Question

You are a senior financial analyst of a firm based in Melbourne. You have been assigned with the task of training interns who recently joined

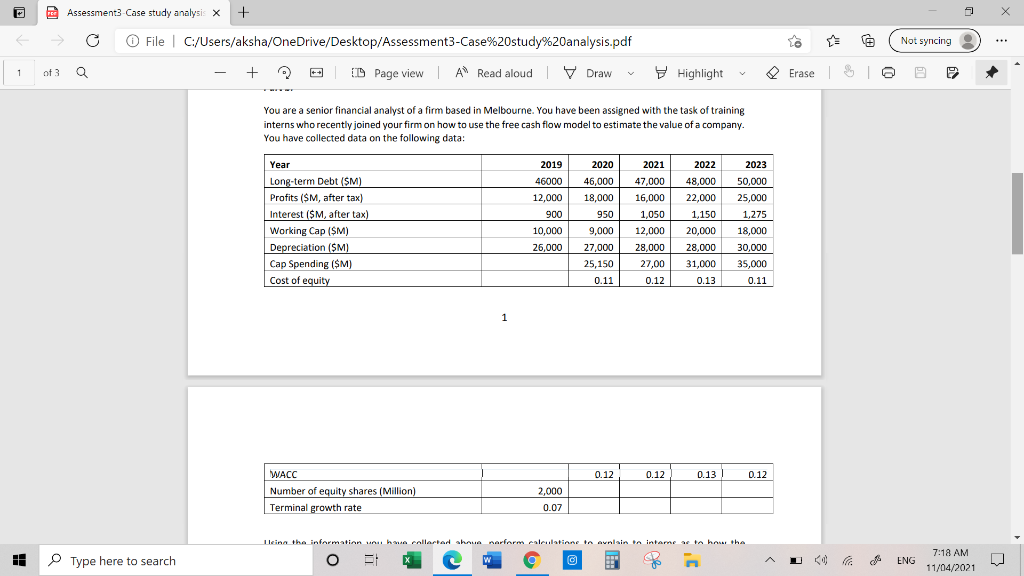

You are a senior financial analyst of a firm based in Melbourne. You have been assigned with the task of training interns who recently joined your firm on how to use the free cash flow model to estimate the value of a company. You have collected data on the following data: Using the information you have collected above, perform calculations to explain to interns as to how the following are calculated:

i. Free cash flow to firm

ii. Free cash to equity

iii. Value of the firm according to the free cash flow to firm method

iv. Value of the firm according to the free cash flow to equity method

v. Estimated price of an equity share according to the free cash flow to firm method and the free cash flow to equity method Notes: You need to show detailed calculations for each year in order to receive full marks for this question.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started