Answered step by step

Verified Expert Solution

Question

1 Approved Answer

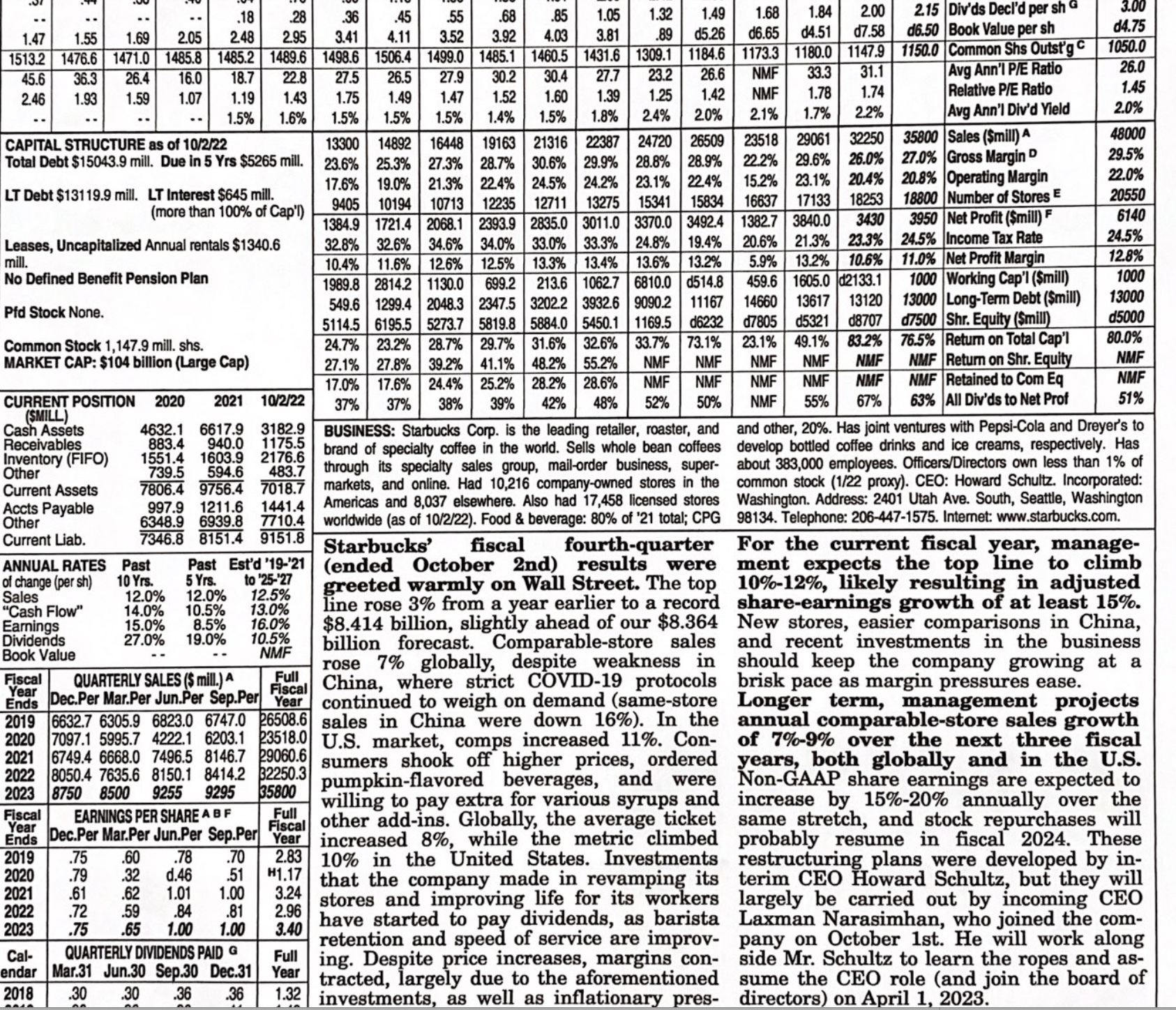

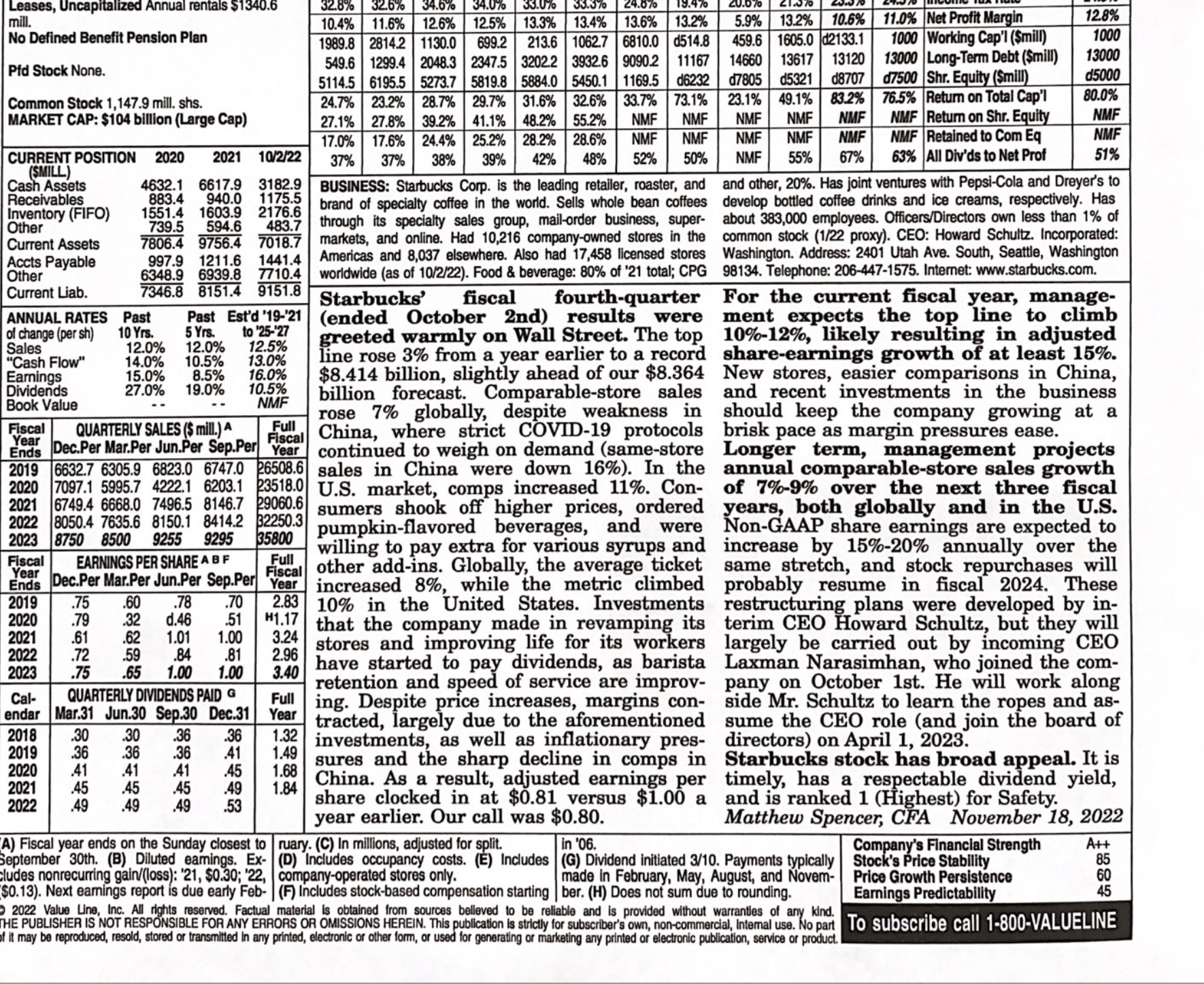

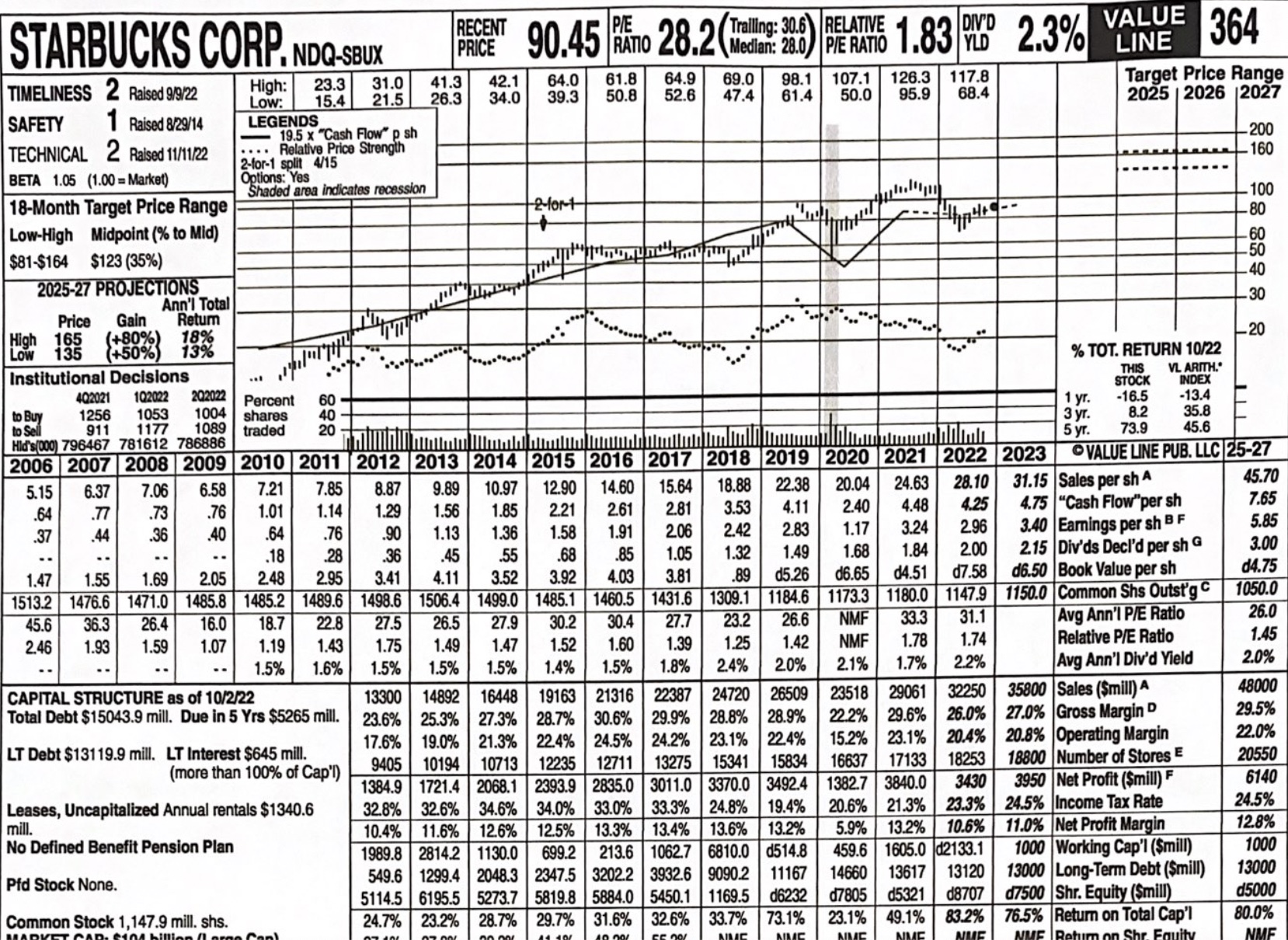

You are a stockbroker at Merrill Lynch. Give three well thought out reasons as to why you would call your clients to sell them this

- You are a stockbroker at Merrill Lynch. Give three well thought out reasons as to why you would call your clients to sell them this stock. Remember, you work on full commission and have to be very persuasive while doing what is in the 'best interests' of the clients.

- Explain and detail the earnings per share of this company over the last five years. What kind of trend do you notice? Why is this happening?

- Summarize what the write up on the bottom half of the Value Line states.

- What rating does the Value Line give in the upper left? Do you agree with this? Why or why not? (The ratings go from 1 to 5 with 1 being the best rating).

