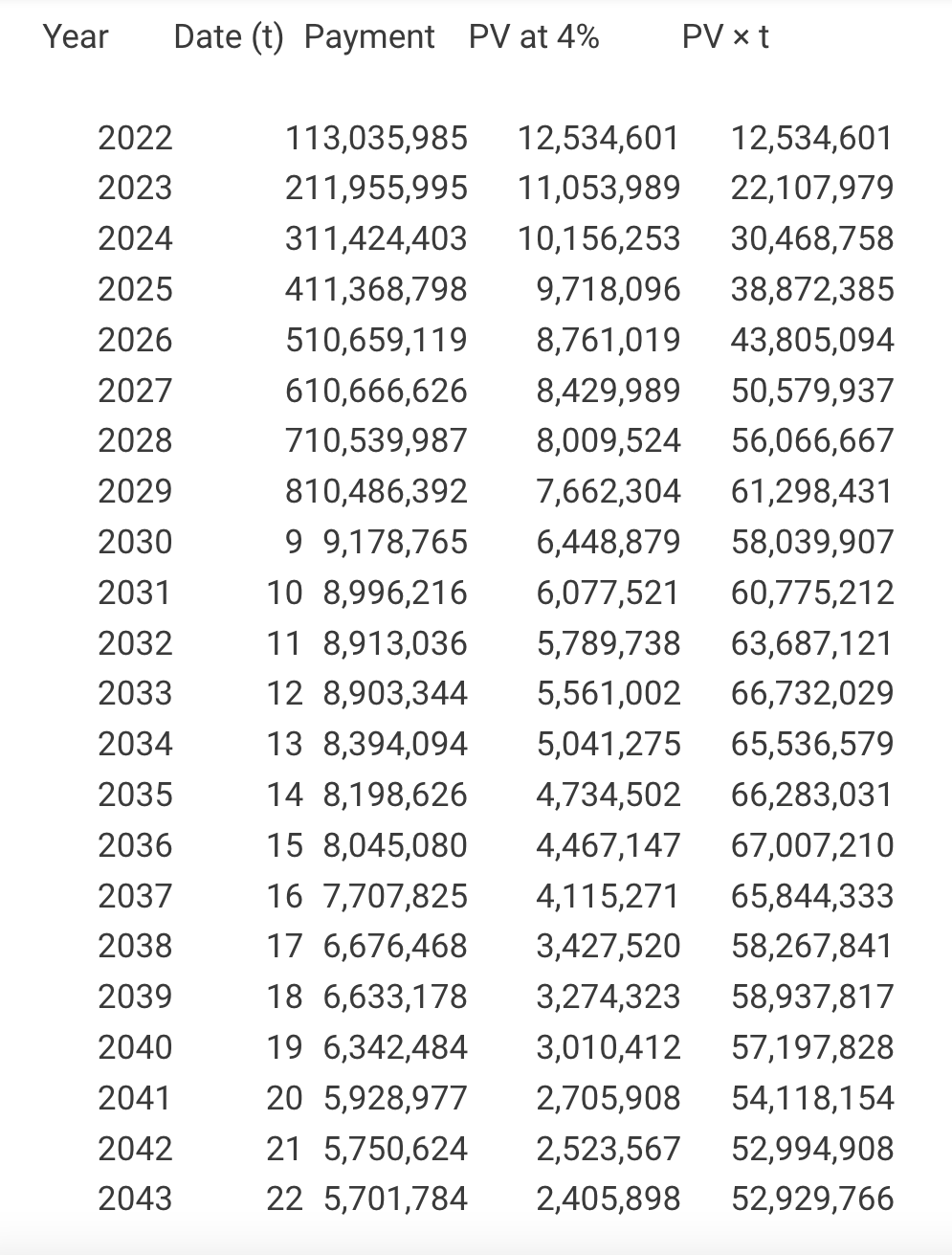

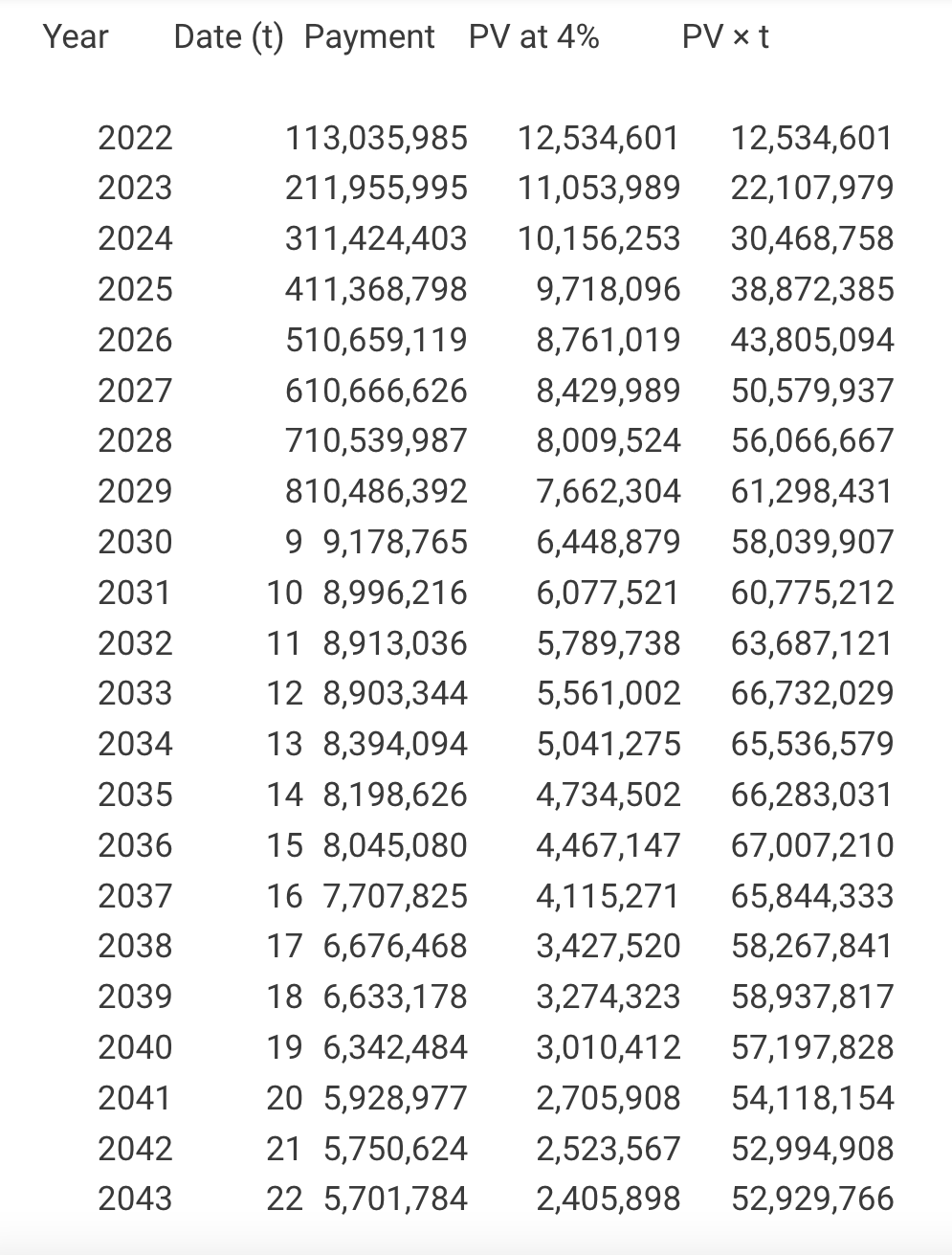

You are a vice president of Rensselaer Advisers (RA), which manages portfolios for institutional investors (primarily corporate pension plans) and wealthy individuals. In mid-2022 RA had about $2.0 billion under management, invested in a wide range of common-stock and fixed-income portfolios. Its management fees average 55 basis points (.55%), so RA's total revenue for 2022 will be about .0055 $2.0 billion = $11.0 million. You are attempting to land a new client, Madison Mills, a conservative, long-established manufacturer of papermaking felt. Madison has established a defined-benefit pension plan for its employees. RA would manage the pension assets that Madison has set aside to cover defined-benefit obligations for retired employees. Defined benefit means that an employer is committed to pay retirement income according to a formula. For example, annual retirement income could equal 40% of the employee's average salary in the five years prior to retirement. In a defined-benefit plan, retirement income does not depend on the performance of the pension assets. If the assets in the fund are not sufficient to cover pension benefits, the company is required to contribute enough additional cash to cover the shortfall. Thus the PV of promised retirement benefits is a debt-equivalent obligation of the company. The table below (do not use the table in the text) shows Madison's obligations to its already retired employees from 2022 to 2043. Each of these employees receives a fixed dollar amount each month. Total dollar payments decline as the employees die off. The PV of the obligations in the table below is about $136 million at the current (2022) 4% long-term interest rate. The table also calculates the duration of the obligations at 8.57 years. Year Date (t) Payment PV at 4% 2022 113,035,985 2023 211,955,995 2024 311,424,403 2025 411,368,798 2026 510,659,119 2027 610,666,626 2028 710,539,987 2029 810,486,392 2030 9 9,178,765 2031 10 8,996,216 2032 11 8,913,036 2033 12 8,903,344 2034 13 8,394,094 2035 14 8,198,626 2036 15 8,045,080 2037 16 7,707,825 2038 17 6,676,468 2039 18 6,633,178 2040 19 6,342,484 2041 20 5,928,977 2042 21 5,750,624 2043 22 5,701,784 PV x t 12,534,601 12,534,601 11,053,989 22,107,979 10,156,253 30,468,758 9,718,096 38,872,385 8,761,019 43,805,094 8,429,989 50,579,937 8,009,524 56,066,667 7,662,304 61,298,431 6,448,879 58,039,907 6,077,521 60,775,212 5,789,738 63,687,121 5,561,002 66,732,029 5,041,275 65,536,579 4,734,502 66,283,031 4,467,147 67,007,210 4,115,271 65,844,333 3,427,520 58,267,841 3,274,323 58,937,817 3,010,412 57,197,828 2,705,908 54,118,154 2,523,567 52,994,908 2,405,898 52,929,766 Madison has set aside $140 million in pension assets to cover the obligations in above table, so this part of its pension plan is fully funded---in fact, slightly overfunded. The pension assets are now invested in a diversified portfolio of common stocks, corporate bonds, and notes. After reviewing Madison's existing portfolio, you schedule a meeting