Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are among the OTC marketmakers in the stock of BioEngineering, Inc. and quote a bid of 102.25 and an ask of 102.5. Suppose

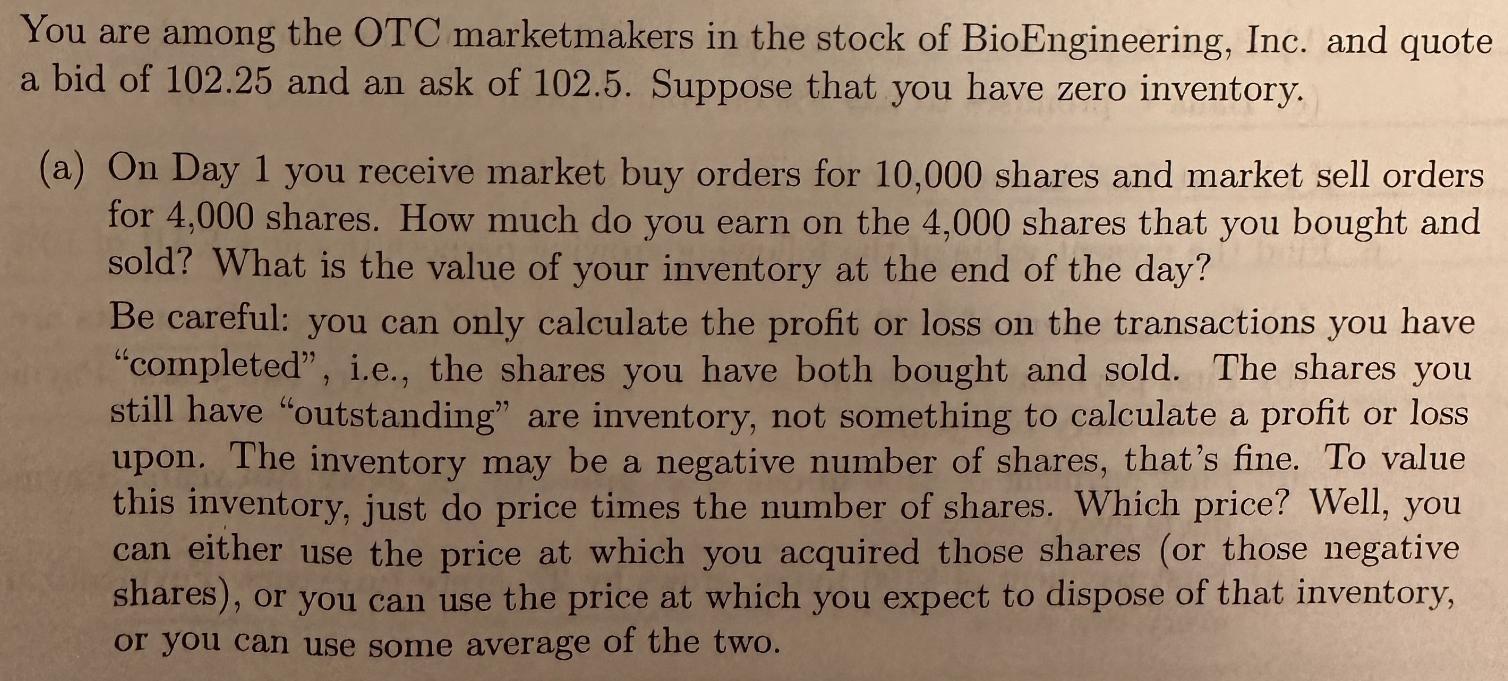

You are among the OTC marketmakers in the stock of BioEngineering, Inc. and quote a bid of 102.25 and an ask of 102.5. Suppose that you have zero inventory. (a) On Day 1 you receive market buy orders for 10,000 shares and market sell orders for 4,000 shares. How much do you earn on the 4,000 shares that you bought and sold? What is the value of your inventory at the end of the day? Be careful: you can only calculate the profit or loss on the transactions you have "completed", i.e., the shares you have both bought and sold. The shares you still have "outstanding" are inventory, not something to calculate a profit or loss upon. The inventory may be a negative number of shares, that's fine. To value this inventory, just do price times the number of shares. Which price? Well, you can either use the price at which you acquired those shares (or those negative shares), or you can use the price at which you expect to dispose of that inventory, or you can use some average of the two.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Order Fulfillment and Profit Calculation Market Buy Orders 10000 shares Market Sell Orders 4000 shar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started