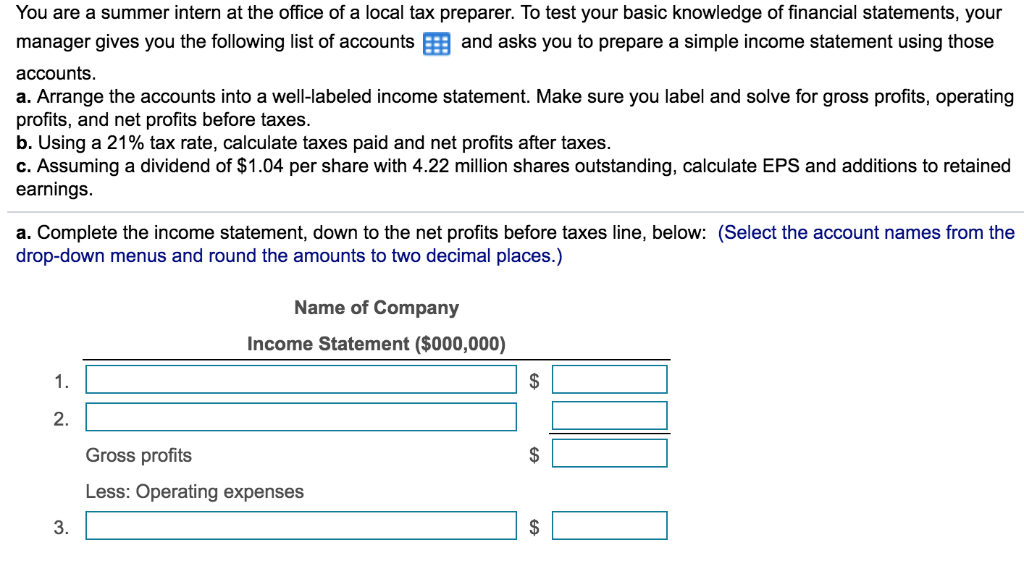

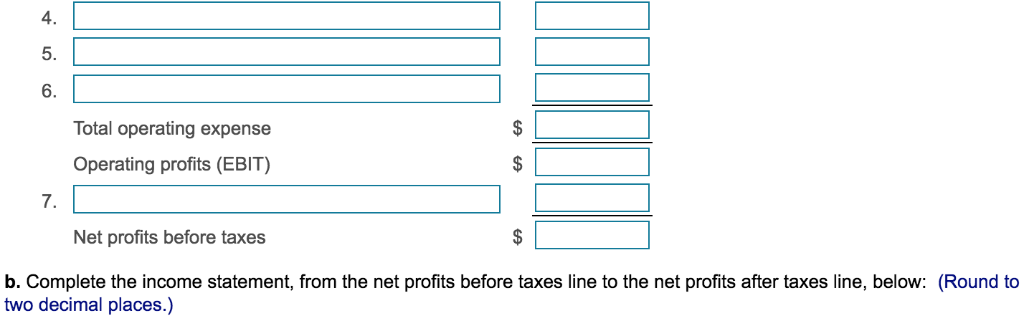

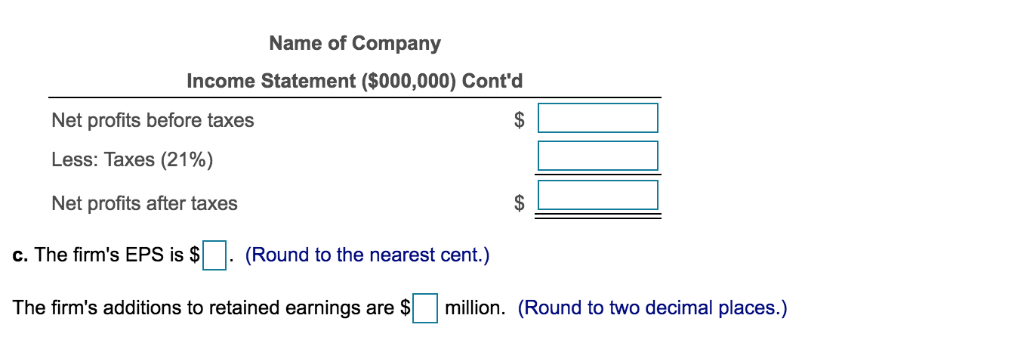

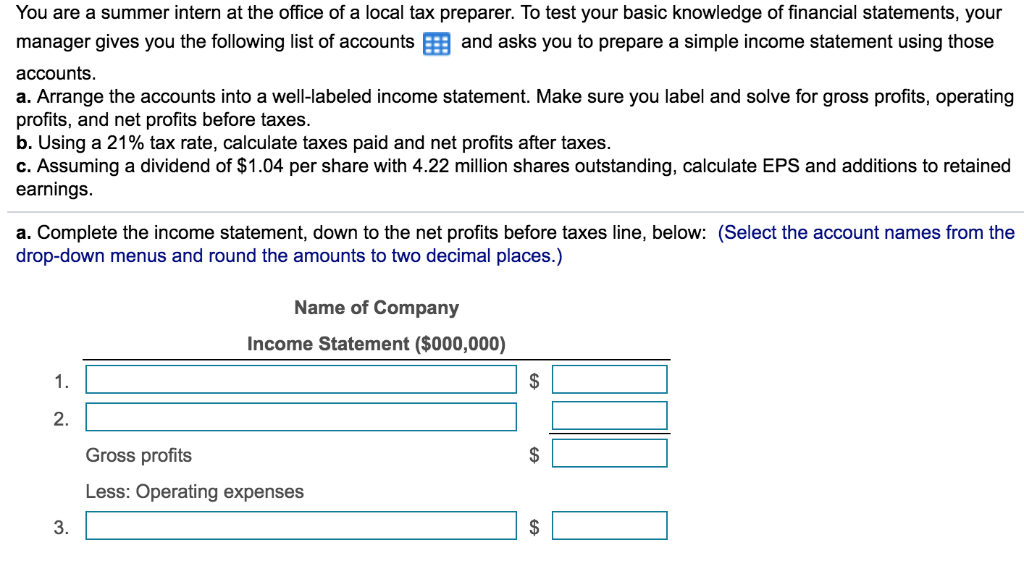

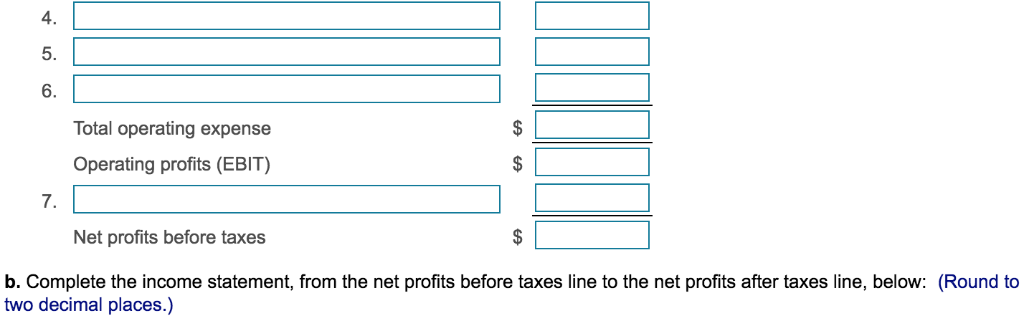

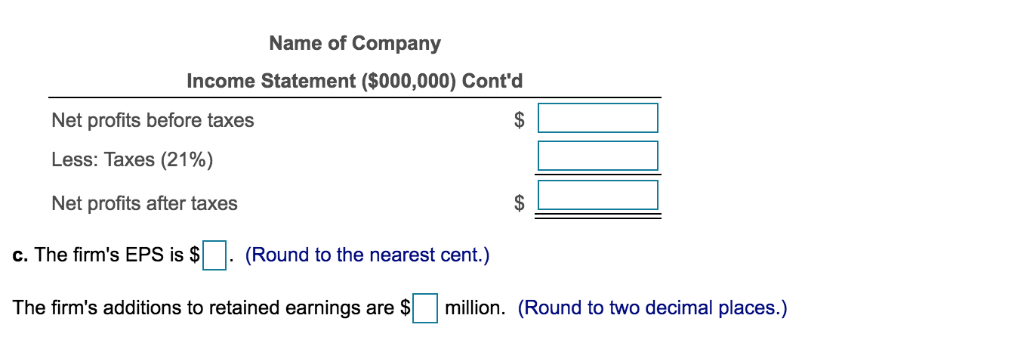

You are a summer intern at the office of a local tax preparer. To test your basic knowledge of financial statements, your manager gives you the following list of accountsand asks you to prepare a simple income statement using those accounts a. Arrange the accounts into a well-labeled income statement. Make sure you label and solve for gross profits, operating profits, and net profits before taxes. b. Using a 21% tax rate, calculate taxes paid and net profits after taxes c. Assuming a dividend of $1.04 per share with 4.22 million shares outstanding, calculate EPS and additions to retained earnings a. Complete the income statement, down to the net profits before taxes line, below: (Select the account names from the drop-down menus and round the amounts to two decimal places.) Name of Company Income Statement ($000,000) 1. 2. Gross profits Less: Operating expenses 3. 4. 5. 6. Total operating expense Operating profits (EBIT) 7 Net profits before taxes b. Complete the income statement, from the net profits before taxes line to the net profits after taxes line, below: (Round to two decimal places.) Name of Company Income Statement ($000,000) Cont'd Net profits before taxes Less: Taxes (21 %) Net profits after taxes G. The firm's EPS is . (Round to the nearest cent.) The firm's additions to retained earnings are Smillion. (Round to two decimal places.) You are a summer intern at the office of a local tax preparer. To test your basic knowledge of financial statements, your manager gives you the following list of accountsand asks you to prepare a simple income statement using those accounts a. Arrange the accounts into a well-labeled income statement. Make sure you label and solve for gross profits, operating profits, and net profits before taxes. b. Using a 21% tax rate, calculate taxes paid and net profits after taxes c. Assuming a dividend of $1.04 per share with 4.22 million shares outstanding, calculate EPS and additions to retained earnings a. Complete the income statement, down to the net profits before taxes line, below: (Select the account names from the drop-down menus and round the amounts to two decimal places.) Name of Company Income Statement ($000,000) 1. 2. Gross profits Less: Operating expenses 3. 4. 5. 6. Total operating expense Operating profits (EBIT) 7 Net profits before taxes b. Complete the income statement, from the net profits before taxes line to the net profits after taxes line, below: (Round to two decimal places.) Name of Company Income Statement ($000,000) Cont'd Net profits before taxes Less: Taxes (21 %) Net profits after taxes G. The firm's EPS is . (Round to the nearest cent.) The firm's additions to retained earnings are Smillion. (Round to two decimal places.)