made payments in their names into his private bank account. When confronted by the Group financial controller, he confessed to pilfering a sum of $20,000. On account of the fraud's immateriality, the Group financial controller had barred the audit team from performing further audit procedures and refused to amend the misstatement pertaining to the fraud.

-- Included in the Group's trade receivables as at the year-end is an outstanding balance of $300,000 from Skylark Co. Skylark Co has gone into administration and correspondence received from their liquidators indicate that the company's creditors shall receive a payment equal to 20% of the amounts so owed to them. On the basis of the evidence gathered, the audit team has proposed an adjustment to write off $240,000 of the $300,000 owed by Skylark Co as irrecoverable. However, the Group financial controller is adamant in recognizing the entire $300,000 as a trade receivable in the consolidated financial statements and refuses to make this adjustment.

You are in the midst of reviewing an extract of the Group auditor's report, as follows:

Required:

Provide a critical appraisal of the extract of the auditor's report in respect of the audit of the Turner Group for the financial year ended 30 June 20Y0.

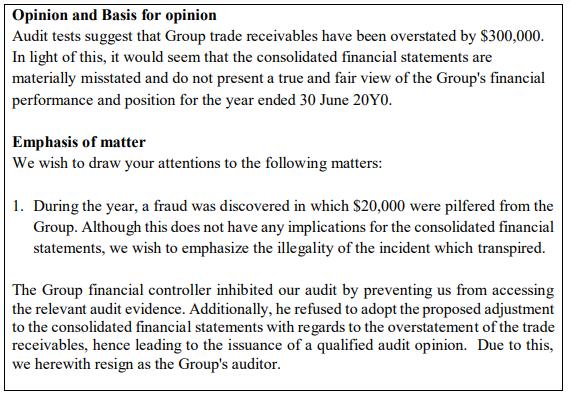

Opinion and Basis for opinion Audit tests suggest that Group trade receivables have been overstated by $300,000. In light of this, it would seem that the consolidated financial statements are materially misstated and do not present a true and fair view of the Group's financial performance and position for the year ended 30 June 20Y0. Emphasis of matter We wish to draw your attentions to the following matters: 1. During the year, a fraud was discovered in which $20,000 were pilfered from the Group. Although this does not have any implications for the consolidated financial statements, we wish to emphasize the illegality of the incident which transpired. The Group financial controller inhibited our audit by preventing us from accessing the relevant audit evidence. Additionally, he refused to adopt the proposed adjustment to the consolidated financial statements with regards to the overstatement of the trade receivables, hence leading to the issuance of a qualified audit opinion. Due to this, we herewith resign as the Group's auditor.

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Audit risk is the risk that financial statements are materially incorrect even though the audit opinion states that the financial reports are free of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started