Answered step by step

Verified Expert Solution

Question

1 Approved Answer

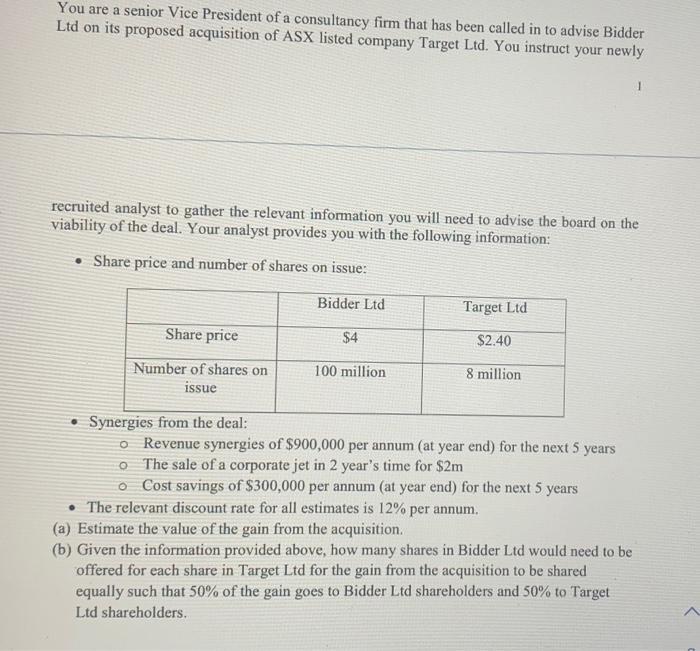

You are a senior Vice President of a consultancy firm that has been called in to advise Bidder Ltd on its proposed acquisition of

You are a senior Vice President of a consultancy firm that has been called in to advise Bidder Ltd on its proposed acquisition of ASX listed company Target Ltd. You instruct your newly recruited analyst to gather the relevant information you will need to advise the board on the viability of the deal. Your analyst provides you with the following information: Share price and number of shares on issue: Bidder Ltd Share price Number of shares on issue $4 100 million Target Ltd $2.40 8 million Synergies from the deal: o Revenue synergies of $900,000 per annum (at year end) for the next 5 years o The sale of a corporate jet in 2 year's time for $2m o Cost savings of $300,000 per annum (at year end) for the next 5 years . The relevant discount rate for all estimates is 12% per annum. (a) Estimate the value of the gain from the acquisition. (b) Given the information provided above, how many shares in Bidder Ltd would need to be offered for each share in Target Ltd for the gain from the acquisition to be shared equally such that 50% of the gain goes to Bidder Ltd shareholders and 50% to Target Ltd shareholders.

Step by Step Solution

★★★★★

3.50 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a Value of the Gain Present Value of Revenue Synergies Present Valu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started