with Hendrik van Wie, Madison's CFO. Mr. van Wie stresses Madison's conservative management philosophy and warns against "speculation." He complains about the performance of the previous manager of the pension assets. He suggests that you propose a plan of investing in safe assets in a way that minimizes exposure to equity markets and changing interest rates. You promise to prepare an illustration of how this goal could be achieved. Later you discover that RA has competition for Madison's investment management business. SPX Associates is proposing a strategy of investing 70% of the portfolio ($98 million) in index funds tracking the U.S. stock market and about 30% of the portfolio ($42 million) in U.S. Treasury securities. SPX argues that their strategy is "safe in the long run," because the U.S. stock market has delivered an average risk premium of about 7% per year. In addition, SPX argues that the growth in its stock market portfolio will far outstrip Madison's pension obligations. SPX also claims that the $42 million invested in Treasuries will provide ample protection against short-term stock market volatility. Finally, SPX proposes to charge an investment management fee of only 20 basis points (-20%). RA had planned to charge 30 basis points (.30%). 1. Prepare a memo for Mr. van Wie explaining how RA would invest to minimize both risk and exposure to changing interest rates. Give an example of a portfolio that would accomplish this objective. Explain how the portfolio would be managed as time passes and interest rates change. Also explain why SPX's proposal is not advisable for a conservative company like Madison. RA manages several fixed-income portfolios. For simplicity, you decide to propose a mix of the following three portfolios: A portfolio of long-term Treasury bonds with an average duration of 15 years. o A portfolio of Treasury notes with an average duration of 8 years. o A portfolio of short-term Treasury bills and notes with an average duration of 1 year. The term structure is flat, and the yield on all three portfolios is 4%. 2. Sorry, you lost. SPX won and implemented its proposed strategy. Now the recession of 2022 (I hope not) has knocked down U.S. stock prices by 20%. The value of the Madison portfolio, after paying benefits for 2022, has fallen from $140 million to $110 million. At the same time interest rates have increased from 4% to 6% as the Federal Reserve changes monetary policy to combat inflation. Mr. van Wie calls again, chastened by the SPX experience, and he invites a new proposal to invest the pension assets in a way that minimizes exposure to the stock market and changing interest rates. Update your memo with a new example of how to accomplish Mr. van Wie's objectives. You can use the same portfolios and portfolio durations as in Question 1. You will have to recalculate the PV and duration of the pension benefits from 2023 onward. Assume a flat term structure with all interest rates at 6%. (Hint: Madison's pension obligations are now underfunded. Nevertheless you can hedge interest rate risk if you