Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a senior project finance account manager at a boutique investment bank who has received the attached summarized project information memorandum (Development, Financing

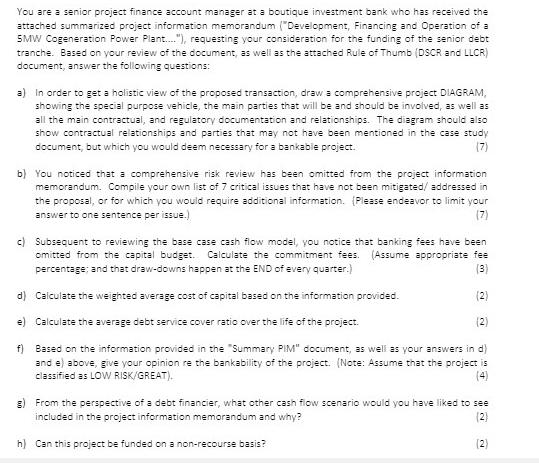

You are a senior project finance account manager at a boutique investment bank who has received the attached summarized project information memorandum ("Development, Financing and Operation of a 5MW Cogeneration Power Plant....."), requesting your consideration for the funding of the senior debt tranche. Based on your review of the document, as well as the attached Rule of Thumb (DSCR and LLCR) document, answer the following questions: a) In order to get a holistic view of the proposed transaction, draw a comprehensive project DIAGRAM, showing the special purpose vehicle, the main parties that will be and should be involved, as well as all the main contractual, and regulatory documentation and relationships. The diagram should also show contractual relationships and parties that may not have been mentioned in the case study document, but which you would deem necessary for a bankable project. (7) b) You noticed that a comprehensive risk review has been omitted from the project information memorandum. Compile your own list of 7 critical issues that have not been mitigated/ addressed in the proposal, or for which you would require additional information. (Please endeavor to limit your answer to one sentence per issue.) (7) c) Subsequent to reviewing the base case cash flow model, you notice that banking fees have been omitted from the capital budget. Calculate the commitment fees. (Assume appropriate fee percentage; and that draw-downs happen at the END of every quarter.) d) Calculate the weighted average cost of capital based on the information provided. e) Calculate the average debt service cover ratio over the life of the project. (3) (2) (2) f) Based on the information provided in the "Summary PIM" document, as well as your answers in d) and e) above, give your opinion re the bankability of the project. (Note: Assume that the project is classified as LOW RISK/GREAT). (4) g) From the perspective of a debt financier, what other cash flow scenario would you have liked to see included in the project information memorandum and why? h) Can this project be funded on a non-recourse basis? [2]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Project Finance Analysis Cogeneration Power Plant a Project Diagram Central Entity Special Purpose Vehicle SPV Equity Investors Sponsors Debt Providers Senior Debt Lenders Bank Mezzanine Lenders Optional Project Contracts Engineering Procurement Construction EPC Contract with EPC Contractor Fuel Supply Agreement with Fuel Supplier Power Purchase Agreement PPA with Power Offtaker Operation Maintenance OM Agreement with OM Provider Regulatory Approvals Land Lease Agreement with Landowner Building Permits from Local Authority Environmental Permits from Environmental Agency Connection Agreement with Grid Operator Additional Parties as deemed necessary Lenders Engineer Independent Auditor Debt Service Reserve Account Provider ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started