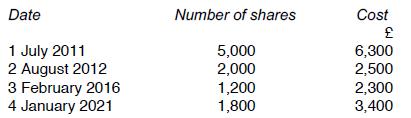

Paula makes the following acquisitions of ordinary shares in Indigent plc: She sells 500 shares on 28 March 2021. No shares are acquired within the

Paula makes the following acquisitions of ordinary shares in Indigent plc:

She sells 500 shares on 28 March 2021. No shares are acquired within the next 30 days.

(a) Show the s104 holding on 28 March 2021, just prior to and just after the disposal on that date.

(b) Compute the chargeable gain or allowable loss on the disposal if sale proceeds are:

(i) £1,300

(ii) £1,000

(iii) £700

Date 1 July 2011 2 August 2012 3 February 2016 4 January 2021 Number of shares 5,000 2,000 1,200 1,800 Cost 6,300 2,500 2,300 3,400

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a The s104 holding is as follows b Acquired 1 July 2011 Acquired 2 August 2012 Acquired ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards