Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are all Equity Researchers for a financial services company in which I am a Portfolio Manager. Our firm is currently evaluating possible equity

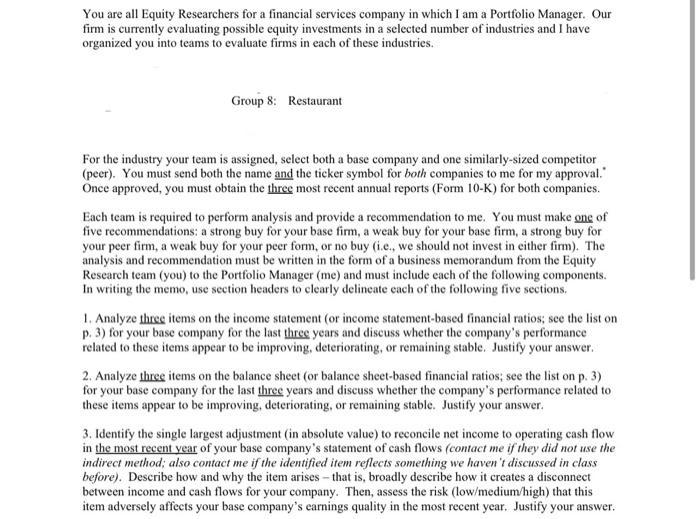

You are all Equity Researchers for a financial services company in which I am a Portfolio Manager. Our firm is currently evaluating possible equity investments in a selected number of industries and I have organized you into teams to evaluate firms in each of these industries. Group 8: Restaurant For the industry your team is assigned, select both a base company and one similarly-sized competitor (peer). You must send both the name and the ticker symbol for both companies to me for my approval." Once approved, you must obtain the three most recent annual reports (Form 10-K) for both companies. Each team is required to perform analysis and provide a recommendation to me. You must make one of five recommendations: a strong buy for your base firm, a weak buy for your base firm, a strong buy for your peer firm, a weak buy for your peer form, or no buy (i.e., we should not invest in either firm). The analysis and recommendation must be written in the form of a business memorandum from the Equity Research team (you) to the Portfolio Manager (me) and must include each of the following components. In writing the memo, use section headers to clearly delineate each of the following five sections. 1. Analyze three items on the income statement (or income statement-based financial ratios; see the list on p. 3) for your base company for the last three years and discuss whether the company's performance related to these items appear to be improving, deteriorating, or remaining stable. Justify your answer. 2. Analyze three items on the balance sheet (or balance sheet-based financial ratios; see the list on p. 3) for your base company for the last three years and discuss whether the company's performance related to these items appear to be improving, deteriorating, or remaining stable. Justify your answer. 3. Identify the single largest adjustment (in absolute value) to reconcile net income to operating cash flow in the most recent year of your base company's statement of cash flows (contact me if they did not use the indirect method; also contact me if the identified item reflects something we haven't discussed in class before). Describe how and why the item arises-that is, broadly describe how it creates a disconnect between income and cash flows for your company. Then, assess the risk (low/medium/high) that this item adversely affects your base company's earnings quality in the most recent year. Justify your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Base company 3 items on the income statement 1 Net income Net income for the base company has been ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started