Question

You are an accountant at XYZ company, which has a fiscal year ending on December 3 1 . ?It is now December 3 1 ,

You are an accountant at XYZ company, which has a fiscal year ending on December ?It is now December ?and you are getting ready to record the adjusting journal entry for this year's bad debt expense. The credit department has prepared for you the following accounts receivable aging schedule, which includes the estimated percentages of each aging bucket that they think will be uncollectible. The estimated percentages are the same for both dates provided.

You then inspect the accounting records for the year and note that during ?the company had writeoffs of $ ?and recoveries of $ ?You also note that total credit sales during ?were $ ?The credit department informs you that historically, ?of credit sales have proven to be uncollectible.

Using the Aging of Accounts Receivable method, what is the bad debt expense for

Using the Aging of Accounts Receivable method, what is the ending balance for the Allowance for Doubtful Accounts for

?Select

Using the Aging of Accounts Receivable method, what is the net accounts receivable that the company has at the end of

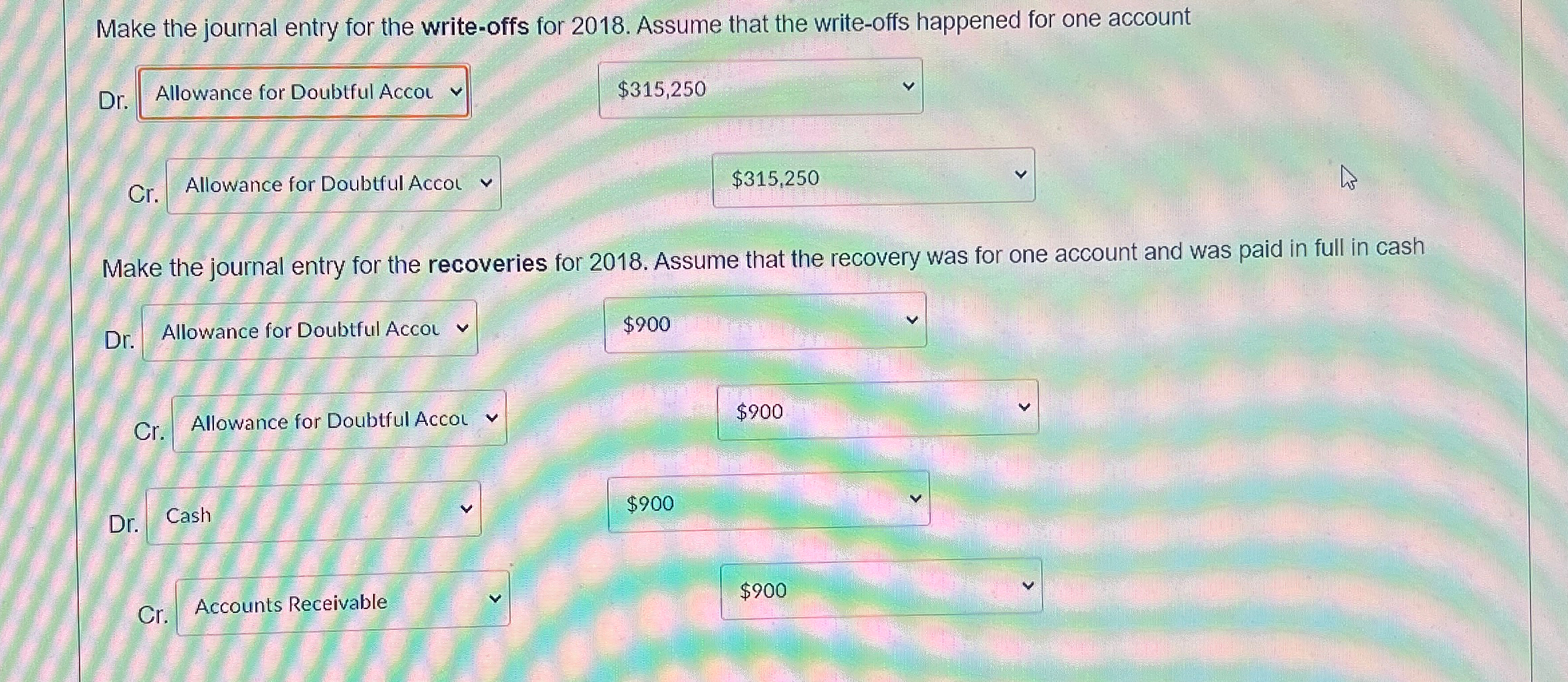

Make the journal entry for the writeoffs for ?Assume that the writeoffs happened for one account

Dr

Cr ?Allowance for Doubtful Accol

Make the journal entry for the recoveries for ?Assume that the recovery was for one account and was paid in full in cash

Dr ?Allowance for Doubtful Accol

$

Cr

Allowance for Doubtful Accol

$

Dr

$

Cr ?Accounts Receivable

$

Make the journal entry for the write-offs for 2018. Assume that the write-offs happened for one account Allowance for Doubtful Accou Dr. Cr. Allowance for Doubtful Accol L $315,250 $315,250 Make the journal entry for the recoveries for 2018. Assume that the recovery was for one account and was paid in full in cash Dr. Allowance for Doubtful Accol $900 Cr. Allowance for Doubtful Accol Cash Dr. Cr. Accounts Receivable $900 $900 $900

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started