.18 28 .36 .45 .55 .68 .85 1.47 1.55 1.69 2.05 2.48 2.95 3.41 4.11 3.52 3.92 1.05 4.03 3.81 1.32 1.49 1.68 .89 d5.26 d6.65 d4.51 1.84 2.00 d7.58 2.15 Div'ds Decl'd per sh G d6.50 Book Value per sh 3.00 d4.75 1050.0 CAPITAL STRUCTURE as of 10/2/22 18.7 22.8 2.46 1.93 1.59 1.07 1.19 1.43 1.5% 1.6% Total Debt $15043.9 mill. Due in 5 Yrs $5265 mill. LT Debt $13119.9 mill. LT Interest $645 mill. (more than 100% of Cap'l) Leases, Uncapitalized Annual rentals $1340.6 mill. 31.1 Avg Ann'l P/E Ratio 26.0 Relative P/E Ratio 1.45 Avg Ann'l Div'd Yield 2.0% 35800 Sales ($mill) A 27.0% Gross Margin D 48000 29.5% 20.8% Operating Margin 22.0% 18800 Number of Stores E 20550 No Defined Benefit Pension Plan Pfd Stock None. Common Stock 1,147.9 mill. shs. MARKET CAP: $104 billion (Large Cap) CURRENT POSITION 2020 (SMILL) Cash Assets 4632.1 Receivables 883.4 Inventory (FIFO) 1551.4 Other 739.5 Current Assets 3950 Net Profit ($mill) F 24.5% Income Tax Rate 11.0% Net Profit Margin 1000 Working Cap'l ($mill) 13000 Long-Term Debt ($mill) d7500 Shr. Equity ($mill) 76.5% Return on Total Cap'l NMF Return on Shr. Equity NMF Retained to Com Eq 63% All Div'ds to Net Prof 6140 24.5% 12.8% 1000 13000 d5000 80.0% NMF NMF 51% Accts Payable Other 2021 10/2/22 6617.9 3182.9 940.0 1175.5 1603.9 2176.6 594.6 483.7 7806.4 9756.4 7018.7 997.9 1211.6 1441.4 6348.9 6939.8 7710.4 7346.8 8151.4 9151.8 1513.2 1476.6 1471.0 1485.8 1485.2 1489.6 1498.6 1506.4 1499.0 1485.1 1460.5 1431.6 1309.1 1184.6 1173.3 1180.0 1147.9 1150.0 Common Shs Outst'g C 45.6 36.3 26.4 16.0 27.5 26.5 27.9 30.2 30.4 27.7 23.2 26.6 NMF 33.3 1.75 1.49 1.74 1.47 1.52 1.78 1.60 1.39 1.25 1.42 NMF 1.5% 1.5% 1.5% 1.4% 1.5% 1.8% 2.2% 2.4% 2.0% 2.1% 1.7% 13300 14892 16448 19163 21316 22387 24720 26509 23518 29061 32250 23.6% 25.3% 27.3% 28.7% 30.6% 29.9% 28.8% 28.9% 22.2% 29.6% 26.0% 17.6% 19.0% 21.3% 22.4% 24.5% 24.2% 23.1% 22.4% 9405 10194 10713 12235 12711 13275 15341 15834 1384.9 1721.4 2068.1 2393.9 2835.0 3011.0 3370.0 3492.4 32.8% 32.6% 34.6% 34.0% 33.0% 33.3% 24.8% 19.4% 10.4% 11.6% 12.6% 12.5% 13.3% 13.4% 13.6% 13.2% 1989.8 2814.2 1130.0 699.2 213.6 1062.7 6810.0 d514.8 549.6 1299.4 2048.3 2347.5 3202.2 3932.6 9090.2 11167 5114.5 6195.5 5273.7 5819.8 5884.0 5450.1 1169.5 d6232 24.7% 23.2% 28.7% 29.7% 31.6% 32.6% 33.7% 73.1% NMF 27.1% 27.8% 39.2% 41.1% 48.2% 55.2% NMF NMF 17.0% 17.6% 24.4% 25.2% 28.2% 28.6% NMF 37% 37% 38% 39% 42% 48% 52% 50% BUSINESS: Starbucks Corp. is the leading retailer, roaster, and brand of specialty coffee in the world. Sells whole bean coffees through its specialty sales group, mail-order business, super- markets, and online. Had 10,216 company-owned stores in the Americas and 8,037 elsewhere. Also had 17,458 licensed stores worldwide (as of 10/2/22). Food & beverage: 80% of '21 total; CPG Starbucks' fiscal fourth-quarter (ended October 2nd) results were greeted warmly on Wall Street. The top line rose 3% from a year earlier to a record $8.414 billion, slightly ahead of our $8.364 billion forecast. Comparable-store sales rose 7% globally, despite weakness in China, where