Answered step by step

Verified Expert Solution

Question

1 Approved Answer

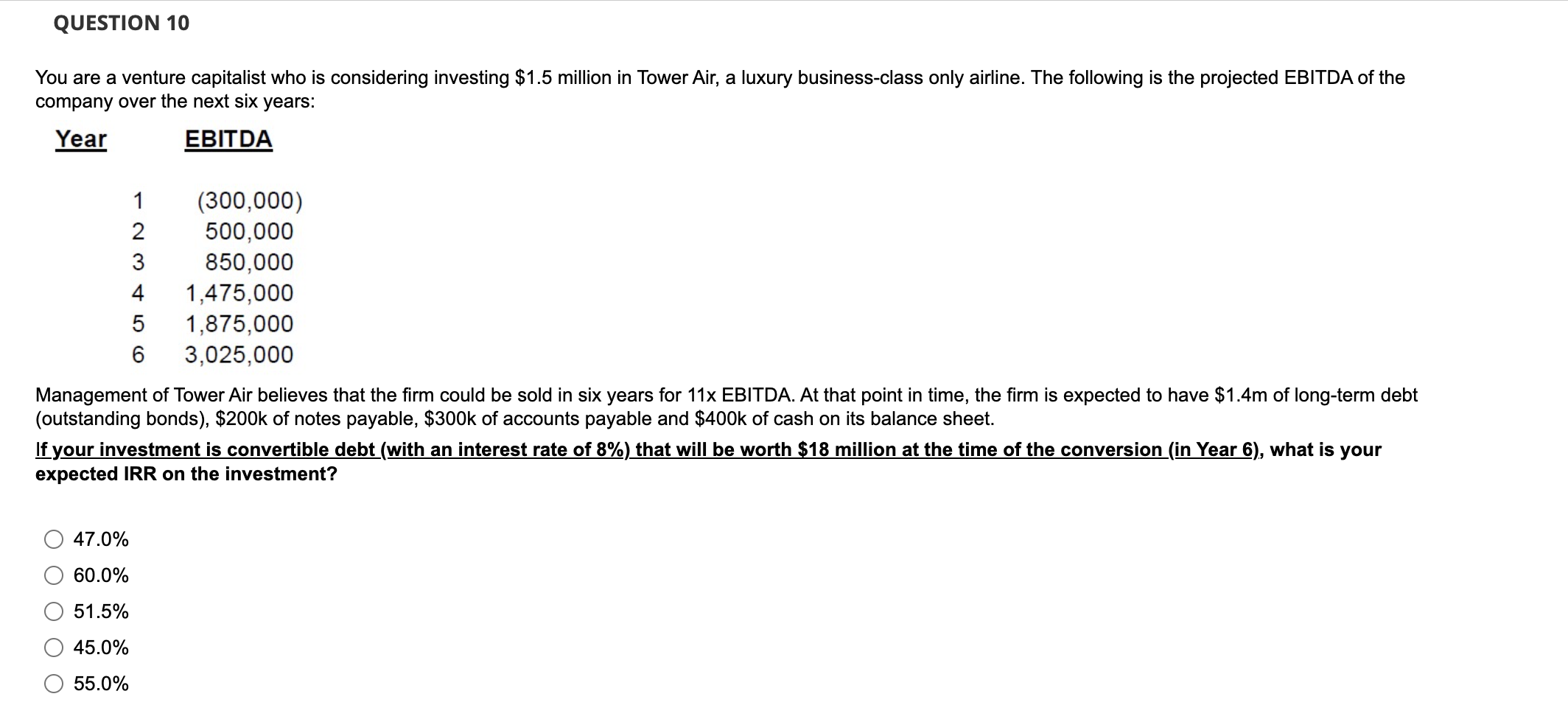

You are a venture capitalist who is considering investing $1.5 million in Tower Air, a luxury business-class only airline. The following is the projected EBITDA

You are a venture capitalist who is considering investing \\$1.5 million in Tower Air, a luxury business-class only airline. The following is the projected EBITDA of the company over the next six years: Management of Tower Air believes that the firm could be sold in six years for \\( 11 x \\) EBITDA. At that point in time, the firm is expected to have \\( \\$ 1.4 \\mathrm{~m} \\) of long-term debt (outstanding bonds), \\( \\$ 200 \\mathrm{k} \\) of notes payable, \\( \\$ 300 \\mathrm{k} \\) of accounts payable and \\( \\$ 400 \\mathrm{k} \\) of cash on its balance sheet. If your investment is convertible debt (with an interest rate of \8 ) that will be worth \\( \\$ 18 \\) million at the time of the conversion (in Year 6 ), what is your expected IRR on the investment? \beginarrayl47.0

You are a venture capitalist who is considering investing \\$1.5 million in Tower Air, a luxury business-class only airline. The following is the projected EBITDA of the company over the next six years: Management of Tower Air believes that the firm could be sold in six years for \\( 11 x \\) EBITDA. At that point in time, the firm is expected to have \\( \\$ 1.4 \\mathrm{~m} \\) of long-term debt (outstanding bonds), \\( \\$ 200 \\mathrm{k} \\) of notes payable, \\( \\$ 300 \\mathrm{k} \\) of accounts payable and \\( \\$ 400 \\mathrm{k} \\) of cash on its balance sheet. If your investment is convertible debt (with an interest rate of \8 ) that will be worth \\( \\$ 18 \\) million at the time of the conversion (in Year 6 ), what is your expected IRR on the investment? \beginarrayl47.0 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started