Question

You are also given the following additional information. Interest is paid annually on the bonds, and has just been paid. The bonds mature in 6

You are also given the following additional information. Interest is paid annually on the bonds, and has just been paid. The bonds mature in 6 years time and are currently selling at $88.65. The preference shares are currently trading at $8.75. The ordinary shares are currently trading at $3.06. STR has just paid a dividend of $0.50, and investors expect earnings and dividends to grow to a constant rate of 4 percent in the future. There are no company or personal taxes levied. The management of STR considers its present capital structure is appropriate and has no plans to change the current mix.

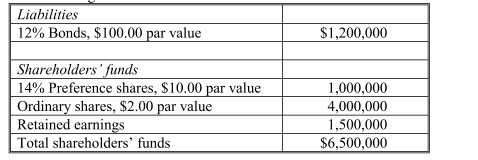

Liabilities 12% Bonds, $100.00 par value $1,200,000 Shareholders funds 14% Preference shares, $10.00 par value Ordinary shares, $2.00 par value Retained earnings Total shareholders' funds 1,000.000 4,000,000 1,500,000 $6,500,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started