You are a Tax Senior at a local CPA firm, your task is to review a tax return that a junior staff has prepared.

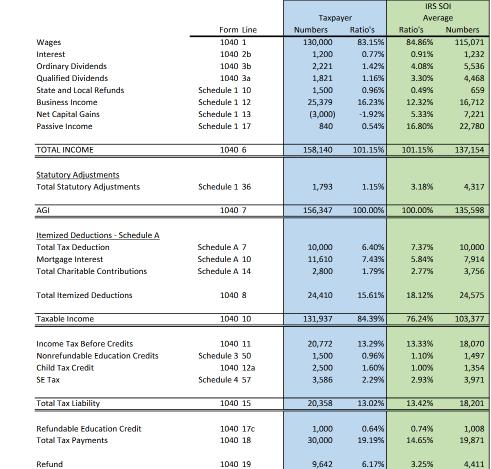

You are a Tax Senior at a local CPA firm, your task is to review a tax return that a junior staff has prepared. You have already reviewed the Client's papers and you believe the return has been prepared accurately based on the information provided. As a final procedure in the review process, you will compare this return to average returns by geographic area looking for potential errors, omissions, and areas of high audit risk. In short you are looking for information that the taxpayer may have failed to provide, or items that appear unusual for someone in the taxpayer's income range. The IRS publishes aggregate data, averaged by state for many types of tax returns, referred to as Statistics of Income (SOI). I have prepared a document containing the average IRS aggregate data for the appropriate AGI. Use the SOI data and the provided ratios to evaluate the Clients' tax return. Ratios are made by using adjusted gross income (AGI). Requirements: Use the ratio comparison sheet to evaluate the Clients' tax return. Identify any abnormal discrepancies between the Clients' and IRS's ratios. Think about what would cause these discrepancies. Below, write an email asking the Clients for more information or documents which could explain or correct the identified discrepancies. Begin Example: Hi Bill, I noticed that your wages are lower than the average taxpayer. Did you perhaps forget to send us a W- 2? Did you make a career change? End Example: I hope this helps illustrate what I am asking you to provide. This is not a real answer. This is just an example. There is not an abnormal discrepancy for wages. Wages Interest Ordinary Dividends Qualified Dividends State and Local Refunds Business Income Net Capital Gains Passive Income TOTAL INCOME Statutory Adjustments Total Statutory Adjustments AGI Itemized Deductions - Schedule A Total Tax Deduction Mortgage Interest Total Charitable Contributions Total Itemized Deductions Taxable income Income Tax Before Credits. Nonrefundable Education Credits Child Tax Credit SE Tax Total Tax Liability Refundable Education Credit Total Tax Payments Refund Form Line 1040 1 1040 2b 1040 3b. 1040 3a Schedule 1 10 Schedule 1 12 Schedule 1 13 Schedule 1 17 1040 6 Schedule 1 36 1040 7 Schedule A 7 Schedule A 10 Schedule A 14 1040 8 1040 10 1040 11 Schedule 3 50 1040 12a Schedule 4 57 1040 15 1040 17c 1040 18 1040 19 Taxpayer Numbers 130,000 1,200 2,221 1,821 1,500 25,379 (3,000) 840 158,140 1,793 10,000 11,610 2,800 24,410 131,937 20,772 1,500 2,500 3,586 156,347 100.00% 20,358 Ratio's 1,000 30,000 9,642 83.15% 0.77% 1.42% 1.16% 0.96% 16.23% -1.92% 0.54% 1.15% 101.15% 101.15% 6.40% 7.43% 1.79% 15.61% 84.39% 13.29% 0.96% 1.60% 2.29% 13.02% 0.64% 19.19% IRS SOI Average 6.17% Ratio's 84.86% 0.91% 4.08% 3.30% 0.49% 12.32% 5.33% 16.80% 3.18% 100.00% 7.37% 5.84% 2.77% 18.12% 76.24% 13.33% 1.10% 1.00% 2.93% 13.42% 0.74% 14.65% 3.25% Numbers 115,071 1,232 5,536 4,468 659 16,712 7,221 22,780 137,154 4,317 135,598 10,000 7,914 3,756 24,575 103,377 18,070 1,497 1,354 3,971 18,201 1,008 19,871 4,411

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Hi Client I hope this email finds you well I have reviewed your tax return and overall it looks accurate based on the information you have provided Ho...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started