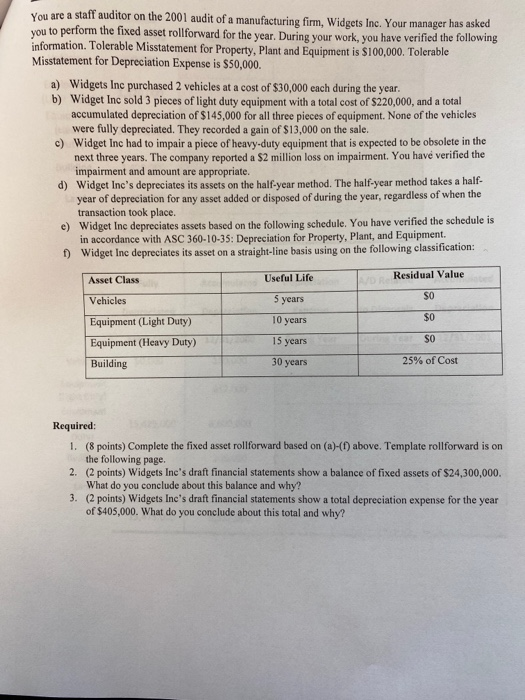

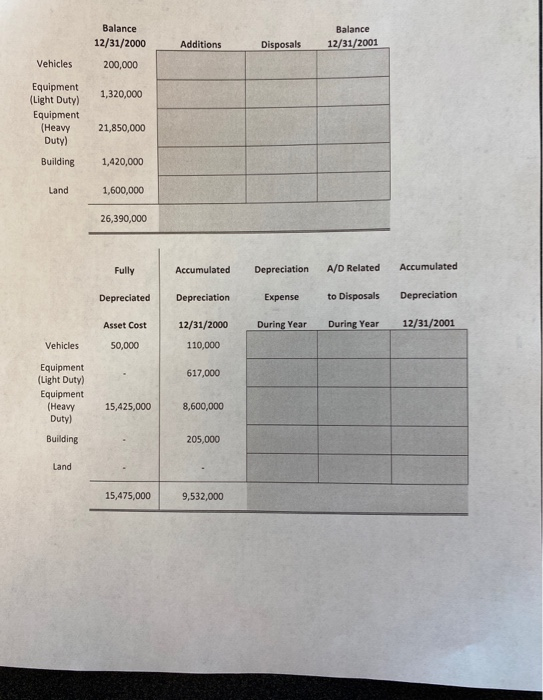

You are a staff auditor on the 2001 audit of a manufacturing firm, Widgets Inc. Your manager has asked you to perform the fixed asset rollforward for the year. During your work, you have verified the following information. Tolerable Misstatement for Property, Plant and Equipment is $100,000. Tolerable Misstatement for Depreciation Expense is $50,000. a) Widgets Inc purchased 2 vehicles at a cost of $30,000 each during the year. b) Widget Inc sold 3 pieces of light duty equipment with a total cost of $220,000, and a total accumulated depreciation of $145,000 for all three pieces of equipment. None of the vehicles were fully depreciated. They recorded a gain of $13,000 on the sale. c) Widget Inc had to impair a piece of heavy-duty equipment that is expected to be obsolete in the next three years. The company reported a $2 million loss on impairment. You have verified the impairment and amount are appropriate. d) Widget Inc's depreciates its assets on the half-year method. The half-year method takes a half- year of depreciation for any asset added or disposed of during the year, regardless of when the transaction took place. e) Widget Inc depreciates assets based on the following schedule. You have verified the schedule is in accordance with ASC 360-10-35: Depreciation for Property, Plant, and Equipment. f) Widget Inc depreciates its asset on a straight-line basis using on the following classification: Asset Class Useful Life Residual Value Vehicles 5 years SO 10 years $0 Equipment (Light Duty) Equipment (Heavy Duty) 15 years SO Building 30 years 25% of Cost Required: 1. (8 points) Complete the fixed asset rollforward based on (a)-(1) above. Template rollforward is on the following page. 2. (2 points) Widgets Inc's draft financial statements show a balance of fixed assets of $24,300,000. What do you conclude about this balance and why? 3. (2 points) Widgets Ine's draft financial statements show a total depreciation expense for the year of $405,000. What do you conclude about this total and why? Balance 12/31/2000 200,000 Balance 12/31/2001 Additions Disposals Vehicles 1,320,000 Equipment (Light Duty) Equipment (Heavy Duty) 21,850,000 Building 1,420,000 Land 1,600,000 26,390,000 Fully Accumulated Depreciation A/D Related Accumulated Depreciated Depreciation Expense to Disposals Depreciation During Year During Year 12/31/2001 Asset Cost 50,000 12/31/2000 110,000 Vehicles 617,000 Equipment (Light Duty) Equipment (Heavy Duty) 15,425,000 8,600,000 Building 205,000 Land 15,475,000 9,532,000