A company makes the following acquisitions of ordinary shares in JKL plc: The company sells 500 shares

Question:

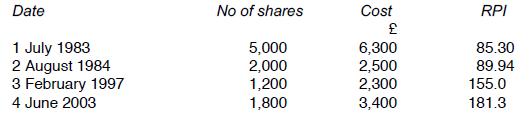

A company makes the following acquisitions of ordinary shares in JKL plc:

The company sells 500 shares on 8 July 2020.

(a) Calculate the cost and indexed cost of the s104 holding on 8 July 2020, just prior to and just after the above disposal. (RPI for April 1985 is 94.78 and RPI for December 2017 is 278.1).

(b) Compute the chargeable gain or allowable loss on the disposal if sale proceeds are:

(i) £2,800

(ii) £1,000

(iii) £700

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: