Answered step by step

Verified Expert Solution

Question

1 Approved Answer

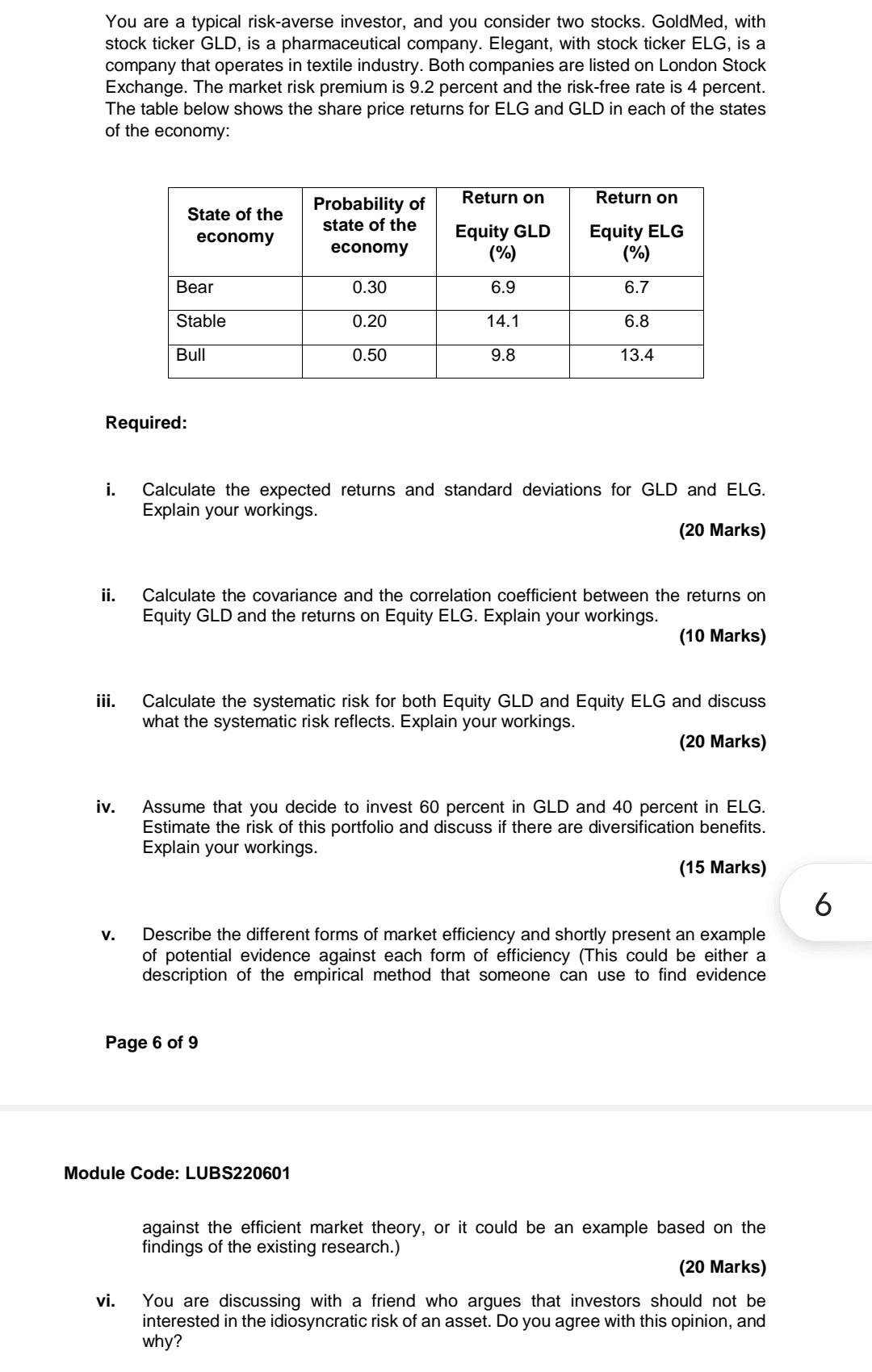

You are a typical risk-averse investor, and you consider two stocks. GoldMed, with stock ticker GLD, is a pharmaceutical company. Elegant, with stock ticker ELG,

You are a typical risk-averse investor, and you consider two stocks. GoldMed, with stock ticker GLD, is a pharmaceutical company. Elegant, with stock ticker ELG, is a company that operates in textile industry. Both companies are listed on London Stock Exchange. The market risk premium is 9.2 percent and the risk-free rate is 4 percent. The table below shows the share price returns for ELG and GLD in each of the states of the economy: Return on Return on State of the economy Probability of state of the Equity GLD Equity ELG economy (%) (%) 0.30 6.9 6.7 0.20 14.1 6.8 0.50 9.8 13.4 Required: i. Calculate the expected returns and standard deviations for GLD and ELG. Explain your workings. (20 Marks) ii. Calculate the covariance and the correlation coefficient between the returns on Equity GLD and the returns on Equity ELG. Explain your workings. (10 Marks) iii. Calculate the systematic risk for both Equity GLD and Equity ELG and discuss what the systematic risk reflects. Explain your workings. (20 Marks) iv. Assume that you decide to invest 60 percent in GLD and 40 percent in ELG. Estimate the risk of this portfolio and discuss if there are diversification benefits. Explain your workings. V. Describe the different forms of market efficiency and shortly present an example of potential evidence against each form of efficiency (This could be either a description of the empirical method that someone can use to find evidence Page 6 of 9 Module Code: LUBS220601 against the efficient market theory, or it could be an example based on the findings of the existing research.) (20 Marks) vi. You are discussing with a friend who argues that investors should not be interested in the idiosyncratic risk of an asset. Do you agree with this opinion, and why? Bear Stable Bull (15 Marks) 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started