strict COVID-19 protocols continued to weigh on demand (same-store sales in China were down 16%). In the U.S. market, comps increased 11%. Con- sumers shook off higher prices, ordered pumpkin-flavored beverages, and were willing to pay extra for various syrups and Fiscal other add-ins. Globally, the average ticket increased 8%, while the metric climbed 10% in the United States. Investments that the company made in revamping its stores and improving life for its workers have started to pay dividends, as barista retention and speed of service are improv- ing. Despite price increases, margins con- tracted, largely due to the aforementioned 1.32 investments, as well as inflationary pres- Current Liab. ANNUAL RATES Past Past Est'd '19-21 to '25-'27 of change (per sh) 10 Yrs. Sales 12.0% 5 Yrs. 12.0% "Cash Flow" 14.0% 10.5% Earnings 15.0% 8.5% 12.5% 13.0% 16.0% Dividends 27.0% 19.0% 10.5% NMF Book Value Year Ends Fiscal Fiscal QUARTERLY SALES ($ mill.) A Full Dec.Per Mar.Per Jun.Per Sep.Per Year 2019 6632.7 6305.9 6823.0 6747.0 26508.6 2020 7097.1 5995.7 4222.1 6203.1 23518.0 2021 6749.4 6668.0 7496.5 8146.7 29060.6 2022 8050.4 7635.6 8150.1 8414.2 32250.3 2023 8750 8500 9255 9295 35800 Fiscal EARNINGS PER SHARE A BF Dec.Per Mar.Per Jun.Per Sep.Per Year 2.83 H1.17 Full Year Ends 2019 .75 .60 .78 .70 2020 .79 .32 d.46 .51 2021 .61 .62 1.01 1.00 3.24 2022 .72 .59 .84 .81 2.96 2023 .75 .65 1.00 1.00 3.40 Cal- QUARTERLY DIVIDENDS PAID G endar Mar.31 Jun.30 Sep.30 Dec.31 2018 .30 .30 .36 .36 Full Year 15.2% 23.1% 20.4% 16637 17133 18253 3430 1382.7 3840.0 20.6% 21.3% 23.3% 5.9% 13.2% 10.6% 459.6 1605.0 d2133.1 14660 13617 13120 d7805 d5321 d8707 23.1% 49.1% 83.2% NMF NMF NMF NMF NMF NMF NMF 55% 67% and other, 20%. Has joint ventures with Pepsi-Cola and Dreyer's to develop bottled coffee drinks and ice creams, respectively. Has about 383,000 employees. Officers/Directors own less than 1% of common stock (1/22 proxy). CEO: Howard Schultz. Incorporated: Washington. Address: 2401 Utah Ave. South, Seattle, Washington 98134. Telephone: 206-447-1575. Internet: www.starbucks.com. For the current fiscal year, manage- ment expects the top line to climb 10%-12%, likely resulting in adjusted share-earnings growth of at least 15%. New stores, easier comparisons in China, and recent investments in the business should keep the company growing at a brisk pace as margin pressures ease. Longer term, management projects annual comparable-store sales growth of 7%-9% over the next three fiscal years, both globally and in the U.S. Non-GAAP share earnings are expected to increase by 15%-20% annually over the same stretch, and stock repurchases will probably resume in fiscal 2024. These restructuring plans were developed by in- terim CEO Howard Schultz, but they will largely be carried out by incoming CEO Laxman Narasimhan, who joined the com- pany on October 1st. He will work along side Mr. Schultz to learn the ropes and as- sume the CEO role (and join the board of directors) on April 1, 2023.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started