Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are about to deposit $219 into one of the following savings accounts to be left on deposit for 25 years. Each bank offers an

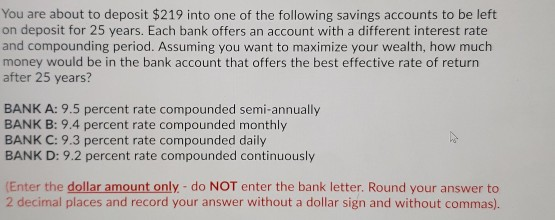

You are about to deposit $219 into one of the following savings accounts to be left on deposit for 25 years. Each bank offers an account with a different interest rate and compounding period. Assuming you want to maximize your wealth, how much money would be in the bank account that offers the best effective rate of return after 25 years? BANK A: 9.5 percent rate compounded semi-annually BANK B: 9.4 percent rate compounded monthly BANK C: 9.3 percent rate compounded daily BANK D: 9.2 percent rate compounded continuously (Enter the dollar amount only do NOT enter the bank letter. Round your answer to 2 decimal places and record your answer without a dollar sign and without commas)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started