increase the duration of the pension assets.) You are a vice president of Rensselaer Advisers (RA), which manages portfolios for institutional investors (primarily corporate pension plans) and wealthy individuals. In mid-2022 RA had about $2.0 billion under management, invested in a wide range of common-stock and fixed-income portfolios. Its management fees average 55 basis points (.55%), so RA's total revenue for 2022 will be about .0055 $2.0 billion = $11.0 million. You are attempting to land a new client, Madison Mills, a conservative, long-established manufacturer of papermaking felt. Madison has established a defined-benefit pension plan for its employees. RA would manage the pension assets that Madison has set aside to cover defined-benefit obligations for retired employees. Defined benefit means that an employer is committed to pay retirement income according to a formula. For example, annual retirement income could equal 40% of the employee's average salary in the five years prior to retirement. In a defined-benefit plan, retirement income does not depend on the performance of the pension assets. If the assets in the fund are not sufficient to cover pension benefits, the company is required to contribute enough additional cash to cover the shortfall. Thus the PV of promised retirement benefits is a debt-equivalent obligation of the company. The table below (do not use the table in the text) shows Madison's obligations to its already retired employees from 2022 to 2043. Each of these employees receives a fixed dollar amount each month. Total dollar payments decline as the employees die off. The PV of the obligations in the table below is about $136 million at the current (2022) 4% long-term interest rate. The table also calculates the duration of the obligations at 8.57 years. Year Date (t) Payment PV at 4% 2022 113,035,985 2023 211,955,995 2024 311,424,403 2025 411,368,798 2026 510,659,119 2027 610,666,626 2028 710,539,987 2029 810,486,392 2030 9 9,178,765 2031 10 8,996,216 2032 11 8,913,036 2033 12 8,903,344 2034 13 8,394,094 2035 14 8,198,626 2036 15 8,045,080 2037 16 7,707,825 2038 17 6,676,468 2039 18 6,633,178 2040 19 6,342,484 2041 20 5,928,977 2042 21 5,750,624 2043 22 5,701,784 PV x t 12,534,601 12,534,601 11,053,989 22,107,979 10,156,253 30,468,758 9,718,096 38,872,385 8,761,019 43,805,094 8,429,989 50,579,937 8,009,524 56,066,667 7,662,304 61,298,431 6,448,879 58,039,907 6,077,521 60,775,212 5,789,738 63,687,121 5,561,002 66,732,029 5,041,275 65,536,579 4,734,502 66,283,031 4,467,147 67,007,210 4,115,271 65,844,333 3,427,520 58,267,841 3,274,323 58,937,817 3,010,412 57,197,828 2,705,908 54,118,154 2,523,567 52,994,908 2,405,898 52,929,766 Madison has set aside $140 million in pension assets to cover the obligations in above table, so this part of its pension plan is fully funded---in fact, slightly overfunded. The pension assets are now invested in a diversified portfolio of common stocks, corporate bonds, and notes. After reviewing Madison's existing portfolio, you schedule a meeting with Hendrik van Wie, Madison's CFO. Mr. van