You are a staff accountant at a local CPA firm. Mymess Inc is an important client that has brought in its general ledger in order to have a compilation of its financial statements prepared. As a first step, you have asked a new employee, Sam Klutz, to prepare an income statement and balance sheet. The results of Sams work are presented below and on the next page. You have been tasked with reviewing Sams work, and prepare a memo to him. Your memo should identify each of the errors you find. You do not need to prepare adjusting entries. However, you do need to explain the proper GAAP treatment for each item.

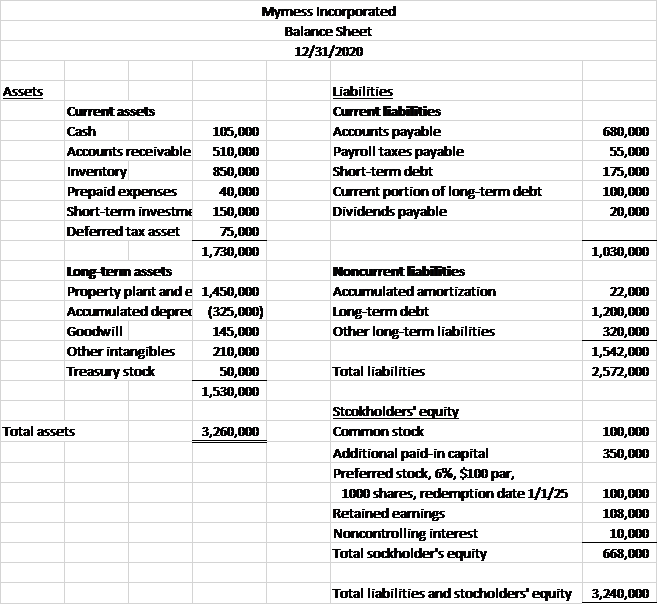

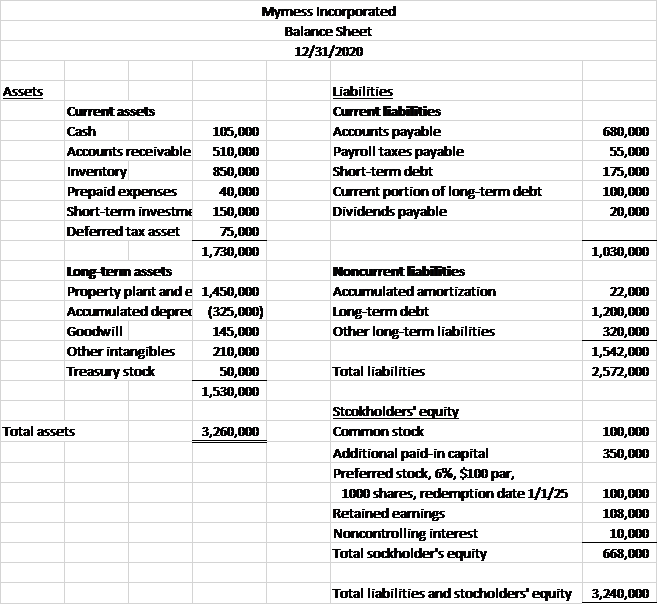

Mymess Incorporated Balance Sheet 12/31/2020 Assets Liabilities Current abilities Accounts payable Payroll taxes payable Short-term debt Current portion of long-term debt Dividends payable 680,000 55,600 175,000 100,000 20,000 Current assets Cash 105,000 Accounts receivable 510,000 Inventory 850,000 Prepaid expenses 40,000 Short-term investm 150,000 Deferred tax asset 15,000 1,730,000 Long term assets Property plant ande 1,450,000 Accumulated deprer (325,000) Goochwill 145,000 Other intangibles 210,000 Treasury stock 50,000 1,530,000 1,630,000 Honcurrent Kabilities Accumulated amortization Long-term deht Other long-term liabilities 22,000 1,200,000 320,000 1,542,000 2,572,000 Total liabilities Total assets 3,260,000 100,000 350,000 Stcokholders' equity Common stock Additional paid-in capital Preferred stock, 6%, $100 par, 1000 shares, redemption date 1/1/25 Retained earnings Noncontrolling interest Total sockholder's equity 100,000 108,000 10,000 668,000 Total liabilities and stocholders' equity 3,240,000 Mymess Incorporated Balance Sheet 12/31/2020 Assets Liabilities Current abilities Accounts payable Payroll taxes payable Short-term debt Current portion of long-term debt Dividends payable 680,000 55,600 175,000 100,000 20,000 Current assets Cash 105,000 Accounts receivable 510,000 Inventory 850,000 Prepaid expenses 40,000 Short-term investm 150,000 Deferred tax asset 15,000 1,730,000 Long term assets Property plant ande 1,450,000 Accumulated deprer (325,000) Goochwill 145,000 Other intangibles 210,000 Treasury stock 50,000 1,530,000 1,630,000 Honcurrent Kabilities Accumulated amortization Long-term deht Other long-term liabilities 22,000 1,200,000 320,000 1,542,000 2,572,000 Total liabilities Total assets 3,260,000 100,000 350,000 Stcokholders' equity Common stock Additional paid-in capital Preferred stock, 6%, $100 par, 1000 shares, redemption date 1/1/25 Retained earnings Noncontrolling interest Total sockholder's equity 100,000 108,000 10,000 668,000 Total liabilities and stocholders' equity 3,240,000