Answered step by step

Verified Expert Solution

Question

1 Approved Answer

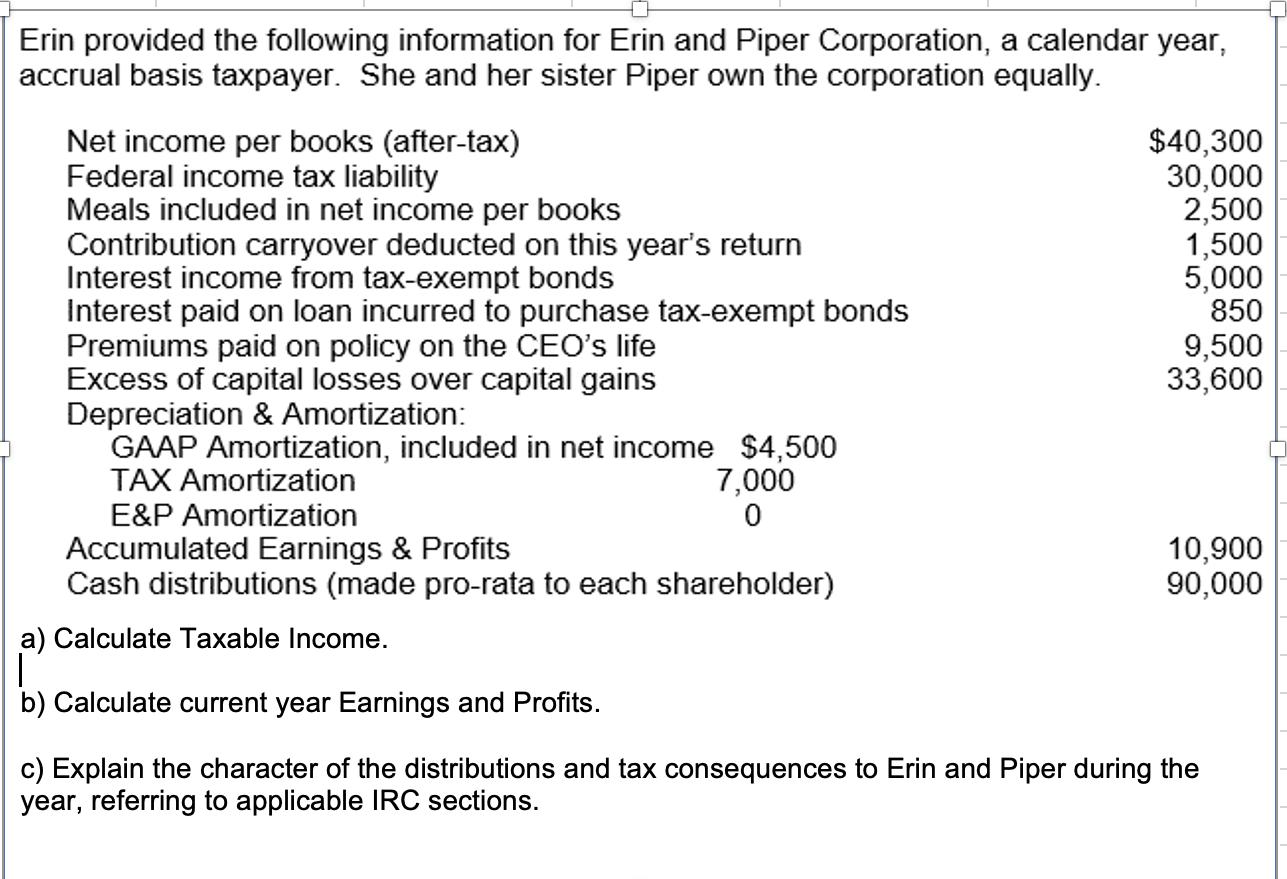

Erin provided the following information for Erin and Piper Corporation, a calendar year, accrual basis taxpayer. She and her sister Piper own the corporation

Erin provided the following information for Erin and Piper Corporation, a calendar year, accrual basis taxpayer. She and her sister Piper own the corporation equally. Net income per books (after-tax) Federal income tax liability Meals included in net income per books Contribution carryover deducted on this year's return Interest income from tax-exempt bonds Interest paid on loan incurred to purchase tax-exempt bonds Premiums paid on policy on the CEO's life Excess of capital losses over capital gains Depreciation & Amortization: GAAP Amortization, included in net income $4,500 TAX Amortization E&P Amortization 7,000 0 $40,300 30,000 2,500 1,500 5,000 850 9,500 33,600 10,900 90,000 Accumulated Earnings & Profits Cash distributions (made pro-rata to each shareholder) a) Calculate Taxable Income. b) Calculate current year Earnings and Profits. c) Explain the character of the distributions and tax consequences to Erin and Piper during the year, referring to applicable IRC sections.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Taxable income is calculated by adding together all sources of income and then subtracting any all...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started