Wie stresses Madison's conservative management philosophy and warns against "speculation." He complains about the performance of the previous manager of the pension assets. He suggests that you propose a plan of investing in safe assets in a way that minimizes exposure to equity markets and changing interest rates. You promise to prepare an illustration of how this goal could be achieved. Later you discover that RA has competition for Madison's investment management business. SPX Associates is proposing a strategy of investing 70% of the portfolio ($98 million) in index funds tracking the U.S. stock market and about 30% of the portfolio ($42 million) in U.S. Treasury securities. SPX argues that their strategy is "safe in the long run," because the U.S. stock market has delivered an average risk premium of about 7% per year. In addition, SPX argues that the growth in its stock market portfolio will far outstrip Madison's pension obligations. SPX also claims that the $42 million invested in Treasuries will provide ample protection against short-term stock market volatility. Finally, SPX proposes to charge an investment management fee of only 20 basis points (-20%). RA had planned to charge 30 basis points (.30%). 1. Prepare a memo for Mr. van Wie explaining how RA would invest to minimize both risk and exposure to changing interest rates. Give an example of a portfolio that would accomplish this objective. Explain how the portfolio would be managed as time passes and interest rates change. Also explain why SPX's proposal is not advisable for a conservative company like Madison. RA manages several fixed-income portfolios. For simplicity, you decide to propose a mix of the following three portfolios: A portfolio of long-term Treasury bonds with an average duration of 15 years. o A portfolio of Treasury notes with an average duration of 8 years. o A portfolio of short-term Treasury bills and notes with an average duration of 1 year. The term structure is flat, and the yield on all three portfolios is 4%. 2. Sorry, you lost. SPX won and implemented its proposed strategy. Now the recession of 2022 (I hope not) has knocked down U.S. stock prices by 20%. The value of the Madison portfolio, after paying benefits for 2022, has fallen from $140 million to $110 million. At the same time interest rates have increased from 4% to 6% as the Federal Reserve changes monetary policy to combat inflation. Mr. van Wie calls again, chastened by the SPX experience, and he invites a new proposal to invest the pension assets in a way that minimizes exposure to the stock market and changing interest rates. Update your memo with a new example of how to accomplish Mr. van Wie's objectives. You can use the same portfolios and portfolio durations as in Question 1. You will have to recalculate the PV and duration of the pension benefits from 2023 onward. Assume a flat term structure with all interest rates at 6%. (Hint: Madison's pension obligations are now underfunded. Nevertheless you can hedge interest rate risk if you increase the duration of the pension assets.)